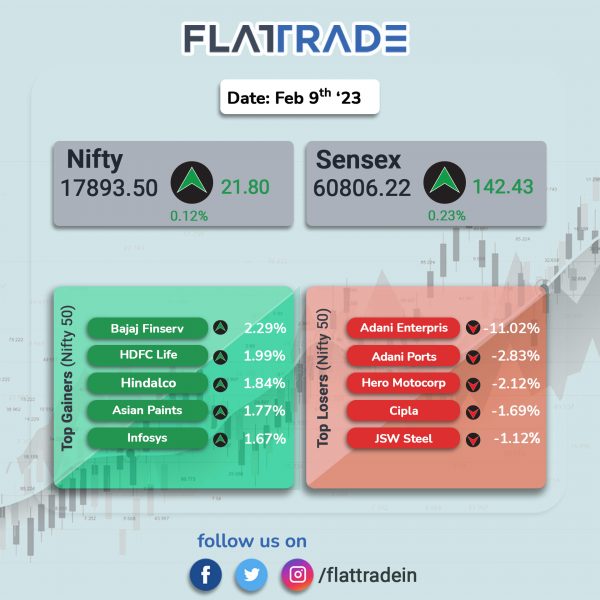

Benchmark stock indices closed with modest gains, helped by rise in IT stocks amid investors remaining cautious after the Federal Reserve officials’ hawkish comments. The Sensex rose 0.23% and the Nifty 50 index edged up 0.12%.

In broader markets, Nifty Midcap 100 witnessed marginally gains of 0.04%, while the BSE Smallcap slipped to end 0.15% lower.

Top gainers were IT [0.70%], Media [0.60%], and Financial Services [0.14%]. Top losers were Metal [-1.58%], Realty [-0.58%], Auto [-0.52%], Pharma [-0.44%] and Oil & Gas [-0.32%]

Indian rupee was nearly flat as it fell 2 paise to 82.51 against the US dollar.

Stock in News Today

Hindalco Industries: The company reported a consolidated net profit for the December quarter at Rs 1,362 crore, down 63% YoY. It had reported a net profit of Rs 3,675 crore in the corresponding quarter of last year. Its revenue from operations was Rs 53,151 crore, up 6% YoY as against Rs 50,272 crore in the year-ago period, helped by higher volumes. The reported a 48% drop in operating profit at Rs 3,930 crore. “We are seeing core industries worldwide being buffeted by macro-economic and inflationary cost pressures, yet we delivered a strong operational performance with higher volumes across India business segments,” said Satish Pai, Hindalco Managing Director.

Adani Group: Norway’s $1.35 trillion sovereign wealth fund said on Thursday that it has in recent weeks divested virtually all its remaining shares in companies belonging to India’s Adani group, Reuters reported. At the end of 2022, the Norwegian fund held shares in Adani Green Energy worth $52.7 million, a stake in Adani Total Gas worth $83.6 million and ownership in Adani Ports & Special Economic Zone worth $63.4 million.

Meanwhile, Adani stocks ended in the red after MSCI Inc said it was reviewing the number of shares linked to the group that were freely tradable in public markets.

IRCTC: The PSU’s standalone net profit was up 22.3% to Rs 255.5 crore in Q3FY23 as against Rs 208.8 crore in Q3FY22. Standalone revenue jumped 69.9% to Rs 918.1 crore in Q3FY23 as against Rs 540.2 crore in Q3FY22. EBITDA increased 16.7% to Rs 325.8 crore in Q3FY23 as against Rs 279.2 crore in Q3FY22. The company’s board approved an interim dividend of Rs 3.50 per share

Paras Defence and Space Technologies: The company’s consolidated net profit rose 27.25% to Rs 9.76 crore in the quarter ended December 2022 as against Rs 7.67 crore during the quarter ended December 2021. Revenue rose 31.09% to Rs 60.88 crore in the quarter ended December 2022 as against Rs 46.44 crore during the quarter ended December 2021. EBITDA advanced 11% to Rs 14.2 crore in Q3FY23 as against Rs 12.8 crore in Q3FY22.

MRF: the tyre manufacturer said that its net profit was up 17% to Rs 174.8 crore in Q3FY23 as against Rs 149.4 crore in Q3FY22. Revenue rose 14.7 % to Rs 5,644.6 crore in Q3FY23 as against Rs 4,920.1 crore in Q3FY22. EBITDA was up 13.9% at Rs 561.7 crore in Q3FY23 as against Rs 493 crore in Q3FY22. EBITDA margin was flat at 10% during the reported quarter.

Devyani International: The company’s net profit rose 13.6% to Rs 71.7 crore in Q3FY23 as against Rs 63.1 crore in Q3FY22. Revenue was up 26.6% to Rs 790.6 crore in Q3FY23 as against Rs 624.4 crore in Q3FY22. EBITDA rose 17.7% to Rs 173.9 crore in Q3FY23 as against Rs 147.8 crore in Q3FY22.

