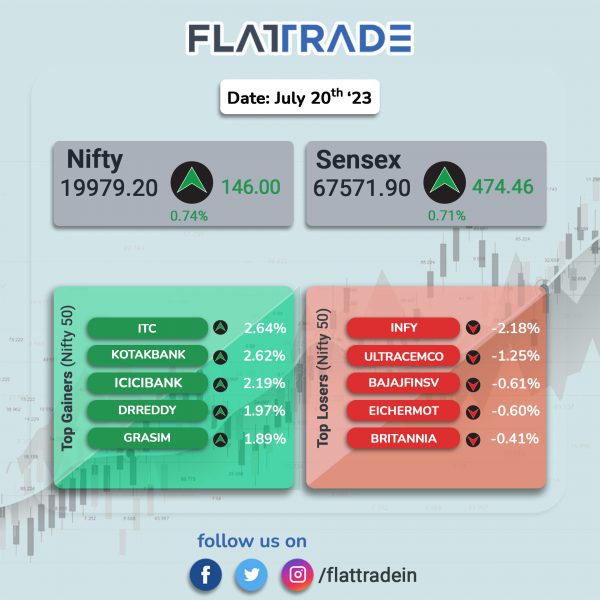

Benchmark equity indices continued its bull rally, driven by upbeat market sentiments amid the ongoing earnings season. The Sensex rose 0.71% and the Nifty 50 index gained 0.74%.

In broader markets, the Nifty Midcap 100 index rose 0.25% and the BSE Smallcap gained 0.19%.

Top gainer were Pharma [1.46%], FMCG [1.35%], Private Bank [1.15%], Financial Services [1.02%], PSU Bank [0.72%]. Top loser was Nifty IT [0.66%].

Indian rupee appreciated by 11 paise by to 81.99 against the US dollar on Thursday.

Stock in News Today

Reliance Industries (RIL): Shares of the company settled at Rs 2,580 per share in the pre-open session and listed at Rs 2,617 per share after the special pre-open session. During a pre-open call auction session, the market price of Jio Financial Services (JFSL) shares was determined to be Rs 261.85 per share on the National Stock Exchange (NSE). This was a result of the demerger of Reliance Industries and Jio Financial Services.

Tata Consultancy Services (TCS): The IT major said that The British Broadcasting Corporation (BBC) has selected the company to transform its finance and payroll functions, and manage the underlying application estate for greater agility and resilience. Under the multi-year partnership, TCS will leverage its contextual knowledge, proprietary platforms, partner ecosystem and future-ready talent pool to power the broadcaster’s media business model reimagination and drive growth.

Tata Motors: The automaker has launched two new variants of Altroz lineup to enhance the appeal and value of the premium hatchback. The new variants are named the Altroz XM and Altroz XM(S), and they come with an attractive price tag of Rs 6.90 lakhs and Rs 7.35 lakhs, respectively (ex-showroom, Delhi). The two new variants are positioned strategically between the Altroz XE and the XM+, to cater to a wider customer base. The Altroz XM variant is equipped with a range of high-end features that include convenient steering-mounted controls, a driver seat height adjuster for optimal driving comfort, electrically adjustable and foldable ORVMs, R16 full wheel cover, and a premium-looking dashboard, all designed to enhance the driving experience and comfort for passengers.

ITC: The FMCG major has become the seventh company to surpass Rs 6 lakh crore market capitalisation. The total market cap stood at Rs 6.11 lakh crore and the shares of the company closed 2.78% higher.

Kellton Tech Solutions: The company has bagged a multi-year large project from Karnataka State Government’s Finance Department to develop and implement HRMS Version 2.0 for over 600,000 state government employees. The Karnataka State Government has entrusted Kellton to bring forth a range of advanced features and functionalities to streamline and enhance the overall human resource management processes.

SJVN: The company’s wholly owned subsidiary, SJVN Green, has signed power purchase agreements (PPA) for 300 MW renewable energy projects. The agreement has been signed for 200 MW Solar Power project capacity with Maharashtra State Electricity Distribution Company (MSEDCL) at Mumbai and with Solar Energy Corporation of India (SECI) for 100 MW Wind Power Capacity at Delhi. The said project is expected to be commissioned in December 2024.

Zensar Technologies: The company’s consolidated revenue edged up 1.2% to Rs 1,227.2 crore in Q1FY24 from Rs 1,212.6 crore in Q4FY23. Profit After Tax climbed 31% to Rs 156.2 crore in Q1FY24 as against Rs 119.2 crore in the preceding quarter. EBIT rose 33.5% to Rs 187.8 crore in Q1vs Rs 140.7 crore QoQ

Havells India: The company’s consolidated revenue was up 13.9% YoY at Rs 4833.8 crore in Q1FY24 as against Rs 4244.46 crore in Q1FY23. Profit After Tax rose 18.1% YoY at Rs 287.07 crore in Q1FY24 as against Rs 243.16 crore in Q1FY23. EBITDA rose 11.2% YoY to Rs 401.97 crore in Q1FY24 from Rs 361.53 crore in Q1FY23.

South Indian Bank: The Kerala-based lender’s net profit surged 75.5% to Rs 202.3 crore in Q1FY24 as against Rs 115 crore in Q1FY23. NII was up 33.9% YoY at Rs 807.7 crore in Q1FY24 as against Rs 603.4 crore in Q1FY23. Net NPA stood at 1.85% in Q1FY24 as against 1.86% in the preceding quarter.

CSB Bank: The company’s net profit rose 15.5% at Rs 132.2 crore in Q1FY24 as against Rs 115 crore in Q1FY23. NII jumped 17.2% to Rs 364 crore in Q1FY24 as against Rs 310.7 crore in Q1FY23. Net NPA stood at 0.32% in Q1FY24 as against 0.35% in the previous quarter.

Shalby: The company’s net profit rose 3.5% to Rs 20.8 crore in Q1FY24 from Rs 20.1 crore in Q1FY23. Revenue rose 16.8% YoY to Rs 235.4 crore in Q1FY24 from Rs 201.6 crore in the year-ago period. Ebitda was up 7.8% at Rs 43 crore in Q1FY24 as against Rs 40 crore in Q1FY23.

Kirloskar Pneumatic: The company posted a net profit of Rs 17.9 crore in Q1FY24, up 9.8% YoY from Rs 16 crore in Q1FY23. Revenue fell 11.1% YoY at Rs 242.2 crore in Q1FY24 as against Rs 272.3 crore in Q1FY23. EBITDA fell 6% YoY at Rs 26.4 crore in Q1FY24 as against Rs 28.1 crore in the same period last year.

DB Corp.: The company’s net profit rose to Rs 78.8 crore in Q1FY24 as against Rs 31 crore in Q1FY23. Revenue rose 12.2% YoY to Rs 554.2 crore in Q1FY24 as against Rs 494.1 crore in Q1FY23. EBITDA was up 70.1% YoY at Rs 116.5 crore in Q1FY24 as against Rs 68.5 crore in Q1FY23. The board has approved a dividend of Rs 3 per equity share of face value of Rs 10 each.

Mphasis: The board has approved the recommendation of dividend of Rs 50 per equity share for FY23. The dividend, if declared at the ensuing Annual General Meeting (AGM) of the company, will be paid within 30 days of the AGM, to those shareholders, the firm said in a stock regulatory filing.