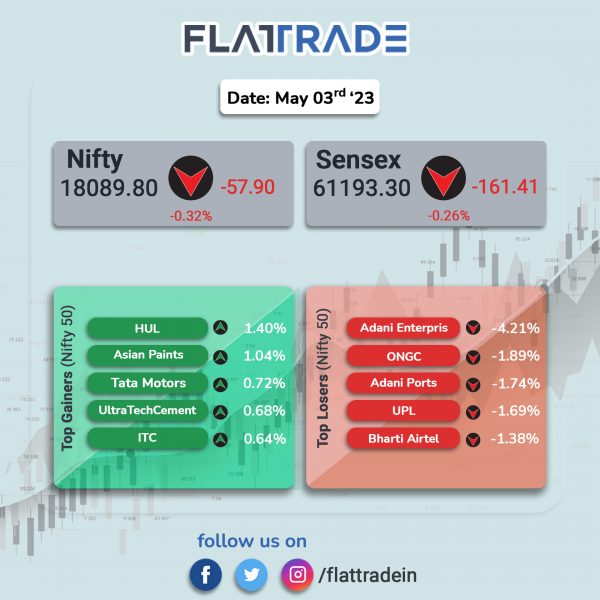

Benchmark equity indices fell, tracking negative sentiments in global markets ahead of the US Fed’s monetary policy decision later today. The Sensex fell 0.26% and the Nifty 50 index dropped 0.32%.

In broader markets, the Nifty midcap 100 index rose 0.26% and the BSE Smallcap rose 0.2%.

Top losers were IT [-1%], Metal [-0.98%], PSU Bank [-0.98%], Oil & Gas [-0.77%], and Energy [-0.61%]. Top gainers were FMCG [0.78%], Media [0.28%], and Realty [0.28%].

Indian rupee rose 6 paise to 81.82 against the US dollar on Wednesday.

Stock in News Today

Adani Wilmar (AWL): The company’s consolidated net profit slumped 60.05% to Rs 93.61 crore in Q4FY23 as against Rs 234.29 crore in Q4FY22. Revenue from operations stood at Rs 13,872.64 crore in Q4 FY23, down 7% from Rs 14,917.26 crore in the corresponding quarter last fiscal. EBITDA fell 16% to Rs 359 crore in Q4FY23 as against Rs 426 crore in same quarter last year. Volumes improved by 15% to 1.49 million metric tonnes (MMT) in Q4 FY23 as compared with 1.29 MMT reported in Q4 FY22.

MRF: The tyre maker’s consolidated net profit zoomed 106.2% to Rs 340.67 crore in Q4FY23 as against Rs 165.21 crore in Q4FY22. Revenue from operations stood at Rs 5,841.72 crore in Q4FY23, a growth of 10.12% from Rs 5,304.82 crore posted in the year-ago period. MRF’s operating margin improved to 9.14% in Q4 FY23 as compared to 4.34% posted in Q4 FY22. Meanwhile, the company’s board has recommended a final dividend of Rs 169 per share for the financial year ended 31 March 2023.

JSW Steel: The company said that its US-based subsidiary, JSW Steel USA Ohio, will invest $145 million in new projects to upgrade its manufacturing operations at Mingo Junction, Ohio. JSW Steel USA aims to meet the demand for quality steel products that are melted & manufactured in the US. The new projects are expected to be completed & commissioned in FY26, said the company.

Manappuram Finance: Shares of the company tanked 12.14% after reports emerged that the Enforcement Directorate (ED) conducted searches at the company’s premises as part of a money laundering investigation. According to various media reports, ED conducted searches at four premises of Manappuram Finance in Kerala, including those of its promoters. The developments come after allegations that the company collected public deposits worth over Rs 150 crore in contravention of Reserve Bank of India (RBI) guidelines.

Jyothy Labs: The company reported a 60.4% jump in consolidated net profit to Rs 59.26 crore and its operating revenue rose 12.8% to Rs 616.95 crore in Q4FY23 over Q4FY22. Operating EBITDA surged 59.4% to Rs 91.3 crore in Q4 FY23 from Rs 57.3 crore in Q4 FY22. Operating EBITDA margin improved to 14.8% in Q4 FY23 as against 10.5% in Q4 FY22.

Havells India: The company reported a 2.48% rise in standalone net profit to Rs 361.71 crore and its operating revenue rose 9.79% to Rs 4,849.59 crore in Q4FY23 over Q4FY22. EBITDA increased by 2% to Rs 531 crore in Q4FY23 as against Rs 521 crore reported in Q4FY22. EBITDA margin declined to 10.9% in Q4FY23 as compared to 11.8% registered in the same period last year. The home appliance company said that the consumer demand remained sluggish, B2B sustained steady demand, led by infrastructure/ construction and Lloyd maintained growth momentum.

Godrej Properties: The company reported a 58% rise in consolidated net profit to Rs 412.14 crore and its operating revenue rose 23.72% to Rs 1,646.27 crore in Q4FY23 over Q4FY22. EBITDA rose 56% to Rs 630 crore in Q4 FY23 compared with Rs 403 crore in Q4 FY22. EBITDA margin stood at 32.6% in the reported quarter as against 27.3% in the year-ago quarter. Total booking value increased by 25% to Rs 4,051 crore in Q4 FY23 as compared with Rs 3,248 crore posted in Q4 FY22. The company said that it has added 5 new projects in Bengaluru, Pune, Chennai, Khalapur, Chembur with an estimated booking value of Rs 5,750 crore.

