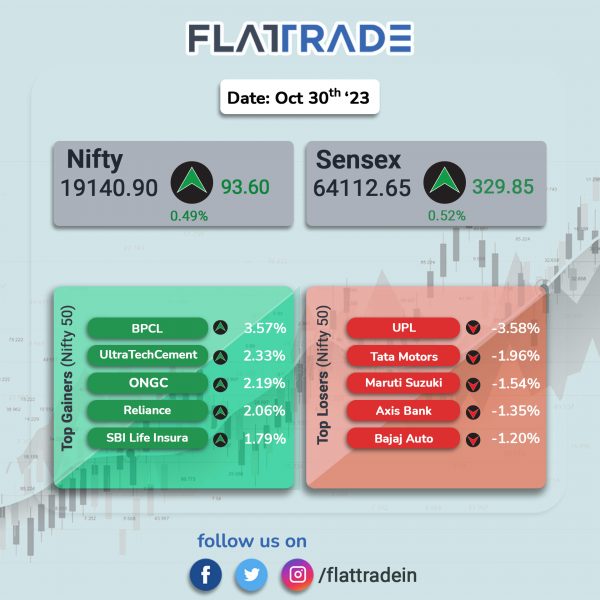

Benchmark equity indices closed higher, aided by gains in index heavyweights amid positive global sentiments. The Sensex rose 0.51% and the Nifty 50 index jumped 0.49%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index edged up 0.09% and the BSE Smallcap marginally rose by 0.06%.

Among Nifty sectoral indices, top gainers were Realty [2.14%], Oil & Gas [1.34%], Energy [1.2%], Bank [0.6%], and Financial Services [0.59%]. Top losers were Auto [-0.9%], FMCG [-0.42%], Media [-0.06%].

The Indian rupee was little changed and closed at 83.25 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The Power Transmission & Distribution business of L&T Construction has secured key orders in India and overseas, in the current quarter. The company has received an order for establishing 400kV & 220kV transmission lines to help relieve the congestion in the Chattisgarh’s electricity transmission grid. In Saudi Arabia, an order for turnkey construction of a 380kV Substation with associated overhead transmission lines has been won. Another order has been bagged from Kuwait to build 5 Substations to provide reliable and efficient power supply to an upcoming residential city. Additional orders have been won in ongoing substation orders in Qatar.

UPL: The company reported a consolidated net loss of Rs 189 crore in the quarter ended September 2023, as against a consolidated net profit of Rs 814 crore in the same quarter last year. Its consolidated revenue from operations dropped 18.7% to Rs 10,170 crore in Q2FY24 from Rs 12,507 crore in the same period last fiscal. Ebitda during the quarter under review tumbled 43% to Rs 1,573 crore from Rs 2,768 crore in the year-ago period. The Ebitda margin 6.66 percentage points to 15.5% from 22.1% in the corresponding period last fiscal.

Petronet LNG: The company’s consolidated revenue was up 7.5% at Rs 12,533 crore in Q2FY24 as against Rs 11,656 crore in Q1FY24. Consolidated Ebitda rose 2.8% to Rs 1,215 crore in Q2FY24 from Rs 1,182 crore in Q1FY24. Consolidated net profit rose 4.5% to Rs 856 crore in Q2FY24 from Rs 819 crore in Q2FY23. The company’s board has approved an interim dividend of Rs 7 per share. It has received the approval to set up project of 750 KTPA of PDH & 500 KTPA of PP plant. The estimated cost of the project is Rs 20685 crore with a variation of 10%.

Adani Green Energy: The company’s consolidated revenue rose 40.2% to Rs 2220 crore in Q2Fy24 from Rs 1584 crore in Q2FY23. The consolidated Ebitda grew 96.2% to Rs 1699 crore in Q2FY24 from Rs 866 crore in Q2FY23. Consolidated net profit soared 149% to Rs 372 crore in Q2FY24 from Rs 149 crore in Q2FY23. The company said that it clocked an 87% YoY rise in energy sales to 5,737 million units, helped by strong capacity addition and improved capacity utilisation factor across solar, wind and hybrid portfolios.

Nazara Technologies: The diversified gaming and sports media platform has unveiled its new game publishing division “Nazara Publishing” to launch high quality games for the Indian and International markets. Nazara will invest a minimum of Rs 1 crore per game and aims to launch up to 20 games over the next 18 months.

Raymond: The company said ‘Ten X Realty Limited’, a step-down wholly owned subsidiary of the company, has been selected as the ‘Preferred Developer’ for redevelopment of Kumari Jethi T Sipahimalani CHS Ltd. (also known as Navjivan Society) located in Mahim West. The land is spread across 3.6 acres and the project is strategically located at one of the most sought-after residential areas of Mumbai and estimated to have a revenue potential in excess of Rs 1,700 crore over the project period.

KPIT Technologies: The company reported a net profit of Rs 140.8 crore in Q2FY24, up 5.1% from Rs 134 crore in the preceding quarter of current fiscal. Its revenue was up 9.2% at Rs 1,199.1 crore in Q2FY24 as against Rs 1,097.6 crore in the previous quarter of current fiscal. Ebitda was up 12.1% at Rs 239.8 crore in Q2FY24 as against Rs 213.9 crore in Q1FY24.

