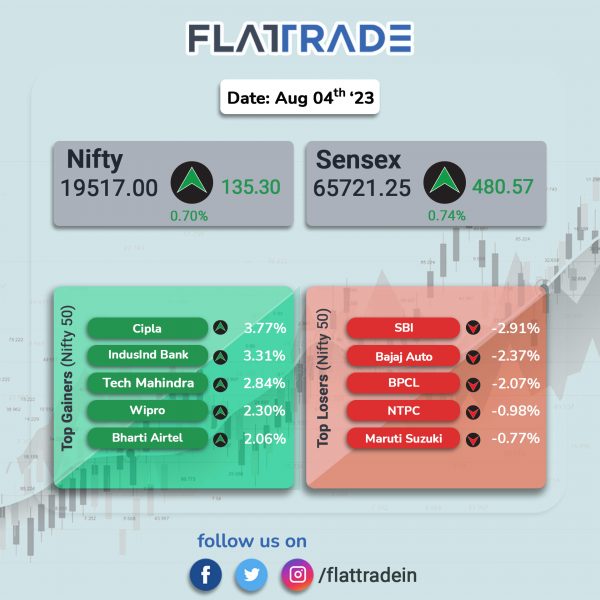

Domestic benchmark equity indices rose on Friday, aided by gains in IT and private bank stocks. The Sensex jumped 0.74% and the Nifty 50 index rose 0.7%.

In broader markets, the Nifty Midcap 100 index gained 0.82% and the BSE Smallcap index advanced 0.66%.

Top gainers were IT [1.55%], Private Bank [1.25%], Consumer Durables [1.01%], Pharma [0.94%], and Bank [0.82%]. Top losers were PSU Bank [-0.7%], Auto [-0.33%], and FMCG [-0.02%].

The Indian rupee fell 10 paise to 82.84 against the US dollar on Friday.

Stock in News Today

State Bank of India (SBI): The country’s largest lender said its standalone net profit surged 178.25% to Rs 16,884.29 crore in Q1FY24 from Rs 6,068.08 crore in Q1FY23. Total income grew 44.07% YoY to Rs 1,08,038.83 crore in the quarter ended June 2023. Net interest income (NII) dropped 3.68% YoY to Rs 38,905 crore during the quarter under review. Operating profit surged 98.37% YoY to Rs 25,297 crore in the reported quarter. The ratio of net NPAs to net advances stood at 1% as on 30 June 2023 as against 0.67% as on 31 March 2022 and 0.71% as on 30 June 2022. Shares of the bank tanked 2.91% to Rs 573.3 per share on the NSE.

Mahindra & Mahindra (M&M): The utility vehicles and tractor manufacturer said its standalone net profit zoomed 98% to Rs 2,774 crore in Q1FY24 as against Rs 1,404 crore recorded in Q1FY23. Revenue from operations jumped 23% YoY to Rs 24,368 crore in the quarter ended June 2023. EBITDA grew by 46% to Rs 3,547 crore in the first quarter of FY24 as compared with Rs 2,422 crore recorded in the same quarter last fiscal. M&M sold 1,86,138 vehicles, up 21% YoY, while total tractors sold in Q1FY24 stood at 1,14,293 units, down 3% YoY.

Aditya Birla Fashion and Retail (ABFRL): The company reported a consolidated net loss of Rs 161.62 crore in Q1FY24 as against a net profit of Rs 94.44 crore in the same quarter of last fiscal. Total revenue stood at Rs 3,196.06 crore, a rise of 11% from Rs 2,874.76 crore in the year-ago period. EBIDTA was at Rs 292.3 crore, a fall of 37.6% YoY.

Bharat Dynamics: The defence manufacturer reported a 5% rise in standalone net profit at Rs 41.8 crore in the quarter ended June as against Rs 39.8 in the year-ago period. The company’s revenue dropped by 57.15% to Rs 297.7 crore in the quarter under review from Rs 694.8 crore in the same period last fiscal. As on June 30, the company’s order book stood at Rs 20,223 crore.