Mold-Tek Packaging: The company reported a 32.74% jump in net profit to Rs 22.99 crore and its operating profit rose 3.81% to Rs 184.70 crore in Q4FY23 over Q4 FY22. The company’s sales volume improved by 8.01% to 9,067 MT in the quarter ended March 2023 as against 8,395 MT in the year-ago period. EBDITA increased by 11% YoY to Rs 36.44 crore during the quarter.

IDBI Bank: The lender’s standalone net profit surged 64.11% YoY to Rs 1,133.37 crore and its total income rose 28.87% YoY to Rs 7,013.84 crore in Q4FY23 over Q4FY22. Net interest income (NII) jumped 35% to Rs 3,280 crore in Q4FY23 from Rs 2,420 crore in the same period a year ago. Net interest margin (NIM) improved to 5.01% in Q4FY23 as compared to 3.97% reported in Q4FY22. Operating profit stood at Rs 2,425 crore in the quarter ended 31 March 2023, recording a growth of 60% year on year (YoY).

Bank of Baroda: The company has appointed Debadatta Chand as Managing Director and Chief Executive Officer for a period of three years effective from July 1. Debadatta Chand was the Executive Director of Bank of Baroda since March 3, 2021. He has over 28 years of experience in Commercial Banks and Developmental Financial Institutions.

Strides Pharma Science: The company announced that it has entered into strategic partnership with Orbicular Pharmaceutical Technologies (Orbicular) to develop, manufacture and commercialize nasal sprays for global markets. Strides will commercialize these nasal sprays across the markets using its commercial engine in the US, Europe and several other markets. The products will be manufactured at company’s Chestnut Ridge, New York facility.

Anupam Rasayan: The company’s consolidated net profit increased by 22.93% YoY to Rs 56.67 crore and revenue from operations jumped 47.71% YoY to Rs 479.96 crore in Q4FY23. EBITDA was at Rs 141.6 crore in Q4FY23 from Rs 96.9 crore in Q4 FY22, registering the growth of 46% year on year. EBITDA margin reduced to 28% in Q4FY23 from 31% in Q4FY22. The board has declared third interim dividend of Rs 1.50 per equity share for FY23. The record date for payment of dividend is fixed on 15 May 2023 and payment date on or before 1 June 2023.

Home First Finance: The housing finance company reported 6.38% increase in net profit at Rs 64.03 crore and its total income jumped 48.19% to Rs 231.30 crore in Q4FY23 over Q4FY22. Disbursements grew by 35.6% YoY to Rs 869 crore in the quarter ended March 2023. Spread on loans stood at 5.5% in Q4 FY22 as compared to 5.6% reported in Q4 FY22. The company’s asset under management (AUM) improved to Rs 7,198 crore as on 31 March 2023, registering a growth of 33.8% from Rs 5,380 crore posted in the same period a year ago.

Gravita India: The company announced that its subsidiary Gravita Netherlands BV has received a 34 million Euros ESG loan from European Developmental Financial Institutions Proparco and Oesterreichische Entwicklungsbank AG. This facility will enable Gravita’s offshore businesses to gain financial independence for their capital expenditure and working capital needs. The loan facility is guaranteed by Gravita India.

Spandana Sphoorty Financial: The company’s consolidated net profit jumped 48% to Rs 105.57 crore in Q4FY23 as compared with Rs 71.36 crore in Q3FY23. Total income stood at Rs 533 crore in Q4FY23, a growth of 42% as against Rs 375 crore posted in Q3FY23. Net interest income (NII) increased to Rs 384 crore in Q4FY23 from Rs 254 crore in Q3FY23. Net interest margin (NIM) stood at Rs 13.9% in Q4FY23. During the quarter, Asset under management (AUM) registered a growth of 24% to Rs 8,511 crore in Q4FY23 from 6,852 crore posted in Q3FY23.

UCO Bank: The bank’s net profit jumped 86% YoY to Rs 581.24 crore and total income rose 36.35% YoY to Rs 5,946.94 crore in Q4FY23. On full year basis, the bank’s net profit jumped 100.30% to Rs 1,862.34 crore in FY23 as compared with Rs 929.76 crore in FY22. Total income increased by 11.49% year on year in FY23 over FY22. Net interest income (NII) increased to Rs 7,343.13 crore in FY23 as against Rs 6,472.95 crore in FY22 registering the growth of 13.44% fuelled by healthy growth in loan book and improved yield on advances. Net interest margin stood at 2.87% in FY23 as against 2.81% in FY22. Net NPA was at 1.29% at the end of March 2023 quarter compared to 2.70% in the year-ago period.

Newgen Software Technologies: The company’s consolidated net profit jumped 63.09% to Rs 78.61 crore and operating revenue rose 19.67% to Rs 305.05 crore in Q4FY23 over Q3FY23. Subscription revenues stood at Rs 87.5 crore, a rise of 26% YoY. Annuity revenue streams stood at Rs 166.2 crore. Revenue from the sale of products/license stood at Rs 59.5 crore. EBITDA margin stood at 31.6% in Q4FY23, higher than 29.1% in Q4FY22.