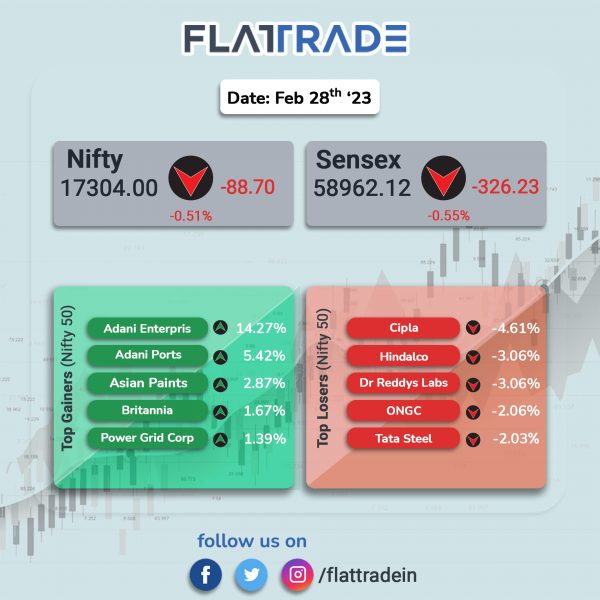

Benchmark equity indices fell as investors remained cautious ahead of release of India’s GDP data today. Losses in energy, pharma and IT stocks weighed on the indices. The Sensex fell 0.55% and the Nifty dropped 0.51%.

Benchmark indices outperformed headline indices. Nifty Midcap 100 index rose 0.74% and the BSE Smallcap gained 0.40%.

Top losers were Oil & Gas [-1.34%], Pharma [-1.31%], Energy [-1%], IT [-0.85%] and Metal [-0.84%]. Top gainers were Media [2.46%], Realty [1.14%], Auto [0.45%] and PSU Bank [0.4%].

India rupee rose 17 paise to 82.66 against the US dollar on Tuesday.

Stock in News Today

Adani Group: Shares of most Adani Group companies gained after the group hosted roadshow in Hong Kong to ease concerns about its financial health and corporate governance induced by a short-seller’s allegations. Earlier, executives of the group met investor on Monday in Singapore, where they said the conglomerate has enough money to repay debt due over the next three years in addition to an $800 million credit facility. Further, Adani Group plans to prepay or repay share-backed loans worth $690 million to $790 million by March-end, Reuters reported citing two people with knowledge of the matter.

State Bank of India (SBI): The lender said that it has raised $1 billion through a syndicated social loan from global banks to lend to socially impactful businesses in India. The funds will be utilised to lend to microfinance institutions and self-help groups. The loan facility was arranged through Japan-based MUFG Bank and Taiwan-based Taipei Fubon Commercial Bank.

Infosys: The IT major announced a strategic collaboration with ng-voice GmbH, a leading provider of cloud-native Infrastructure Management Services (IMS) solutions. Infosys will provide systems integration services for ng-voice through a global delivery model facilitating telecom operators with digital capabilities to deploy fully containerized and cloud-native network solutions across Europe.

Shree Cement: The company has emerged as the highest bidder for the Datima Coal Mine Block, which is located in Surajpur Tehsil in Surguja District of Chattisgarh. The Datima Coal Mine Block has geological reserves of 13.30 million tonnes.

NTPC: The company announced that the first unit of 60 MW capacity of North Karanpura Super Thermal Power Station (3×660 MW) is declared on commercial operation. With this, standalone and group commercial capacity of NTPC will become 58,979 MW and 71,594 MW, respectively.

Adani Ports and SEZ: The company said that its step down subsidiary, Adani Agri Logistics (AALL) has incorporated a wholly-owned subsidiary in the name of PU Agri Logistics. The new company’s purpose will be development, design, construction, financing, procurement, engineering, operation and maintenance of silo complexes (spoke silo complex) without container depot on design, build, finance, own and operate basis under public-private partnership (PPP) mode at twenty six locations in Punjab.

PNC Infratech: The company has been declared the lowest bidder for a project which entail design and construction of civil works and connectivity to Indian Railways network from New Patli to Patli Station and New Patli to Sultanpur Station including modifications/civil works at Sultanpur Station in connection with laying of New BG Double Railway Line of HORC Project of Haryana Orbital Rail Corporation Limited. The cost of the project is Rs. 771.46 crore and it is expected to be constructed in 30 months.

Balrampur Chini Mills: The company said that its board has approved the private allotment of 14,000 non-convertible debentures (NCDs) to HDFC Bank, aggregating to Rs 140 crore. The company’s board approved the allotment of 14,000 senior, unlisted, secured, rated, redeemable, non-convertible debentures having face value of Rs 1 lakh each aggregating to Rs 140 crore, on a private placement basis.

Happiest Minds Technologies: The IT firm announced that its board will consider fund raising through issuance of non-convertible debentures (NCDs) in domestic market, in one or more tranches on Thursday (March 2, 2023). The company’s board will also consider the issue of commercial papers in domestic market, in one or more tranches as on the same date.

HPL Electric & Power: The company said that it has bagged a smart meter order worth Rs 409.10 crore from an institutional customer in Western India. The company currently has an order book of over Rs 1200 crore as of February 27. Gautam Seth, joint managing director of the company, said, “We are fully equipped to cater to more large DISCOMs and service providers in the Indian market and are excited to continue growing our order books.”

South India Paper Mills: The paper manufacturing company said that its board has approved issue of equity shares aggregating to Rs 45 crore to non promoters on a preferential basis through private placement. The paper manufacturer will issue 37.5 lakh equity shares having face value of Rs 10 each for cash at a price of Rs 121 each. The shareholder’s approval for aforementioned issuance will be taken on March 23, 2023, said the company.

3i Infotech: The company has won Oracle Data Warehouse and Business Intelligence (DWBI) Managed Services deal with SBI General Insurance. With a value of around Rs 16.5 crore, the contract is spread over a tenure of three years. As a part of the deal, 3i Infotech will perform 24/7 application and production support, data migration and integration, ETL operations, DWBI Service Management L2, L3, MIS report, ad hoc reports and dashboards, data reconciliation, data democratization, data remediation, user management, knowledge management, security, audit and compliance services for data warehouse and Business Intelligence solution using end-to-end Oracle stack.

Rain Industries: The company’s consolidated net profit rose to Rs 89.52 crore in Q4CY22 as against a net loss of Rs 96.96 crore in Q4CY21. Revenue from operations jumped 35.54% to Rs 5,456.81 crore in the reported quarter from Rs 4,026.05 crore in the year-ago period. EBITDA stood at Rs 689.5 crore in the quarter under review, up 27.45% from Rs 541 crore reported in Q4CY21.

Jyothy Labs: The company informed that the Mumbai bench of the National Company Law Tribunal (NCLT) has sanctioned the scheme of amalgamation of Jyothy Fabricare Services with Jyothy Labs. The amalgamation will help pool and combine finances and resources into one consolidated entity which will result in administrative and operations rationalization, organization efficiencies, optimal utilization of various resources, overheads, and better compliance management.