Sarda Energy and Minerals: The company’s consolidated revenue rose 3.6% at Rs 1,001.36 crore in Q2FY24 as against Rs 966.54 crore in Q2FY23. Consolidated Ebitda fell 10.92% to Rs 250.41 crore in Q2FY24 as against Rs 281.09 crore in Q2FY23. Its profit after tax dropped 19.69% to Rs 149.21 crore in Q2FY24 as against Rs 185.8 crore in Q2FY23.

Supreme Industries: The company’s net profit stood at Rs 243.2 crore in Q2FY24 as against Rs 82 crore in Q2FY23. Revenue rose 10.6% YoY to Rs 2,308.7 crore in Q2FY24 from Rs 2,086.6 crore in Q2FY23. Its Ebitda was at Rs 353.3 crore in Q2FY24 as against Rs 147.3 crore in Q2FY23.

J Kumar Infraprojects: The company reported a net profit was up 8.7% at Rs 73.4 crore in Q2FY24 as against Rs 68 crore in Q2FY23. Revenue increased 9% to Rs 1,104.2 crore in Q2FY24 as against Rs 1,012.8 crore in Q2FY23. Its Ebitda rose 9.5% at Rs 159.5 crore in Q2FY24 as against Rs 145.7 crore in Q2FY23.

Craftsman Automation: The company’s net profit rose 53.3% to Rs 93.2 crore in Q2FY24 from Rs 61 crore in Q2FY23. Revenue climbed 54.2% to Rs 1,197.1 crore in Q2FY24 from Rs 776.2 crore in Q2FY23. Its Ebitda rose 48.4% to Rs 255.5 crore in Q2FY24 from Rs 172.2 crore in Q2FY23.

Mahanagar Gas: The company’s consolidated revenue was up 2.29% at Rs 1,570.93 crore in Q2FY24 as against Rs 1,537.79 crore in Q1FY24. Ebitda fell 8.14% QoQ to Rs 478.88 crore in Q2FY24 as against Rs 521.27 crore in Q1FY24. Its consolidated profit after tax fell 8.11% to Rs 338.5 crore in Q2FY24 from Rs 368.4 crore in Q1FY24.

Supreme Petrochem: The company’s revenue rose 3.49% to Rs 1,277.67 crore in Q2FY24 from Rs 1,234.58 crore in Q2FY23. Its Ebitda was up 34.67% YoY at Rs 106.27 crore in Q2FY24 as against 78.91 crore in Q2FY23. The company’s profit after tax was up 30.51% at Rs 78.06 crore in Q2FY24 as against Rs 59.81 crore in Q2FY23.

NTPC: The company’s consolidated revenue was up 1.8% at Rs 44983 crore in Q2FY24 as against Rs 44175 crore in Q2FY23. Consolidated Ebitda was up 20.6% at Rs 12680 crore in Q2FY24 as against Rs 10513 crore in Q2FY23. Consolidated net profit rose 38.3% to Rs 4726 crore in Q2FY24 from Rs 3417.7 crore in Q2FY23.

Macrotech Developers (Lodha): The company’s consolidated revenue fell 0.9% to Rs 1750 crore in Q2FY24 as against Rs 1765 crore in Q2FY23. Consolidated Ebitda fell 1.9% to Rs 416 crore in Q2FY24 as against Rs 424 crore in Q2FY23. Consolidated net profit rose to Rs 203 crore in Q2FY24 as against a net loss of Rs 933 crore in Q2FY23.

IRB Infrastructure Developers: The company’s consolidated revenue rose 29.93% to Rs 1,744.996 crore in Q2FY24 from Rs 1,342.95 crore in Q2FY23. Consolidated Ebitda jumped 19.47% at Rs 794.61 crore in Q2FY24 from Rs 665.1 crore in Q2FY23. The consolidated profit after tax was up 12.23% at Rs 95.75 crore in Q2FY24 compared with Rs 85.31 crore in Q2FY23.

Great Eastern Shipping: The company’s consolidated revenue fell 15.1% to Rs 1,229.02 crore in Q2FY24 from Rs 1,447.45 crore in Q2FY23. Consolidated Ebitda was down 18.87% YoY at Rs 643.37 crore in Q2FY24 in Rs 793 crore in Q2FY23. Consolidated profit after tax dropped 22.65% to Rs 594.66 crore in Q2FY24 from Rs 768.83 crore in Q2FY23.

Oberoi Realty: The real estate builder said its consolidated revenue jumped 76.79% at Rs 1,217.41 crore in Q2FY24 as against Rs 688.59 crore in Q2FY23. Its consolidated Ebitda surged 105.57% to Rs 638.21 crore in Q2FY24 from Rs 310.45 crore in Q2FY23. Its consolidated profit after tax was up 43.35% at Rs 456.76 crore in Q2FY24 as against Rs 318.62 crore in Q2FY23.

Ion Exchange: The company’s consolidated revenue rose 19.07% to Rs 532.97 crore in Q2FY24 from Rs 447.61 crore in Q2FY23. Consolidated Ebitda rose 13.28% to Rs 60.39 crore in Q2FY24 from Rs 53.31 crore in Q2FY23. The company’s consolidated profit after tax grew 9.43% to Rs 42.35 crore in Q2FY24 from Rs 38.7 crore in Q2FY23.