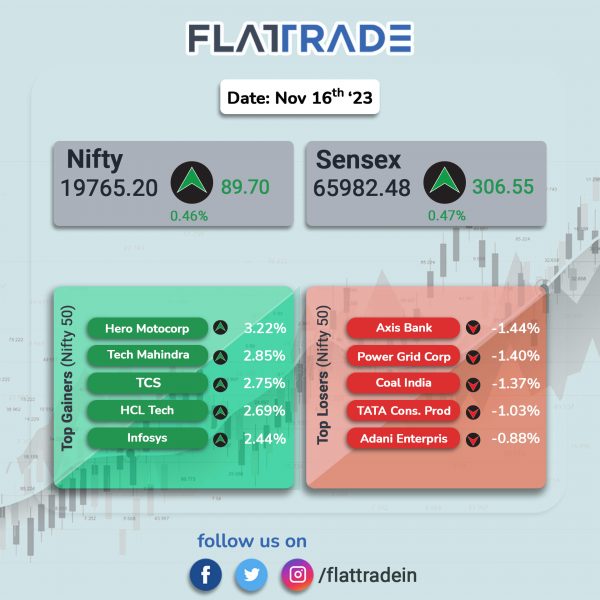

Benchmark equity indices closed higher for the second straight day, helped by strong gains in IT, Pharma and auto stocks. The Sensex rose 0.46% and the Nifty 50 index climbed 0.46%.

In broader markets, the Nifty Midcap 100 index jumped 0.78% and the BSE Smallcap advanced 0.51%.

Top gainers were IT [2.69%], Realty [0.92%], Pharma [0.87%], Auto [0.84%], and Media [0.82%]. Top losers were PSU Bank [-0.24%], FMCG [-0.15%], and Bank [-0.09%].

The India rupee fell 8 paise to 83.23 against the US dollar on Thursday.

Stock in News Today

Dr.Reddy’s Laboratories (DRL): The company received an approval from the USFDA to roll out wearable therapy device, Nerivio, for drug-free management of migraine. Nerivio is a prescription-based non-invasive device intended for acute and prophylactic (preventive) treatment of migraine with or without aura for adults and adolescents aged 12 years and above. Nerivio can be worn on the upper arm. The device is accompanied by the Nerivio app. This app can be used to control the intensity levels of the device.

Hero MotoCorp: The company recorded its highest-ever festive sales, clocking more than 14 lakh units in retail sales during the 32-day festive period – between the first day of the Navratras and Bhai Dooj – this year. Riding on robust demand across rural markets as well as steady retail off-take in key urban centers, the company registered a 19% growth over the previous year, and surpassed its previous highest retail of 12.7 lakh units which was recorded in the festive period of 2019, the two-wheeler manufacturer said in an exchange filing.

PTC India: The company plans to divest its arm, PTC Energy, to ONGC for an enterprise value of Rs 2,021 crore, PTI reported citing a top official. With this, the company will achieve a debt-free status and the company will be more focused on improving core margin per unit rather than on increasing trade volumes, said Chairman and Managing Director Rajib K Mishra to PTI.

Puravankara : The realty company has bagged redevelopment projects two housing societies in Mumbai with a revenue potential of Rs 1,500 crore. The project is spread over 3 acres in Andheri West and it has a cumulative estimated development potential of 5.8 lakh square feet of carpet area, with approximately 3.65 lakh square feet available for sale, the company said in a statement.

TCI Express: The logistics solution provider said that CRISIL Ratings has reaffirmed its ‘CRISIL AA-/Stable’ rating on the bank loan facilities of the company. The rating continues to reflect the company’s healthy operating efficiency, strong market position and robust financial risk profile. These strengths are partially offset by its modest scale of operations, low cash flow diversity and exposure to intense competition.

Pennar Industries: The company said in an exchange filing that it has bagged orders worth Rs 669 crore across various business verticals such as PEB, Ascent Buildings USA, ICD, Railways, Tubes, and Steel. The orders are expected to be executed within the next two quarters.

Divi’s Laboratories: The company said in an exchange filing that it has received a goods and service tax (GST) demand notice for Rs 82 crore from GST Commissionerate in Hyderabad. In addition, the tax department has imposed a penalty of Rs 82.04 crore. The company said its is hopeful of a favourable outcome and does not expect the said order to have any material financial impact on the company.