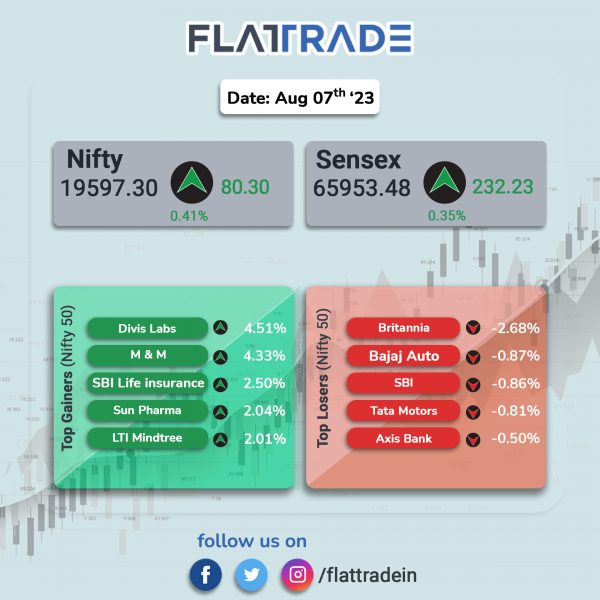

Benchmark equity indices closed higher, aided by gains in pharma and IT stocks amid weak global cues. The Sensex closed 0.35% higher and the Nifty was up 0.41%.

In broader markets, the Nifty Midcap 100 index rose 0.51% and the BSE Smallcap index gained 0.26%.

Top gainers were Healthcare [2.01%], Pharma [1.56%], IT [1.13%], Realty [0.58%], and Auto [0.41%]. Top losers were PSU Bank [-0.6%], Media [-0.2%], and Bank [-0.09%].

The Indian rupee rose 10 paise to 82.75 against the US dollar on Monday.

Stock in News Today

One 97 Communications (Paytm): Shares of the company surged 11% in intraday trade after the company’s founder and CEO Vijay Shekhar Sharma entered into an agreement to purchase 10.30% stake in Paytm, from Antfin (Netherlands) Holding B.V. With this acquisition, Sharma’s total shareholding in Paytm will increase to 19.42%, while reducing Antfin’s shareholding to 13.5%. The transaction will be completed at the prevailing market price, with the 10.30% stake valued at $628 million as of 4 August 2023.

Whirpool India: The company’s revenue was down 2.04% YoY at Rs 2,038.59 crore in Q1FY24 as against Rs 2,081 crore in Q1FY23. Consolidated net profit fell 10.57% at Rs 74.88 crore in Q1FY24 as against Rs 83.73 crore in Q1FY23. EBITDA was down 6.36% YoY at Rs 123.39 crore in Q1FY24 as against Rs 131.77 crore in Q1FY23.

Balkrishna Industries: The company reported a 2.3% fall in standalone net profit at Rs 312.28 crore in Q1FY24 as compared with 319.74 crore in Q1FY23. Revenue from operations declined 19.9% to Rs 2,120.02 crore in Q1FY24 compared with Rs 2,646.28 crore in Q1FY23. EBITDA fell 11% YoY to Rs 487 crore during the quarter compared with Rs 547 crore posted in same quarter last year. Meanwhile, the board has declared final dividend of Rs 4 per equity share for FY24.

Balrampur Chini Mills: The company reported a standalone net profit of Rs 69.33 crore in Q1FY24, compared with a PAT of Rs 11.61 crore in Q1FY23. Net sales increased by 28.7% to Rs 1389.62 crore during the period under review compared with the same period last year. The rise in sales was due to higher volume in sugar & distillery segments coupled with higher realizations. EBITDA in Q1 FY24 was Rs 163.18 crore as against Rs 44.42 crore in Q1 FY23, up 267.4% YoY.

Emami: The FMCG company said its consolidated revenues was up 6.76% at Rs 825.66 crore in Q1FY24 as against Rs 773.31 crore in Q1FY23. Consolidated net profit jumped 86.5% to Rs 137.72 crore in Q1FY24 from Rs 73.83 crore in Q1FY23. Ebitda was up 9.63% at Rs 190.01 crore in Q1FY24 from Rs 173.32 crore in Q1FY23.

India Cements: The cement manufacturer said its revenue was down 5.1% YoY at Rs 1436.74 crore in Q1FY24 as against Rs 1514.35 crore in Q1FY23. Consolidated net loss stood at Rs 73.58 crore in Q1FY24 as against a net profit of Rs 83.83 crore in Q1FY23. Ebitda plunged 79.2% at Rs 8.28 crore in Q1FY24 from Rs 39.82 crore in Q1FY23.

Coromandel International: The company’s subsidiary, Dhaksha Unmanned Systems, has bagged Rs 165 crore worth of orders for Defence and Agri drones. It will supply 200 medium altitude logistics drones and accessories to the Indian Army. Recently, Dhaksha had also bagged a 400-drone contract from agri inputs cooperative IFFCO for supply of agri-spraying drones. These are planned to be delivered over the course of next 12 months, Coromandel said in a regulatory filing.

APL Apollo Tubes: The company reported 60% YoY jump in consolidated net profit to Rs 193.6 crore and a 32% YoY rise in revenue at Rs 4,544.9 crore in Q1FY24. Sales volume increased by 56% to 662,000 tons in Q1FY24 from 423,000 tons in Q1FY23. For the period under review, EBITDA was Rs 307.2 crore, up 58% YoY. APL Apollo said that the ramp-up of new Raipur plant is on expected lines and the company expects the ramp up from the greenfield plant in Raipur will support sales volume/EBITDA growth in coming quarters.