Bharat Heavy Electricals Ltd (BHEL): The state-run company registered a net loss of Rs 343.9 crore for the first quarter ended June 2023, compared with a net loss of Rs 188 crore in the corresponding quarter last year. Its total revenue stood at Rs 5,003.4 crore during the period under review, up 7.1% from Rs 4,672 crore in the corresponding period of the last fiscal. EBITDA jumped 14.9% to Rs 1,037.4 crore in the first quarter of this fiscal over Rs 902.7 crore in the corresponding period of FY23.

JK Tyre and Industries: The company’s profit after tax (PAT) increased over 310% YoY to Rs 154 crore in Q1FY24 from Rs 37.2 crore in Q1FY23. Its revenue from operations rose 2.1% to Rs 3,718.1 crore in the reported quarter from Rs 3,643 crore in the corresponding quarter last year. The company’s EBITDA saw a sharp rise of 60.6% to Rs 457.3 crore in the quarter under review from Rs 284.8 crore in the same period last fiscal.

Devyani International: The company’s consolidated net profit tanked 84.08% to Rs 11.75 crore in Q1FY24 from Rs 73.84 crore in Q1FY23. Revenue from operations jumped 20.14% YoY to Rs 846.63 crore during the quarter under review from Rs 704.72 crore posted in the same quarter last year. EBITDA rose 6.09% YoY to Rs 173.4 crore in Q1FY24. Same-store sales growth of KFC fell 0.9%, Pizza Hut dropped 5.3% and Costa Coffee was 9.4% in Q1FY24.

Alembic Pharmaceuticals: The drug maker posted a consolidated net profit of Rs 120.6 crore in the quarter ended June 2023 as against a consolidated net loss of Rs 65.88 crore in the same quarter last fiscal. Consolidated revenue from operations in the first quarter of the current fiscal was Rs 1,486.15 crore, compared with Rs 1,262.14 crore in the corresponding quarter last fiscal. The company’s domestic business grew 9% to Rs 524 crore, while the US generics business grew 6% to Rs 390 crore in the reported quarter.

Madhav Infra Projects: The company said in an exchange filing that it has secured an order worth Rs 117.91 crore from ONGC. The order entails design, engineering, procurement & supply, construction & installation, commissioning, associated transmission system and operation & maintenance of 15 MW (AC) solar photovoltaic grid. The time of completion and commissioning of the plant is 15 months from the date of issue of Letter of Acceptance, according to its regulatory filing.

Cipla: The pharma company’ shares surged after The Economic Times reported that PE fund Blackstone may acquire a 33.47% promoter stake in the drug maker. Blackstone is likely to submit a non-binding bid next week for the Hamied family’s stake in the company. With this move, Blackstone may also trigger an open offer for an additional 26% in Cipla, and if fully subscribed, Blackstone could end up owning about 59.4% of the pharma major, according to the report.

Mahanagar Gas: The company’s net profit jumped 98.92% to Rs 368.40 crore in Q1FY24 compared with Rs 185.20 crore in Q1FY23. Revenue from operations increased 6.09% to Rs 1,690.18 crore in Q1FY23 from Rs 1,593.18 crore in Q1FY23. EBITDA rose 82.55% to Rs 521.27 crore in the reported quarter from Rs 285.55 crore in the year-ago period. Total volumes declined 1.04% YoY to 310.50 SCM million in Q1FY24 over Q1 FY23.

Rane Holdings: The company has reported a consolidated total income of Rs 897.69 crore during the quarter ended June 2023 compared to Rs.821.08 crore in the year-ago period. The company has posted a net profit of Rs.12.77 crore for the period ended June 30, 2023 as against net profit of Rs.20.05 crore in the year-ago period. The company has reported an EPS of Rs.8.94 in the reported quarter compared to Rs.14.04 for the year-ago period.

Shivalik Bimetal Controls: The company said in an exchange filing that the credit rating agency, CRISIL, reaffirmed its ratings for the company’s bank facilities amounting to Rs 71 crore. The total bank loan facilities rated amount to Rs 71 crore. The long-term rating and short-term rating have been reaffirmed as CRISIL A/Stable and CRISIL A1, respectively.