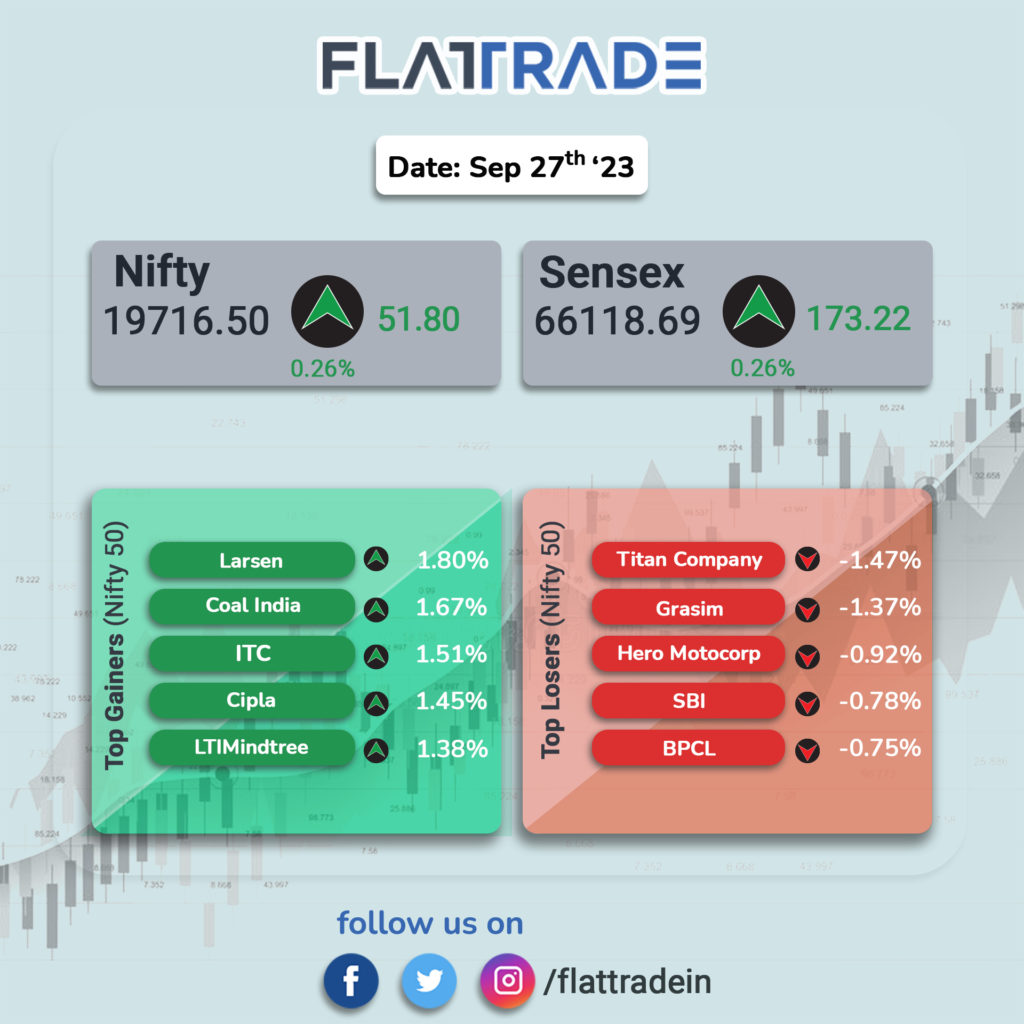

Benchmark equity indices rebounded from losses and closed higher, aided by gains in pharma and PSU Banks. The Sensex rose 0.26% and the Nifty gained 0.26%.

In broader markets, the Nifty Midcap 100 jumped 0.75% and the BSE Smallcap rose 0.67%.

Top gainers among Nifty sectoral indices were Pharma [1.19%], PSU Bank [0.83%], FMCG [0.8%], Realty [0.73%], and IT [0.38%]. Top losers were Financial Services [-0.13%] and Bank [-0.08%].

The local currency closed flat at 83.23 against the U.S dollar on Wednesday.

Stocks in News Today

Adani Ports: In an exchange filing, the company said that it has commenced a tender offer to purchase for cash up to $195,000,000 in aggregate principal amount of the outstanding 3.375% senior notes due 2024, which represents 30% of the principal amount of the notes. The purpose of the tender offer is to partly prepay the company’s near-term debt maturities. After the completion of this tender Offer, the company expects $325 million notes to remain outstanding. The company intends to fund the notes accepted for purchase in the tender offer from its cash reserves.

Apollo Hospitals Enterprise: The company’s wholly owned subsidiary, Apollo Multispecialty Hospitals, has acquired the assets relating to a partially built hospital in Sonapur, Kolkata, with a total capacity of 325 beds. The company has acquired the assets from Future Oncology Hospital and Research Centre for a total consideration of Rs 102 crore and the acquisition is being fully funded through internal accruals. The first phase of the hospital with 225 beds built over 1.75 lakh square feet will be commissioned in the next 12 months.

