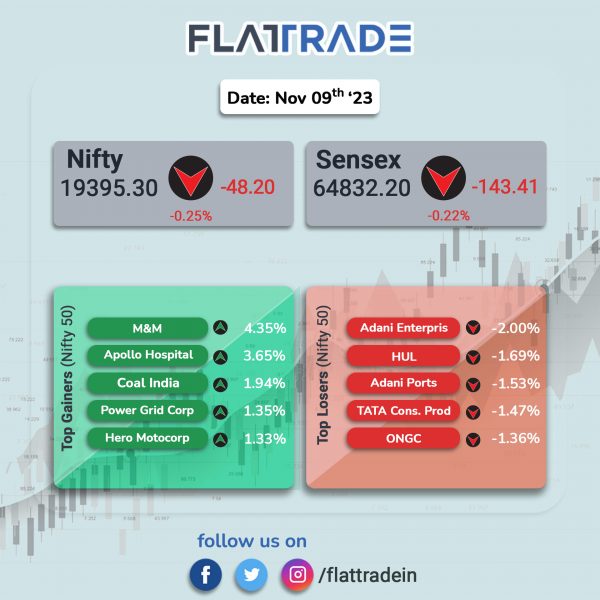

Benchmark equity indices closed lower as investors were concerned over higher interest rates and global economic slowdown amid subdued FII inflows. The Sensex fell 0.22% and the Nifty ended 0.25% lower.

Broader markets were mixed with the Nifty Midcap 100 index rising 0.22% and the BSE Smallcap falling 0.27%.

Top losers among Nifty sectoral indices were FMCG [-0.9%], Oil & Gas [-0.8%], IT [-0.65%], Metal [-0.4%], and PSU Bank [-0.2%]. Top gainers were Realty [1.23%], Auto [0.83%], and Private Bank [0.19%].

The India rupee closed flat at 83.29 against the US dollar on Thursday.

Stock in News Today

Adani Ports and SEZ (APSEZ): The company’s consolidated revenue from operations jumped 27.6% to Rs 6,646.41 crore in Q2FY24 from Rs 5,210.8 crore in Q2FY23. Its consolidated Ebitda rose 24.4% to Rs 3,880.5 crore in Q2FY24 from Rs 3,315.9 crore in Q2FY23. The company’s net profit was at Rs 1,761.6 crore in Q2FY24 as against Rs 1,737.8 crore in Q2FY23. Its cargo volumes stood at 202.6 MMT in H1FY24, up 14% YoY, led by containers (+18%), dry cargo (+10%) and liquids (21%), said the company.

Apollo Hospitals: The hospital chain said its consolidated net profit grew 14.17% to Rs 232.9 crore in Q2FY24 from Rs 204 crore in Q2FY23. Its revenue from operations stood at Rs 4,846.9 crore during the quarter ended September 2023, up 14.02% from Rs 4,251.1 crore recorded in the same period last fiscal. Ebitda grew to Rs 627.6 crore during the quarter under review from Rs 565.4 crore in Q2FY23.

During the quarter, the company’s revenue from Healthcare Services was Rs 2,565.9 crore (up 12.71% YoY) and revenue from Digital Health & Pharmacy Distribution was Rs 1,945.4 crore (up 16.61% YoY) and the revenue from Retail Health & Diagnostics stood at Rs 354.2 crore (up 11.28% YoY). Meanwhile, the board has approved an expansion plan for 2,285 beds, involving a balance capital outlay of around Rs 3,435 crore after reckoning for land/ asset acquisition costs already incurred.

JSW Steel: The steel maker reported a consolidated net profit of Rs 2,760 crore in Q2FY24 as against a net loss of Rs 848 crore in Q2FY23. Revenue from operations grew 6.72% YoY to Rs 44,584 crore in the quarter ended September 2023. Meanwhile, the steel manufacturer said that its consolidated crude steel production for the month of October 2023 grew by 12% YoY to 23.12 lakh tonnes from 20.64 lakh tones. Production of Indian operations rose 9% to 22.36 lakh tonnes, while production of JSW Steel USA-Ohio rose to 0.76 lakh tonnes in October 2023 from 0.15 lakh tonnes in October 2022.

Finolex Cables: Shares of the company rose over 4% in intraday trading after it reported strong earnings. The company reported a consolidated revenue from operations at Rs 1,187 crore in Q2FY24, up 8.8% from Rs 1,091 crore in Q2FY23. Its consolidated Ebitda was at Rs 145 crore in Q2FY24, up 47% from Rs 98.8 crore in Q2FY23. Its consolidated net profit was at Rs 154 crore in Q2FY24 as against Rs 55.4 crore in the year-ago period.

