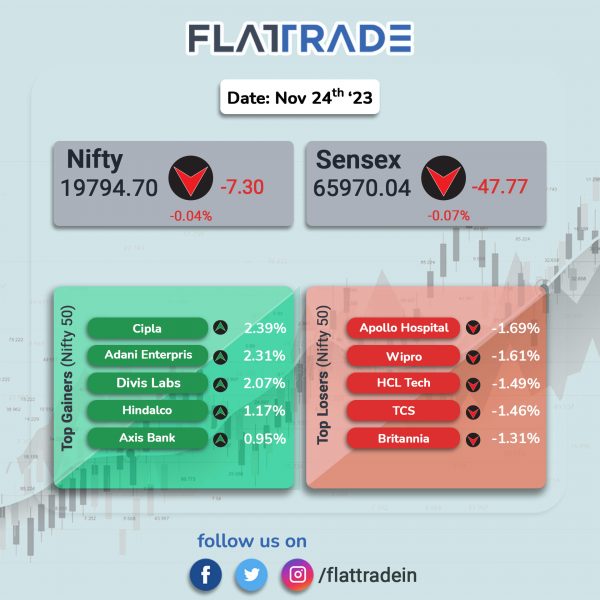

Benchmark equity indices closed marginally lower as gains in pharma and metal stocks were offset by losses in IT and FMCG stocks. The Sensex fell 0.07% and the Nifty 50 index slipped 0.04%.

In broader markets, the Nifty Midcap 100 rose 0.06% and the BSE Smallcap edged up 0.14%.

Top losers were IT [-0.97%], FMCG [-0.47%], PSU Bank [-0.34%] and Oil & Gas [-0.22%]. Top gainers Pharma [0.87%], Metal [0.67%], Bank [0.44%], Private Bank [0.39%], and Financial Services [0.33%].

The Indian rupee fell 2 paise to 83.37 against the US dollar on Friday.

Stock in News Today

ICICI Bank: The company’s board of directors has approved the appointment of Ajay Gupta as an additional director and whole-time director of the bank effective from November 27, 2023, subject to necessary approvals. The appointment shall be for a period till November 26, 2026. He is currently the head – retail & business credit & policy and operations group and is part of senior management personnel and material risk takers of the bank.

IndusInd Bank: The private sector lender announced its association with Indraprastha Gas Limited (IGL), to facilitate the acceptance of Digital Rupee. Under this collaboration, customers will be able to make payments using the Digital Rupee at select IGL stations in Delhi NCR.

Bank of Baroda (BoB): The public sector bank plans to raise infrastructure bonds of up to Rs 10,000 crore (base issue of Rs 2000 crore and green shoe option of Rs 8000 crore) over a tenor of seven years. Subsequently, the bank has decided to issue, in first tranche, infrastructure bonds of up to Rs 5,000 crore (base issue of Rs 1000 crore and green shoe option of up to Rs 4000 crore) for a tenor between 7 to 10 years.

GATI: The logistics company has launched a tech-enabled Surface Transhipment Centre and Distribution Warehouse (STCDW) at Mayasandra, Hobli, on the outskirts of Bengaluru, Karnataka. Strategically located at just 5.5 Km away from NH 44 (Bengaluru-Hosur Highway) at the border of Tamil Nadu and Karnataka, the STCDW is spread over 3.5 lakh sq. ft. and it has a 1.5 lakh sq. ft. Grade A warehouse.

Axita Cotton: The company’s board has recommended the issuance of bonus equity shares in the ratio of 1:3, subject to the approval of shareholders. Accordingly, the shareholders would get one bonus equity share for every three fully paid-up equity share held as on record date, which will be announced later. A total sum of Rs 6.522 crore would be utilized from balance of free reserves for implementation of this bonus issue. The company has convened an extra-ordinary general meeting of the company on Saturday, 16 December 2023, to seek necessary approval of the members, for the aforementioned issuance.

Ramkrishna Forgings: The company has collaborated with Prozeal Green Energy Private Limited for the installation of a 7.82 MWp Solar PV Project at Unit 5 and Unit 6 & 7. Out of the total 7.82 MWp capacity, 5.2 MWp solar capacity is operational at the site. The balance 2.62 MWp is expected to be operational shortly, the company said in an exchange filing.

Ganesha Ecosphere: The company’s board has approved raising of funds through a Qualified Institutions Placement (QIP) for an aggregate amount not exceeding Rs 350 crore by issue of equity shares of face value of Rs 10 each. Further, the company’s board has approved preferential issue of warrants convertible into equivalent number of equity shares to GPL Finance Limited, a member of promoter group, for an aggregate amount up to Rs 150 crore.

RateGain Travel Technologies: Financial services major Societe Generale sold 615,945 shares, representing 0.57% equity stake, in the company in a bulk deal for an average price of Rs 663.74 aggregating to Rs 40.88 crore.

Suprajit Engineering: The company has purchased industrial property with land measuring 1,75,000 sq.ft. along with buildings measuring 70,000 sq.ft. located at Jigani Industrial Area. Jigani is one of the prime industrial areas in Karnataka on the outskirts of Bangalore with close proximity to certain key customers of Suprajit.

Gland Pharma: The company said that it has received Establishment Inspection Report (EIR) from the USFDA indicating closure of the inspection. The EIR was for Pashamylaram facility and the audit was conducted from August 23 and August 26.

Dilip Buildcon: The infrastructure company announced that it has received a provisional completion certificate for Repallewada Telangana/Maharashtra border project in the state of Telangana. The scope of the project involved four laning of NH-363 from Repallewada to Telangana/Maharashtra border in Telangana under NH (O) on hybrid annuity mode. The cost of the project stood at Rs 1,140.50 crore.

Loyal Equipments: The company has bagged new order worth Rs 5.22 crore from Siemens Energy Industrial Turbomachinery India. The domestic order entails the supply of separators with spares and is scheduled to be fulfilled within 6 months. Loyal Equipments specializes in the design, manufacturing, supply, and erection/commissioning of various process equipment for multiple sectors.