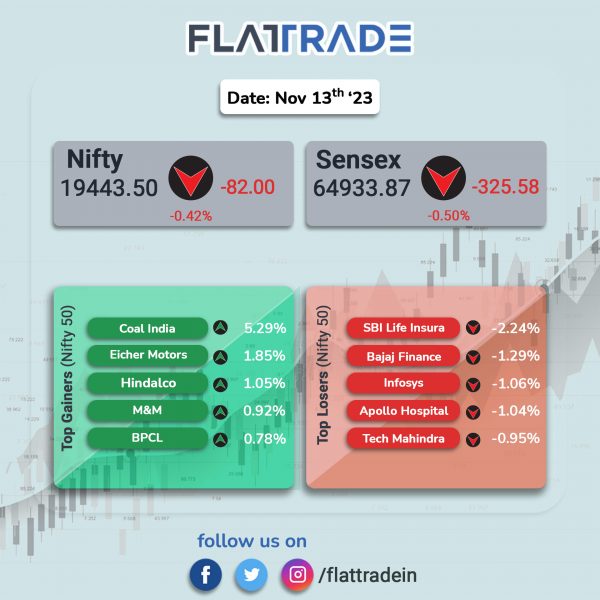

Benchmark equity indices closed lower, a day after registering gains on the first session of Samvat 2080, as investors’ sentiments were dampened by stronger US dollar and higher US Treasury yields. The Sensex fell 0.49% and the Nifty fell 0.42%.

In broader markets, the Nifty Midcap 100 rose 0.07% and the BSE Smallcap index ended flat.

Among Nifty sectoral indices, top losers were IT [-0.73%], Financial Services [-0.59%], Media [-0.46%], FMCG [-0.45%], and Pharma [-0.42%]. Top gainers were PSU Bank [2.64%], Energy [0.39%], and Metal [0.37%].

The Indian rupee rose by 2 paise to close at 83.33 against the US dollar on Monday.

Stock in News Today

Dilip Buildcon: The infrastructure company informed that the project — Construction of bridge including approaches across river Zuari on NH-17/NH-66 on Panjim-Mangalore section in Goa has been completed. The cost of the project is Rs 545.4 crore and the provisional completion certificate has been issued by the authority effective August 30, 2023. Shares of the company jumped 10% to Rs 398.35 per share.

Protean eGov Technologies: Shares of the company opened at Rs 792 on th BSE , which was the issue price. It hit a high of Rs 890.9 and a low of Rs 775 per share. The shares closed at 883 per share.

Jubilant Pharmova: The company’s wholly-owned subsidiary, Jubilant Draximage Inc., USA, has received an approval from the USFDA for its Abbreviated New Drug Application (ANDA) for preparation of Technetium Sulfur Colloid Injection.

Hindustan Copper: The copper manufacturer said its revenue soared 79.8% to Rs 381.4 crore in Q2FY24 from Rs 212.1 crore in Q2FY23. Its Consolidated Ebitda jumped 89.2% to Rs 121.2 crore in Q2FY24 as against Rs 64.1 crore in Q2FY23. The company’s net profit more than doubled to Rs 60.7 crore in Q2FY24 from Rs 25.9 crore in Q2FY23.

Techno Electric and Engineering: The company’s consolidated revenue from operations jumped to Rs 462 crore in Q2FY24 from Rs 186 crore in Q2FY23. Consolidated Ebitda was at Rs 77.5 crore in Q2FY24 compared with Rs 32.4 crore in Q2FY23, while Ebitda margin fell 64 bps year-on-year to 16.77% in Q2FY23. The consolidated net profit rose 25.5% to Rs 73.8 crore in Q2FY24 from Rs 58.8 crore in Q2FY23.

Technocraft Industries: The company posted a consolidated revenue from operation of Rs 52 crore, up 9.14% from Rs 476 crore in Q2FY23. Its consolidated Ebitda was up 5.34% at Rs 102 crore in Q2FY24 compared with Rs 96.7 crore in Q2FY23. Consolidated net profit was up 6.9% at Rs 70.2 crore in Q2FY24 as against Rs 65.6 crore in Q2FY23.

Timken India: The company’s consolidated revenue was down 1.9% at Rs 682 crore in Q2FY24 from Rs 695 crore in Q2FY23. Consolidated Ebitda was up 2.6% at Rs 136 crore in Q2FY24 compared with Rs 132 crore in Q2FY23. The company’s consolidated net profit declined 4.6% to Rs 93 crore in Q2FY24 from Rs 98 crore in Q2FY23.

Galaxy Surfactants: The company’s consolidated revenue from operations fell 20.5% to Rs 983 crore in Q2FY24 from Rs 1,236 crore in Q2FY23. Consolidated Ebitda was down 5.2% to Rs 125 crore in Q2FY24 from Rs 132 crore in Q2FY23. The company’s consolidated net profit declined 7.7% to Rs 77.4 crore in Q2FY24 from Rs 83.8 crore in Q2FY23.