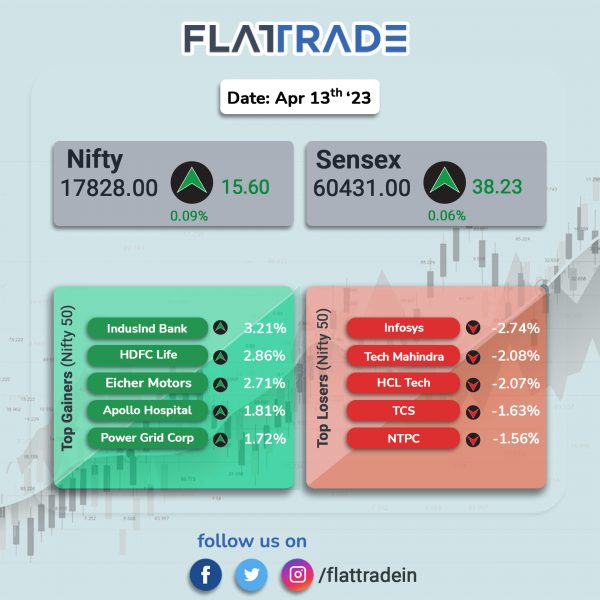

Benchmark equity indices closed marginally higher as gains in banking stocks were capped by losses in IT and pharma stocks. However, this is the ninth day the headline indices managed to close in the green. The Sensex was up 0.06% and the Nifty inched up 0.09%.

In broader markets, Nifty Midcap 100 index rose 0.2% and the BSE Smallcap index gained 0.33%.

Top gainers were PSU Bank [1.45%], Bank [1.38%], Realty [1.13%], Private Bank [1.06%], and Financial Services [0.81%]. Top losers were IT [-2.2%], Pharma [-0.76%], Media [-0.74%], and Oil & Gas [-0.31%].

Indian rupee strengthened by 23 paise to 81.85 against the US dollar on Thursday.

Friday will be a market holiday on account of Ambedkar Jayanti. However, MCX will be open for trading in the evening session from 5:00 p.m.

Stock in News Today

IDBI Bank: Shares of the lender ended 9.77% higher on NSE amid media reports that RBI has started the evaluation process of potential bidders interested in the lender. The Reserve Bank of India has begun evaluating at least five potential bidders interested in picking up a majority stake in state-owned IDBI Bank, three people familiar with the matter told Reuters. Kotak Mahindra Bank, Prem Watsa-backed CSB Bank and Emirates NBD are among those that have submitted expressions of interest, two of the people said.

Vedanta: The diversified minerals company announced that its board approved raising of funds through issuance of non‐convertible debentures (NCDs) aggregating up to Rs 2,100 crore in one or more tranches, on a private placement basis. Vedanta will allot 21,000 secured, unrated, unlisted, redeemable NCDs of face value Rs 10 lakh.

Bharat Heavy Electricals (BHEL): The state-owned company said that it has signed a MoU with the Nuclear Power Corporation of India (NPCIL) to jointly pursue business opportunities around nuclear power plants based on pressurised heavy water reactor (PHWR) technology. This partnership is expected to pave the way for early implementation of non-polluting and long-cycle nuclear power projects, BHEL said in a press release.

Coal India Limited(CIL): The company announced that its coking coal production has risen 17.2% to 54.6 million tonnes (MTs) in FY23 as compared with 46.6 MTs in FY22. The Ministry of Coal has urged CIL to elevate the output of coking coal to 105 MTs by 2030 to reduce the country’s imports and foreign exchange outflow. In addition, CIL’s raw coking coal feed to washeries in FY23 improved by 27% to 6.1 MTs from 4.8 MTs in FY22.

Jindal Steel & Power: The company plans to commission a 1.2 MTPA rail & heavy structure mill at its Angul Steel complex in Odisha. After the commissioning of the new rail mill at Angul, the company’s total rail-making capacity will be 2.2 MTPA, JSPL said.

Ashok Leyland: The company has launched e-Marketplace for used commercial vehicles, Re-AL. The marketplace will aid customers in exchanging used vehicles and upgrading them to new Ashok Leyland trucks and buses. By leveraging this digital platform, Ashok Leyland hopes to increase transparency in the otherwise disorganized used vehicle ecosystem.

Varun Beverages: The bottling company of PepsiCo said its board will also consider a stock split of the existing shares having a face value of Rs. 10/- each, subject to shareholders and regulatory approvals. The board will meet on May 2, 2023 for the same.

Happiest Minds Technologies: The IT services company announced its partnership with NIQ Brandbank, a global leader in providing digital product content, to solve product data & shopper experience challenges. The partnership will help NIQ Brandbank to build agile and adaptive digital solutions.

PNB Housing Finance: The NBFC said that its rights issue will open on April 13 and close on April 27. The housing finance company will issue 29 new equity shares for every 54 shares held by its existing shareholders as of the record date of April 5. The housing finance company will issue over nine crore fully paid-up equity shares, each worth Rs 275, for an amount aggregating up to Rs 2,493.8 crore.

KPI Green Energy: The company said that it has inked a joint business development agreement with Tristar Transport LLC for the development of eco-friendly energy solutions across multiple regions. The agreement involves the utilization of respective expertise of both the parties to identify and execute renewable energy projects, such as wind, solar, green hydrogen, and green ammonia projects across regions, which include India, Middle East, Africa, Asia Pacific, America, and Europe.

K.P. Energy: The company said that KP Group has executed joint business development agreement with UAE- based Tristar Transport LLC for the development of eco-friendly energy solutions. The development would be done across multiple regions including India, Middle East, Africa, Asia Pacific, America, and Europe. The agreement involves the utilization of respective expertise of both the parties to identify and execute renewable energy projects, such as wind, solar, green hydrogen, and green ammonia projects.