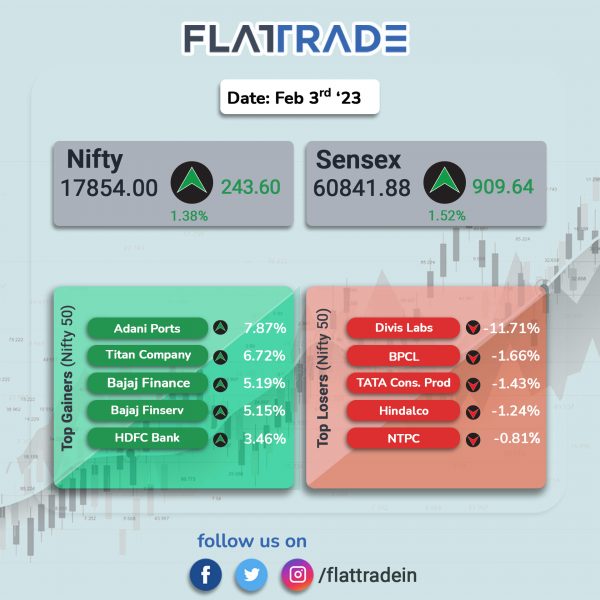

Benchmark stock indices ended in the green, aided by strong gains in financial services, banks and auto shares. The Sensex gained 1.52% and the Nifty 50 index closed 1.38% higher.

In broad markets, Nifty Midcap 100 index fell 0.18%, while BSE Smallcap was down 0.47%.

Top gainers were PSU Bank [3.07%], Financial Services [2.36%], Bank [2.04%], Private Bank [1.64%], and Auto [1.25%]. Top losers Energy [-1.03%], Pharma [-0.99%], Oil & Gas [-0.89%], Realty [-0.82%] and Media [-0.44%].

Indian rupee rose 34 paise to 81.83 against the US dollar on Friday.

Stock in News Today

Adani Group: Shares of some Adani Group companies steadied in the second half of today’s session after stock exchanges placed Adani Enterprises, Adani Ports and Ambuja Cements under the short-term additional surveillance measure (ASM) framework. Adani Ports shares closed 7.87% higher and Adani Enterprises rebounded significantly recouping most of the morning losses and closed 1.38% higher. Earlier, it was reported that Adani Enterprises shares will be removed from the Dow Jones Sustainability Indices. Ambuja Cements and ACC shares also ended in the green.

Bank of Baroda: Shares of the state-owned lender rose 6.2% after it reported a standalone net profit of Rs 3,853 crore for the third quarter ended December 2022 (Q3 FY23), up by over 75% from the year ago quarter of Rs 2,197 crore. Its net interest income (NII) grew over 26% to Rs 10,818 crore as compared to Rs 8,552 crore year-on-year (YoY). Net Interest Margin (NIM) stands at 3.37% in the October-December period, increase of 24 basis points YoY for the quarter. Its net NPA stood at 0.99% as against 1.16% QoQ.

Divi’s Labs: The company said its net profit slumped 66% to Rs 306.8 crore in Q3FY23 from Rs 902.2 crore in Q3FY22. The revenue also fell 31.5% to Rs 1707.7 crore in Q3FY23 from Rs 2493.3 crore in Q3FY22. Its EBITDA tanked 62.8% to Rs 408.2 crore in the reported quarter as against Rs 1098 crore in the year-ago period. Shares plunged 11.71% on Friday.

TVS Motor Company: The company’s wholly-owned subsidiary, TVS Motor (Singapore), has entered into an agreement to acquire shares of ION Mobility to support in electric two-wheeler markets of Singapore and Indonesia. TVS will subscribe 3,144,198 series AA shares of ION Mobility with aggregate investment of $95,00,000. The proposed investment is expected to be completed within 30 days. It will enable the company to drive the premium electric ecosystem in South-east Asia.

