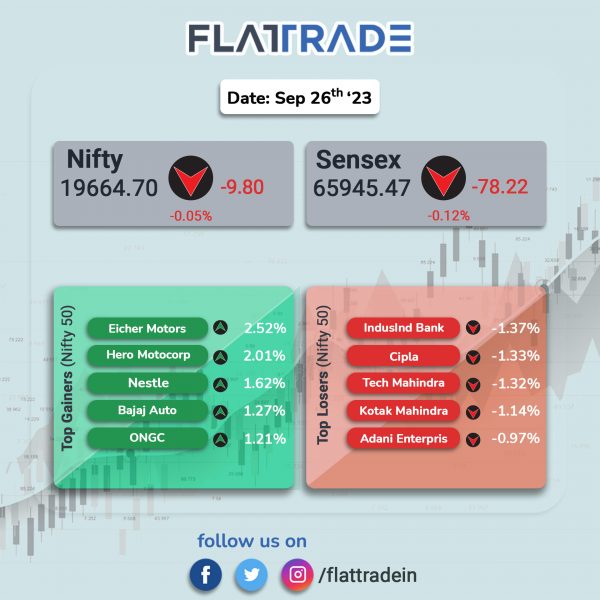

Domestic benchmark indices closed lower as losses in bank and IT stocks weighed on the overall indices. The Sensex fell 0.11% and the Nifty slipped 0.05%.

In broader markets, the Nifty Midcap 100 fell 0.17% and the BSE Smallcap rose 0.33%.

Top losers were Media [-0.86%], PSU Bank [-0.64%], IT [-0.54%], Bank [-0.32%], Private Bank [-0.32%]. Top gainers were FMCG [0.52%], Auto [0.35%], Metal [0.31%], Realty [0.31%], and Oil & Gas [0.16%].

The Indian rupee weakened 9 paise to close at 83.24 against the US dollar on Tuesday.

Stock in News Today

Samvardhana Motherson International: The company said that CRISIL Ratings has revised its outlook on long-term bank loan facilities and corporate credit rating to ‘positive’ from ‘stable’ while reaffirming the rating at ‘CRISIL AA+’. CRISIL said that the revision in outlook reflects significant improvement in leverage profile of the company with net debt to EBIDTA expected to remain in range of 1.1 to 1.5 times, lower than the agency’s earlier expectations of 1.5-2 times, over the medium term.

Rail Vikas Nigam (RVNL): The company has emerged as the lowest bidder (L1) for construction of four tunnels having a total length of 1.6 km with ballast less track, earthwork in formation, construction of important bridges, major bridges, minor bridges, supply of stone ballast, track linking, side drain retaining wall etc. in Dharakoh Maramjhiri section. The total cost of the project is Rs 311.17 crore.

Happiest Minds Technologies: The company’s board has approved the allotment of 3,500 rated, listed, negotiable, unsecured, redeemable nonconvertible debentures aggregating Rs 35 crore on private placement basis.

GVK Power & lnfrastructure: The company hit an upper circuit of 5% after its board appointed Sanjeev Kumar Singh as the chief financial officer, key managerial personnel of the company with immediate effect. Sanjeev Kumar Singh will replace Anicattu lssac George who had resigned with effect from August 31, 2023. Sanjeev Kumar Singh had joined GVK Group in 2007 and presently is serving as senior vice president (Finance & Accounts).

Sun Pharma Advanced Research Company: The company has incorporated a wholly owned subsidiary company SPARCLIFE Inc. in Delaware, US. The main object of the subsidiary is to engage a team of seasoned professionals based in the US to coordinate, review and monitor the global clinical trials being conducted through various CROs in the US.

Suven Pharmaceuticals: The company said that the Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers, has granted its approval for acquisition of up to 76.1% shareholding in Berhyanda, Cyprus, by way of transfer of 12,75,37,043 equity shares aggregating to 50.1% of shareholding in the company from promoters of the company and acquisition of up to 6,61,86,889 equity shares aggregating to 26% of shareholding in the company from public shareholders through mandatory open offer.

Delta Corp: The company extends losses after investor Ashish Kacholia sold 0.56% stake in the casino operator via bulk deal on Monday. The stock hit a 52-week low of Rs 134.55 today. The clump in the share price is after the company received notices from the Directorate General of GST Intelligence, Hyderabad, demanding payment of shortfall tax, interest, and penalty totaling Rs 16,822 crore.

Vishnu Prakash R Punglia: The company shares rose after the company received letter of award (LoA) from Madhya Pradesh Jal Nigam (MPJN), Government of Madhya Pradesh for construction at Chillar Dam in Shajapur district, Madhya Pradesh. The project entails engineering, procurement, construction, testing, commissioning, trial run and operation & maintenance for 10 years of Chillar Dam multi-village drinking water supply scheme, Shajapur, in single package on ‘Turn-key Job Basis’. The cost of said project is Rs 634.41 crore.

Sheela Foam: The company has allotted 1,11,31,725 equity shares to eligible qualified institutional buyers at the issue price of Rs 1,078 per equity share, aggregating to approximately Rs 1200 crore. Pursuant to the allotment of equity shares in the issue, the paid-up equity share capital of the company stands increased from Rs 48.782 crore consisting of 9,75,65,616 equity shares to Rs 54.349 crore consisting of 10,86,97,341 equity shares each.

Anupam Rasayan: The company has signed three Memorandums of Understanding (MoUs) with the Government of Gujarat for afforestation on a total land area of 150 hectares – 50 hectares located in Narmada district, 50 hectares located in Tapi District and 50 hectares located in Surat District. This project will be a part of Green Belt Development Drive by development of various lands earmarked by the Gujarat government for the purpose of plantation and maintenance of different kinds of trees.

Nuvama Wealth Management: Shares of the company made a dull stock market debut. The company opened at Rs 2,750 on the NSE and the stock hit a high of Rs 2790 apiece. Shares hit a lower circuit and closed at Rs 2,612.50 per share.

Gland Pharma: The company announced that following the Pre-Approval Inspection (PAI) for Seven products and Good Manufacturing Practice (GMP) Inspection by the US FDA at the company’s Pashamylaram facility at Hyderabad between 15 June 2023 and 27 June 2023. The company has received Establishment Inspection Report (EIR) from the US FDA indicating closure of the inspection.

Kirloskar Pneumatic Co.: The company inaugurated a new manufacturing facility at Nashik and and the facility includes a 32 ton forge hammer to make high speed gear blanks and a comprehensive fabrication facility to make base frames, pressure vessels and a range of heat exchangers. The facility will primarily cater to the requirements of KPCL and help in enhancing the competitiveness through value chain advantage as well as to speed up execution of projects.

Poonawalla Fincorp Limited: The non-banking finance company said it has received a permission from the Reserve Bank of India (RBI) to issue co-branded credit card with IndusInd Bank. The company plans to launch this credit card within three months. This partnership will enable the company to usher in a new age of flexible and versatile retail credit.