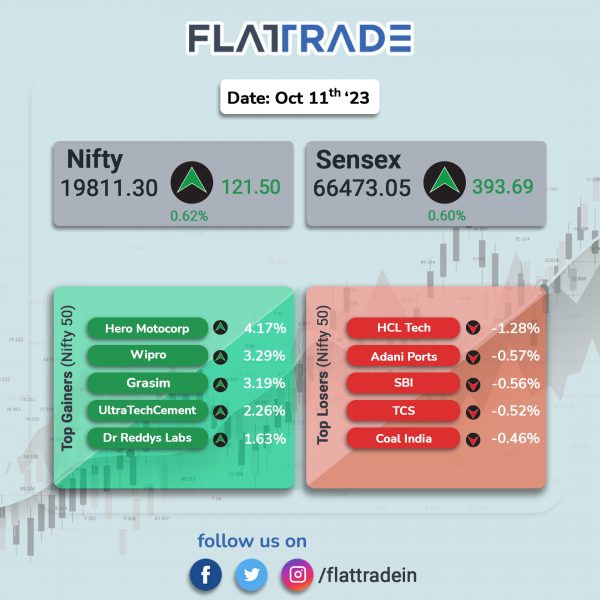

Benchmark equity indices closed higher for the second straight day, aided by gains in index heavyweights amid improving risk-on sentiments. The Sensex rose 0.59% and the Nifty 50 index jumped 0.62%.

In broader markets, the Nifty Midcap 100 index gained 0.5% and the BSE Smallcap rose 0.77%.

Top gainers among Nifty sectoral indices were Auto [0.92%], FMCG [0.87%], Media [0.86%], Realty [0.84%], and Oil & Gas [0.73%]. Top losers were PSU Bank [-0.73%] and IT [-0.07%].

The Indian rupee rose 7 paise to 83.19 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): The Hydrocarbon Business of L&T has recently secured a Letter of Intent for a mega onshore project from a client in the Middle East. The scope of the work involves engineering, procurement and construction of Gas Compression Plants. As per Larsen & Toubro’s (L&T) classification, the value of the ‘mega project’ is more than Rs 7,000 crore.

Vedanta: The mining company announced that it has incorporated a wholly owned subsidiary, Vedanta Base Metals, for carrying out metal business. The subsidiary was incorporated with an authorized capital and subscribed capital of Rs 1 lakh each and for the purpose of implementation of demerger scheme.

Bank of Baroda: The public sector lender announced that its board has approved raising long term bonds worth Rs 10,000 crore for financing of infrastructure and affordable housing. The fundraising will be in single or multiple tranches during the current financial year and beyond, the bank said in exchange filing.

Info Edge (India): The company said that the board of its subsidiary Redstart Labs (India) has agreed to invest about $400,000 in Ray IOT Solutions Inc. at applicable exchange rate. Ray IOT is engaged in the healthcare sector and develops a non-contact breathing and sleep tracker for babies.

Zuari Industries: The company’s board has approved allotment of 1,000 unlisted, unrated, secured, redeemable, non-convertible debentures (NCDs) of Rs 10 lakh each, aggregating to Rs Rs 100 crore to 360 One Prime. The company is engaged in the manufacture sale and trading of fertilizers seeds and pesticides.

Angel One: The company informed that a wholly-owned subsidiary company in the name of Angel One Wealth Management has been incorporated. The new subsidiary will be engaged in the business of providing all kind of distribution services, advisory services in investment, wealth management, insurance products [including life, general and health] and financial planning products in accordance with the applicable laws.

Ashok Leyland: The automaker has launched ecomet Star 1915 truck with Gross Vehicle Weight of 18.49 tonnes in the Intermediate Commercial Vehicle segment. The vehicle is equipped with 110 kW (150 hp) H4 engine, which is ideally suited for long-distance applications.

Satia Industries: Shares of the paper manufacturing company jumped over 3% after the company received multiple contracts totalling Rs 340 crore for supplying paper to print textbooks for 34,000 metric tonnes (MT). The company received order from Text Book Production and Marketing (Bhuvneshwar), M.P. Text Book Corporation (Bhopal), Rajasthan State Textbook Corporation (Jaipur), Maharashtra State Bureau of Textbook Production & Curriculum Research (MSBT) Pune.

Astral: The company announced the commencement of commercial production of plastic water storage tank and PVC pipes at Guwahati Plant. The plant has a capacity of 12,000-15,000 tonnes per annum and has been set up on a lease model.

Dynamic Cables: The company announced that it has received Letter of Acceptance from Northern Railway for supply of PVC Insulated Armored Unscreened Underground, Railway Signaling Copper Conductor Cables worth Rs. 95.91 crore. The delivery of the said order is expected to be supplied within six months.

Rama Steel Tubes: The company’s board has given approval to allot 7.2 lakh equity shares and 28.8 lakh bonus equity shares pursuant to conversion of warrants. With this development, the paid-up equity share capital of the company stood at Rs. 50,99,52,025 of face value of Re 1 each.