RattanIndia Enterprises: The company said that Revolt Motors has bagged an order from Adani Green Energy Limited (AGEL), for environment friendly electric motorcycles. Revolt Motors will supply the electric bikes for Adani Green’s corporate fleet, aligned to AGEL’s strategic priority to reduce its carbon footprint. The company’s revenue from operations rose to Rs 1394.24 crore in Q2FY24 from Rs 1175.76 crore in Q2FY23. Its net profit rose to Rs 142.2 crore in the reported quarter from Rs 102.81 crore in the year-ago period.

Samvardhana Motherson: The company reported a consolidated revenue from operations at Rs 23,474 crore in Q2FY24, up 28.3% from Rs 18,302 crore in Q2FY23. Its consolidated Ebitda soared 31% to Rs 1889 crore in Q2FY24 from Rs 1445 crore in Q2FY23. Its consolidated net profit jumped to Rs 294 crore in Q2FY24, up 2.1% from Rs 288 crore in Q2FY23.

Raymond: The company said that its step-down wholly owned subsidiary, Ten X Realty, has been selected as the ‘Preferred Developer’ for redevelopment of Shree-Hind CHS Ltd. located in Sion East. It is spread across 4.3 acres and estimated to have a revenue potential in excess of Rs 1,400 crores over the project period.

Abbott India: The company’s consolidated revenue from operations stood at Rs 1,494 crore in Q2FY24, up 8.3% YoY from Rs 1,379 crore in Q2FY23. Its consolidated Ebitda rose 11.2% YoY to Rs 381 crore in Q2FY24 from Rs 342 crore in Q2FY23. Its consolidated net profit was at Rs 313 crore in the quarter under review, up 18% from Rs 266 crore in Q2FY23.

Granules India: The company’s revenue from operations rose 3.4% at Rs 1189.5 crore in Q2FY24 from Rs 1150.7 crore in Q2FY23. Its consolidated Ebitda was at Rs 213 crore in Q2FY24, down 12.3% from Rs 242.9 crore in Q2FY23. Its net profit fell 29.6% to Rs 102.1 crore in Q2FY24 from Rs 145.1 crore in Q2FY23.

Ramco Cements: The company’s consolidated revenue from operations rose 30.5% to Rs 2,341 crore in Q2FY24 from Rs 1,794 crore in Q2FY23. Its consolidated Ebitda rose to Rs 407 crore in Q2FY24 from Rs 188 crore in Q2FY23. Its consolidated net profit soared to Rs 72 crore in Q2FY24 from Rs 3.7 crore in Q2FY23.

Page Industries: The company’s revenue from operations stood at Rs 1125 crore in Q2FY24, down 8.4% from Rs 1228 crore in Q2FY23. Its consolidated Ebitda fell 1.8% to Rs 233.4 crore in Q2FY24 from Rs 237.7 crore in Q2FY23. The company’s net profit declined 7.3% YoY to Rs 150.3 crore in Q2FY24 from Rs 162.1 crore in the year-ago period.

Bajaj Hindustan Sugar: The company said its consolidated revenue from operations rose 14.4% to Rs 1,133 crore in Q2FY24 from Rs 1,323 crore in Q2FY23. Its consolidated Ebitda stood at Rs 55.3 crore in Q2FY24 as against a net loss of Rs 83.2 crore in Q2FY23. Its net loss narrowed to Rs 123 crore in Q2FY24 as against a net loss of Rs 162 crore in Q2FY23.

Global Health: The company’s consolidated revenue from operations rose 24.3% to Rs 844 crore in Q2FY24 from Rs 679 crore in Q2FY23. Its consolidated Ebitda increased 36% to Rs 213 crore in Q2FY24 from Rs 157 crore in Q2FY23. The company’s net profit jumped 46% to Rs 125.2 crore in Q2FY24 from Rs 85.7 crore in Q2FY23.

Somany Ceramics: The company’s consolidated revenue from operations was up 6% to Rs 655.2 crore in Q2FY24 from Rs 617.8 crore in Q2FY23. The company’s Ebitda was up 52% to Rs 64.12 crore in Q2FY24 from Rs 42.22 crore in Q2FY23. The company’s net profit climbed to Rs 29.5 crore in Q2FY24 from Rs 11.7 crore in Q2FY23.

Brigade Enterprises: The realty company’s consolidated revenue from operations jumped 55% to Rs 1,366.6 crore in Q2FY24 from Rs 879.2 crore in Q2FY23. Its Ebitda surged 50% to Rs 324.8 crore in Q2FY24 from Rs 216.5 crore in Q2FY23. The company’s net profit more than doubled to Rs 112.5 crore in Q2FY24 from Rs 51.8 crore in Q2FY23.