Sapphire Foods India: The company’s consolidated net profit of declined 36.11% to Rs 32.61 crore in the quarter ended December 2022 as against Rs 51.04 crore during the quarter ended December 2021. Sales rose 17.45% to Rs 596.13 crore in the quarter ended December 2022 as against Rs 507.54 crore during the quarter ended December 2021. EBITDA was up 2.2% at Rs 116.6 crore in Q3FY23 as against Rs 114.1 crore in Q3FY22.

Greaves Cotton: The company’s net profit stood at Rs 6.43 crore in the quarter ended December 2022 as against a net loss of Rs 6.24 crore during the quarter ended December 2021. Sales rose 5.57% to Rs 513.51 crore in the quarter ended December 2022 as against Rs 486.40 crore during the previous quarter ended December 2021. EBITDA tumbled 77.9% to Rs 3 crore in Q3FY23 as against Rs 13.6 crore in Q3FY22.

Rane Brake Lining: The company’s net profit rose 33.28% to Rs 9.17 crore in the quarter ended December 2022 as against Rs 6.88 crore during the quarter ended December 2021. Sales rose 14.03% to Rs 153.33 crore in the quarter ended December 2022 as against Rs 134.47 crore during the quarter ended December 2021. EBITDA up 46.8% at Rs 16 crore in Q3FY23 as against Rs 10.9 crore in Q3FY22.

Alkyl Amines: The company’s net profit slipped 0.2% to Rs 45.7 crore in Q3FY23 as against Rs 46 crore in Q3FY22. Its revenue was up 3.6% to Rs 388.5 crore in Q3FY23 as against Rs 376.6 crore in Q3FY22. EBITDA rose 4.5% to Rs 69.6 crore in Q3FY23 as against Rs 66.6 crore in Q3FY22.

Suzlon Energy: The company’s net profit rose to Rs 78.4 crore in Q3FY23 as against Rs 38 crore in Q3FY22. Revenue fell 9.3% to Rs 1,449 crore in Q3FY23 as against Rs 1,597 in Q3FY22. EBITDA fell 24.5% to Rs 206.3 crore in Q3FY23 as against Rs 273.1 crore in Q3FY22.

DCW: The company’s net profit soared 80.5% to Rs 48.2 crore in Q3FY23 as against Rs 26.7 crore in Q3FY22. Revenue fell 11.6% at Rs 579.2 crore in Q3FY23 as against Rs 655.1 crore in Q3FY22. EBITDA was up 13.8% to Rs 101.5 in Q3FY23 as against Rs 89.2 crore in Q3FY22.

Natco Pharma: The drugmaker’s net profit slumped 22.5% to Rs 62.3 crore in Q3FY23 as against Rs 80.4 crore in Q3FY22. Revenue fell 12.1% to Rs 492.5 crore in Q3FY23 as against Rs 560.5 crore in Q3FY22. EBITDA was up 4% to Rs 105.9 crore in Q3FY23 as against Rs 101.8 crore in Q3FY22.

Nesco: The company’s net profit was up 42% to Rs 70 crore in Q3FY23 as against Rs 49.3 crore in Q3FY22. Revenue climbed 52.9% to Rs 142.8 crore in Q3FY23 as against Rs 93.4 in Q3FY22. EBITDA rose 35% to Rs 82.2 crore in Q3FY23 as against Rs 60.9 crore in Q3FY22.

SP Apparels: The clothing company’s net profit fell 46.3% to Rs 13.2 crore in Q3FY23 as against Rs 24.6 crore in Q3FY22. Revenue was almost flat at Rs 251.1 crore in Q3FY23 as against Rs 250.3 crore in Q3FY22. EBITDA tumbled 41.8% to Rs 22.4 crore in Q3FY23 as against Rs 38.5 crore in Q3FY22.

Rainbow Medicare: The hospital chain reported a net profit of Rs 58 crore in Q3FY23, up 28.9% from Rs 45 crore in Q3FY22. Revenue was up 23.2% to Rs 306.4 crore in Q3FY23 as against Rs 248.7 crore in Q3FY22. EBITDA was up 19.9% to Rs 106.8 crore in Q3FY23 as against Rs 89.1 crore in Q3FY22.

Shriram Pistons and Rings: The country’s largest piston manufacturer said that it will buy 75% stake in Japan-based Takahata Precision India Private Limited (“TPIL”) through its wholly owned subsidiary, SPR Ingenious Limited (“SEL”), subject to regulatory approvals. With this acquisition, SPRL will foray into the manufacturing of the precision injection moulded components. This is the second major acquisition by the company Shriram Pistons, after it took over EMFI, manufacturers of Electric Vehicle Motors and Controllers based at Coimbatore, Tamil Nadu (India).