Max Ventures and Industries: The company’s net profit declined 87.70% to Rs 4.02 crore in the quarter ended December 2022 as against Rs 32.69 crore during the quarter ended December 2021. Sales declined 23.39% to Rs 29.28 crore in the quarter ended December 2022 as against Rs 38.22 crore during the quarter ended December 2021.

TeamLease Services: Shares of the company rose 3.57% after the company’s board approved buyback worth up to Rs 100 crore at a price of Rs 3,050 each through tender offer route. The buyback price is fixed at Rs 3,050 per share, representing a premium of 35.74% to Thursday’s closing price on the BSE. The indicative maximum number of equity shares to be bought back under the buyback would be 3,27,869 equity shares, representing 1.92% of paid-up equity shares of the company. As on 27 January 2023, promoters and promoter group held 31.51% in the company.

Zydus Lifesciences: The company reported a 11.7% increase in its net profit at Rs 548 in Q3FY23 from Rs 490.6 crore in Q3FY22. Its revenue was up 19.8% to Rs 4362 crore in Q3FY23 from Rs 3639.8 crore in Q3FY22. The EBITDA advanced 27.2% to Rs 955.7 crore in the reported quarter from Rs 752.5 crore in the same period last fiscal.

Borosil: The company’s net profit 6% to Rs 23.3 crore in Q3FY23 from Rs 24.8 crore in Q3FY22. Its revenue rose 7.9% YoY to Rs 280.6 crore in the reported quarer as against Rs 260 crore in the year-ago period. EBITDA was down 45.1% to Rs 21.3 crore in the quarter under review from Rs 38.8 crore in the corresponding quarter last fiscal.

Jubilant Pharmova: The company reported a net loss at Rs 15.67 crore in Q3FY23 compared with Rs 50.9 crore in Q3FY22. It revenue was up 18.5% YoY at Rs 1,552.5 crore in Q3FY23 as against Rs 1,310.5 crore in Q3FY22. EBITDA slumped 24.9% to Rs 145.9 crore in the reported quarter from Rs 194.2 crore in the year-ago period.

India Cements: The company reported a standalone net profit at Rs 90.7 crore in Q3FY23 as against Rs 3.3 crore in Q3FY22. The company’s revenue was up 10% at Rs 1,219.5 crore in the reported quarter as against Rs 1,108.5 crore in the year-ago period. EBITDA loss at Rs 69.5 crore vs EBITDA of Rs 104 crore (YoY).

Birlasoft: The company reported a consolidated net loss of Rs 16.36 crore in Q3FY23 as against net profit of Rs 115.05 crore in Q2FY23. Revenue from operations rose 2.5% QoQ and 14% YoY to Rs 1,221.89 crore in the quarter ended December 2022. EBITDA (excluding one-time provision) stood at Rs 158.4 crore in quarter ended December 2022, registering a decline of 10.2% QoQ and 2.7% YoY.

Inox Green Energy Services: The company has entered into a definitive investment agreement with I-Fox Windtechnik India, an Independent O&M Wind Service Provider (target company), to acquire a majority stake in share capital of the target company. The target company has a fleet of 230+MW majorly operating in South India.

Dredging Corporation of India: The company said that it has signed an agreement with lnland Waterways Authority of India (IWAI) under the Ministry of Ports, Shipping and Waterways, Government of lndia, for a project worth Rs 204.5 crore. The project involves development & maintenance of fairway width of 32 m and depth of 2 m / 2.5 m for 5 years in various national waterways in North-Eastern Region by undertaking required dredging, bandalling, channel marking, river training etc. to ensure safe navigation of vessels.

Kansai Nerolac: The company said its net profit fell 14.2% to Rs 109.9 crore in Q3FY23 from Rs 128 crore in the year-ago period. Its revenue inched up 1% to Rs 1,827 crore in Q3FY23 from Rs 1,810 crore in Q3FY22. EBITDA was down 7.8% to Rs 195.5 crore in Q3FY23 from Rs 212.1 crore in Q3FY22.