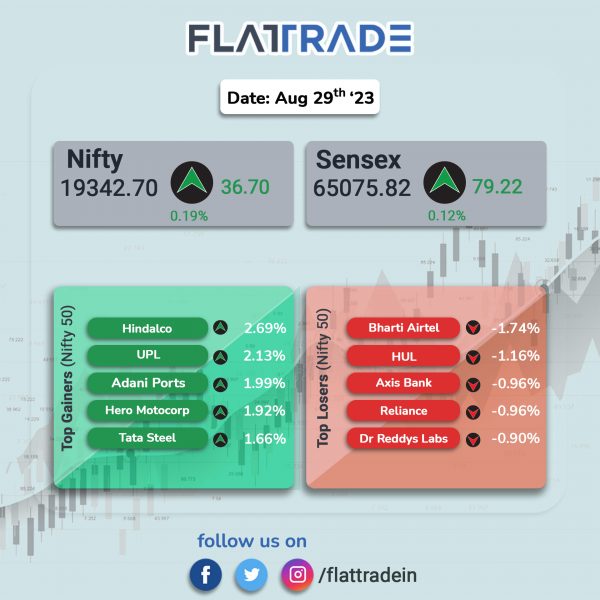

Sensex and Nifty ended with marginal gains amid a range-bound session with gains in select sectors. The Sensex rose 0.12% and the Nifty gained 0.19%.

Broader markets outperformed benchmark equity indices. The Nifty Midcap 100 advanced 0.34% and the BSE Smallcap jumped 0.69%.

Top gainers were Realty [1.69%], Metal [1.28%], Media [0.77%], Auto [0.67%], and IT [0.3%]. Top losers were PSU Bank [-0.49%], FMCG [-0.33%], and Pharma [-0.27%].

The Indian rupee weakened 8 paise to close at Rs 82.71 against the US dollar on Tuesday.

Stock in News Today

Maruti Suzuki: The automaker plans to invest about Rs 45,000 crore to achieve a cumulative production of 4 million cars by FY2031. The company aims to add a production capacity of 2 million additional cars within the next eight years, said Maruti Suzuki Chairman RC Bhargava during the Annual General Meeting (AGM).

Further, Maruti Suzuki said that its board has approved the appointment of Arnab Roy as chief financial officer (CFO) (designate) with effect from 16 October 2023 and will take the role of whole-time CFO of the company, effective from 1 January 2024.

Hero MotoCorp: The two-wheeler manufacturers launched the Karizma XMR 210 at Rs 1,82,900 with an introductory discount of Rs 10,000. Actor and brand ambassador Hrithik Roshan unveiled the Karizma XMR 210, which is being offered in three colour options – Iconic Yellow, Turbo Red and Matte Phantom Black. The motorcycle is equipped with Hero MotoCorp’s first liquid-cooled 210 cc DOHC 4V engine, making 25.5 PS of maximum power at 9250 rpm and 20.4 Nm torque at 7250 rpm.

Titan Company: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL AAA/Stable/CRISIL A1+’ ratings on the bank facilities of the company. CRISIL said that the ratings continue to reflect the leadership position of Titan in the jewellery and watch segments, healthy operating efficiency and strong financial risk profile with robust liquidity. Titan is expected to sustain its healthy operating performance, supported by strong market position across products.

Tata Power: The company said its subsidiary, Tata Power Renewable Energy Limited (TPREL), signed a Group Captive Power Delivery Agreement (PDA) with the ANAND Group. Under the agreement, TPREL will help facilitate the generation of 10 million units of clean energy using renewable sources. This project aims to eliminate approximately 5500 tonnes of carbon emissions annually, aligning with TPREL’s goal of creating a greener and cleaner future for its Commercial and Industrial (C & I) customers. With this new undertaking, TPREL’s total renewable capacity, including projects under various stages of implementation, has reached 7,787 MW.

Lupin: The company announced that it has received approval from US Food Drug and Administration (USFDA) for its ANDA to market Pirfenidone capsules, which is used to treat a certain lung disease called idiopathic pulmonary fibrosis (IPF). The said capsules are generic equivalent of Esbriet of Hoffmann La Roche Inc. Pirfenidone Capsules (RLD Esbriet) had estimated annual sales of $95 million in the U.S. (IQVIA MAT June 2023).

Rashtriya Chemicals & Fertilizers (RCF): The company announced that the Department of Public Enterprises (DPE) has granted the Navratna Status to RCF. Navratna Companies are a group of companies in the Central Public Sector Enterprises (CPSEs) that have enhanced financial autonomy.

Gravita India: The company said that its step down subsidiary in Togo, West Africa, has started commercial production of lead from its existing recycling plant having an annual capacity of around 6,000 MTPA. The Group has invested approximately Rs 3.61 crore for commissioning of the new battery recycling facility, which is funded from internal accruals of the company. The company is already having Aluminum recycling plant having an annual capacity of 4,000 MTPA in Togo, West Africa and this new facility will enjoy the benefits of economy of scale and will be cost effective due to saving in logistic cost.

PG Electroplast: The company’s consolidated net profit surged 106.2% to Rs 33.81 crore in Q1FY24 from 16.40 crore in Q1FY23. Revenue from operations jumped 26.2% to Rs 677.62 crore in Q1FY24 as compared with Rs 536.73 crore in Q1FY23. Meanwhile, the board has approved to raise Rs 500 crore through qualified institutions placement. The floor price has been determined at Rs 1,641.09 per equity share.

Gensol Engineering: The company said that it has bagged its maiden two turnkey international Solar Engineering, Procurement, and Construction (Solar EPC) projects in Dubai. These projects have a combined capacity of 14.08 MWp and a total order value of Rs 101.6 crore. Gensol will be responsible for various activities such as design, engineering, supply, construction, testing, commissioning, and operation & maintenance of these projects. The Dubai Government Workshop Warehouse project is expected to be commissioned in November 2023, while the Dubai Police project is scheduled to go online in June 2024.

Capacite Infraprojects: The company’s joint venture (JV) with Mohan Mutha Exports received order from Rail Vikas Nigam (RVNL) worth Rs 575 crore for EPC project in Maldives. The project is to be completed within a period of 18 months from the date of commencement. The civil construction company will have 51% share in the joint venture.

Som Distilleries & Breweries: The liquor maker announced that its beer brands have received permissions for supply to Chhattisgarh. The company also informed that it has also commenced the initial dispatches to the state.

KPI Green Energy: The company has received new orders aggregating to 9.70 MW capacity for executing solar power project, out of which 4.70 MW capacity undertaken by KPI Green Energy and 5 MW capacity by Sun Drops Energia Private Limited, a wholly owned subsidiary of the company under ‘Captive Power Producer (CPP)’ Segment of the Company.

Krishana Phoschem: The company’s board has approved 1:1 bonus issue of shares as well as raising its authorised capital to Rs 70 crore from Rs 40 crore.

Pyramid Technoplast: The company had a modest stock market debut. Shares of the company shares got listed at Rs 187 apiece on the NSE, a premium of 12.65% compared to its final issue price of Rs 166 per share. Shares hit a high of Rs 188 and closed at Rs 177.65 per share on the NSE, up 7.02% to its final issue price.