Zen Technologies: Shares of the company was locked in 10% upper circuit after the company reported standalone net profit of Rs 47.13 crore in Q1FY24, higher from Rs 8.21 crore in Q1FY23. Net sales jumped to Rs 132.45 crore in Q1FY24 from Rs 33.23 crore in Q1FY23. EBITDA stood at Rs 68.79 crore in Q1FY24, a growth of 414.13% as compared with Rs 13.38 crore posted in corresponding quarter last year. As on 30 June 2023, the company’s total order book stood at Rs 542.84 crore.

Aurobindo Pharma: The company announced that its wholly owned subsidiary, Eugia Pharma, has received a final approval from US Food & Drug Administration (USFDA) for Vancomycin Hydrochloride for Injection USP. The aforementioned drug is a bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Vancomycin Hydrochloride for Injection USP, by Mylan Laboratories Ltd. The product is being launched in August 2023. The approved product has an estimated market size of around US$ 34.4 million for the twelve months ending May 2023, according to IQVIA.

Punjab & Sind Bank: The bank’s net profit slumped 25.4% to Rs 152.67 crore in Q1FY24 from Rs 204.70 crore in Q1FY23. Total income rose 30.2% YoY to Rs 2,494.37 crore in the quarter ended June 2023. Net interest income rose 4.09% YoY to Rs 738 crore in Q1FY24 from Rs 709 crore recorded in Q1FY23. Operating profit stood at Rs 257.34 crore in the first quarter of FY24 from Rs 251.97 crore posted in the corresponding period last fiscal. The ratio of net NPAs stood at 1.95% as on 30 June 2023 as against 1.84% as on 31 March 2023 and 2.56% as on 30 June 2022.

Alembic Pharma: The drug maker reported a consolidated net profit of Rs 120.60 crore in Q1FY24 as against a net loss of Rs 65.88 crore in Q1FY23. Revenue from operations jumped 17.7% to Rs 1,486.15 crore in the June quarter from Rs 1,262.14 crore recorded in Q1FY23. EBIDTA soared to Rs 210 crore in Q1FY24 from Rs 9 crore reported in Q1FY23.

Gujarat Narmada Valley Fertilizers & Chemicals: The company’s consolidated revenue was down 38.7% YoY at Rs 1652 crore in Q1FY24 as against Rs 2696 crore in Q1FY23. Consolidated net profit plunged 84.6% to Rs 88 crore in Q1FY24 from Rs 572 crore in Q1FY23. Ebitda fell 86.24% at Rs 105 crore in Q1FY24 as against Rs 763 crore in Q1FY23.

Paras Defence and Space Technologies: The company’s revenue was up 18.5% YoY at Rs 48.32 crore in Q1FY24 as against Rs 40.76 crore in Q1FY23. Consolidated net profit was down 15% YoY at Rs 6.01 crore in Q1FY24 as against Rs 7.07 crore in Q1FY23. Ebitda was down 3.8% at Rs 10.83 crore in the quarter under review as against Rs 11.26 crore in the year-ago period.

Ramco Cements: The company’s consolidated revenues was up 26.26% YoY at Rs 2,246.66 crore in Q1FY24 as against Rs 1,779.41 crore in Q1FY23. Consolidated net profit fell 31.7% to Rs 74.41 crore in Q1FY24 from Rs 109.02 crore in Q1FY23. Ebitda was up 13.3% at Rs 343.46 crore in Q1FY24 as against Rs 303.11 crore in Q1FY23.

Eris Lifesciences: The company said its consolidated revenues was up 17.1% at Rs 466.62 crore in Q1FY24 as against Rs 398.58 crore in Q1FY23. Consolidated net profit was up 0.7% at Rs 94.93 crore in Q1FY24 as against Rs 94.24 crore in Q1FY23. Ebitda rose 31.3% YoY at Rs 169.69 crore in Q1FY24 as against Rs 129.19 crore in Q1FY23.

Jindal Worldwide: The company’s consolidated revenues fell 35.8% YoY to Rs 410.7 crore in Q1FY24 from Rs 639.26 crore in Q1FY23. Consolidated net profit was down 67.2% at Rs 13.69 crore in Q1FY24 as against Rs 41.7 crore in Q1FY23. Ebitda dropped 42.8% YoY at Rs 42.23 crore in Q1FY24 from Rs 73.91 crore in Q1FY23.

Mrs. Bectors Food Specialities: Shares of the company soared over 6% after the company reported a rise in net profit at Rs 34.9 crore in Q1FY24 from Rs 12.7 crore in Q1FY23. Revenue increased 24.4% YoY to Rs 374.2 crore in the first quarter of FY24. Biscuit segment revenue for Q1FY24 stood at Rs 223 crore against Rs 178 crore in Q1 FY23, a growth of 25% compared with Q1 FY23 including domestic & export biscuit segment. Bakery segment revenue in Q1FY24 stood at Rs 135 crore, up 26% YoY. Further, EBITDA improved by 85.2% YoY to Rs 57.9 crore.

Yatharth Hospital: The company had a strong stock market debut on Monday. Shares of the company opened at Rs 306 against its issue price of Rs 300. The company hit a high of Rs 343.10 per share and closed at Rs 333.85 on the NSE.