Procter & Gamble Health: The company announced that it plans to source injections portfolio of its products from a contract manufacturer, and the company shall discontinue production of injections at its manufacturing plant in Goa with effect from September 30, 2023. The company added that the discontinuation of production at Goa, shall not have an impact on continuity of sale of injections by the company.

Sun Pharmaceutical Industries: The company’s wholly owned subsidiary, Sun Pharma Canada, launched Winlevi in Canada. Winlevi works differently from any other topical acne treatment. The launch of Winlevi enhances Sun Pharma’s specialty product portfolio in Canada and reflects our commitment to providing innovative dermatology medicines that address patients’ needs.

Bombay Dyeing: The company said that it has terminated deposit pact with Citibank effective October 26, 2023. Global Depository Receipts of company will be delisted from Luxembourg Stock Exchange.

Sterling & Wilson Renewable Energy: The company’s board has approved fund raising up to Rs 1500 crore by way of issuance of equity shares, global depository receipts, depository receipts, foreign currency convertible bonds fully/partly convertible debentures, non-convertible debentures, and/or any other financial instruments convertible into equity shares (including warrants) or a combination of any of the securities (Securities) mentioned above in one or more tranches through one or more public and/ or private offerings including by way of a qualified institutions placement or any combination.

Ashoka Buildcon: The infrastructure company announced September 8, 2023, as the Commercial Operations Date (CoD) for its hybrid annuity mode project of National Highways Authority of India (NHAI) for the project “Four Laning of Tumkur – Shivamogga section”. The project was executed by Ashoka Karadi Banwara Road (SPV), a wholly owned subsidiary of Ashoka Concessions, a subsidiary of the company. Upon the declaration of CoD, the SPV is eligible for receipt of annuity payments from NHAI for the operation period of 15 years at an interval of every six months from the date of achievement of CoD.

Hikal: The company has appointed Berjis Minoo Desai and Ramachandra Kaundinya Vinnakota as Independent Directors of the company for a period of five years with effect from October 1, 2023.

GIC Housing Finance: The company announced that Rajeshwari Singh Muni, CMD of National Insurance Co., has been appointed as additional director (Non-Executive) on the board of the company w.e.f. 26 September 2023.

Yes Bank: The lender announced that Ravi Thota, Country Head-Large Corporates, had tendered his resignation effective from close of business hours on 26 September 2023.

Man Infraconstruction: The company has received an Intimation of Disapproval (IOD) approval for its luxurious residential project of 10 societies located at Ghatkopar East having carpet area of about 4 lakh sq. ft. for sale. The company plans to launch the project likely in the fourth quarter of the financial year 2023-24. The company is expected to generate a revenue of Rs 1,200 crore in next 4 years from this project.

CESC: The company has approved the issue of 30,000 secured, unlisted, redeemable, rated non-convertible debentures having a face value of Rs 1 lakh each for cash at par aggregating to Rs 300 crore on a private placement basis.

Sandur Manganese & Iron Ores: The company announced the resignation of Bijan Kumar Dash as company secretary and compliance officer of the company with effect from close of business hours on 20 November 2023.

HLE Glascoat: DSP Micro Cap Fund has bought 3.52% stake in the company via bulk deal. Bulk deal data on the NSE showed that DSP Micro Cap Fund bought 24,01,016 shares at an average price of Rs 505 per share. At the same time, three promoters of HLE Glascoat collectively sold 3.63% equity through a bulk deal.

Glenmark Pharmaceuticals: The company said that its subsidiary, Glenmark Specialty S.A., and Cosmo Pharmaceuticals N.V. has signed a distribution and license agreements for Winlevi in Europe and South Africa. Under the terms of the agreements, Glenmark will receive from Cassiopea, a subsidiary of Cosmo, the exclusive right to commercialize Winlevi in 15 EU countries as well as in South Africa and the UK.

Signatureglobal India: The company shares got listed at Rs 444 apiece on the NSE, 15.32% premium to IPO issue price. The shares hit a high of Rs 474 and closed at Rs 458.55 apiece.

Sai Silks Kalamandir: The company shares opened at Rs 231 apiece on the NSE, 4.05% premium to IPO issue price. The company shares hit a high of Rs 247 apiece and closed at Rs 244.9 per share.

Paisalo Digital: The company has allotted 5,000 secured, rated, listed, redeemable non-convertible debentures of face value of Rs 1 lakh on private placement basis totalling Rs 50 crore.

Black Box: The company said that its cybersecurity business unit onboarded 17 prominent clients in the United States from diverse industries. Black Box offers cutting-edge services in Digital Infrastructure, Enterprise Networking, and Digital Collaboration, aligning seamlessly with the ever-evolving business environment.