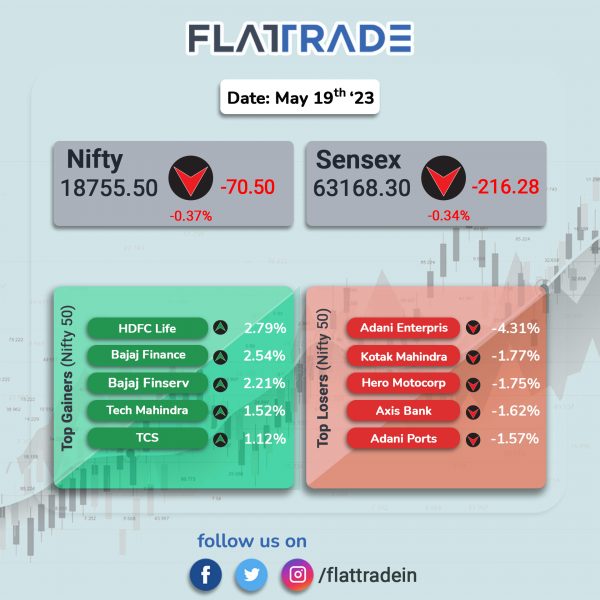

Benchmark equity indices closed lower on weak global cues and as investors booked profits. The Sensex fell 0.34% and the Nifty 50 index dropped 0.37%.

In broader markets, the Nifty Midcap 100 index inched up 0.04% and the BSE Smallcap rose 0.24%.

Top losers among Nifty sectoral indices were Media [0.89%], Private Bank [-0.89%], Energy [-0.78%], Realty [-0.73%], and Bank [-0.69%]. Top gainers were PSU Bank [0.96%], IT [0.42%], and Pharma [0.17%].

India rupee stood at 81.94 against the US dollar on Monday.

Stock in News Today

Adani Transmission: The company said it has received shareholders’ approval to raise up to Rs 8,500 crore through issuance of equity shares on qualified institutional placement basis. According to the company’s regulatory filing, 98.64% votes were polled in favour of the resolution. The raised funds will be used for the desired growth and expansion of the company.

Vedanta: The company’s parent organisation Vedanta Resources (VR) plans to repay a debt of $2.2 billion in the current financial year, through measures like brand monetisation, refinancing, and transfer of general reserves to retained earnings to meet its repayment deadlines, The Economic Times (ET) reports. Out of the total debt repayment of $4.2 billion falling due in FY24, the company has already paid $2 billion in the first quarter, the report added.

InterGlobe Aviations (IndiGo): The airline’s board is expected to approve an order of 500 Airbus A320 Neo family aircraft, The Economic Times (ET) reported. If the board approves the proposal, then this would be largest order for aircraft in the history of the country’s aviation

Shriram Properties: The company plans to invest about Rs 750 crore this fiscal on construction of its ongoing and new residential projects as it looks to scale up business amid strong housing demand, its CMD M Murali said in an interview to PTI news agency. The realty firm had spent Rs 500 crore in the last financial year on construction works. Shriram Properties Chairman and Managing Director (CMD) M Murali said that the company achieved a 25% growth in sales bookings to touch an all-time high of Rs 1,846 crore last fiscal, on higher volumes and better price realisation.

Lupin: The drugmaker announced that it has received the Establishment Inspection Report (EIR) from the US drug regulator for its API manufacturing facility located in Visakhapatnam, India. The EIR was issued post the last inspection of the facility conducted from 6 March to 10 March 2023. The inspection closed with the facility receiving an inspection classification of ‘No Action Indicated’ (NAI).

Lupin launched Thiamine Hydrochloride injection multiple-dose vials, after its alliance partner Caplin Steriles received an approval for its ANDA from the United States Food and Drug Administration (USFDA). Thiamine prevents and treats low thiamine levels in the body. It helps maintain the health of heart, nerves, and digestive tract. According to IQVIA MAT April 2023, Thiamine Hydrochloride injection had estimated annual sales of $35 million in the U.S.

Laurus Labs: The company has signed memorandum of agreement (MoA) with IIT Kanpur (IITK) to bring novel gene therapy assets to market. As per the MoA, Laurus labs will in-license few gene therapy assets and will provide research grant for advancing these products through the pre-clinical development. Laurus will also provide funding for the clinical trials and will launch these products in India and emerging markets. Laurus labs will also establish a GMP facility at the Techno Park facility of IITK.

Som Distilleries & Breweries: The company announced that it has commenced trial production of its enhanced capacity at Odisha plant. With this development, the firm plans to expand its product offerings and increase its production capabilities. The commercial production is expected by early next month, it added.

Genus Power Infrastructures: The company announced that it has incorporated a wholly owned subsidiary, ‘Gemstar Infra Pte.’ in Singapore. Gemstar Infra Pte. is in the power infrastructure and distribution industry and is yet to commence its business operation. The subsidiary was incorporated with the object to facilitate advanced metering infrastructure service provide concessions.

Manappuram Finance: The company said that Kerala High Court has quashed FIR filed against the company’s promoter V P Nandakumar. In May, the Enforcement Directorate (ED) conducted searches in Thrissur, Kerala, at six locations connected to Manappuram Finance and its managing director, V P Nandakumar. As a result of the investigation into allegations of money laundering through illegal collection of deposits from the public, the ED froze assets worth Rs 143 crore belonging to V P Nandakumar.

Gujarat Pipavav Port: The company informed the exchanges that the operations at Pipavav Port have been resumed since early morning hours on Saturday (June 17, 2023) with normalisation of the weather conditions, said the port services company. Earlier, the company had notified about the suspension of port operations since late evening on 10 June 2023, due to the severe weather conditions emanating from Cyclone Biparjoy.

Grasim Industries: The company said that the construction of the first phase of the one lakh metric tonne chlorinated polyvinyl chloride (CPVC) resin facility in Vilayat, Gujarat, will commence in later part of the year 2023. The first phase of the plant was planned to commence production in the year 2022, but due to global COVID outbreak and its consequences, such as supply chain disruptions, prevented project work from starting.

Shriram Finance: Shares of the company surged 7.1% in intraday trade on NSE after a large block deal took place on the exchanges. About 99.2 lakh shares or a 2.65% stake in the company worth about Rs 1400 crore was sold by Private Equity, TPG, in a block deal, according to Business Standard.