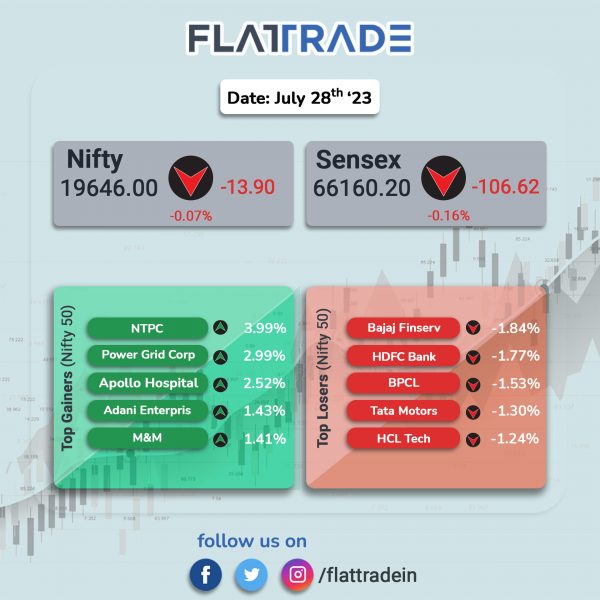

Benchmark equity indices closed lower due to selling pressure in IT and financial services stocks. The Sensex fell 0.16% and the Nifty ended marginally lower by 0.07%.

In broader markets, the Nifty Midcap 100 index rose 0.55% and the BSE Smallcap jumped 0.49%.

Top losers were IT [-0.86%], Bank [-0.46%], Financial Services [-0.41%], Private Bank [-0.33%], Auto [-0.22%]. Top gainers were Realty [1.83%], Media [1.38%], Energy [1.29%], Metal [0.90%], and FMCG [0.88%].

Indian rupee fell by 3 paise to 82.25 against the US dollar on Friday.

Stock in News Today

Indian Oil Corporation (IOC): The oil marketing company reported a standalone net profit of Rs 13,750.44 crore in Q1FY24 as against a net loss of Rs 1,992.53 crore recorded in Q1FY23. Revenue from operations (excluding excise duty) declined 11.92% to Rs 1,97,526.57 crore in the quarter ended June 2023 from Rs 2,24,249.22 crore posted in Q1FY23. Domestic sales rose by 1.45% to 23.305 million metric tons (MMT), while export sales dropped 34.21% to 1.102 MMT in Q1FY24 over Q1FY23. Average gross refining margin (GRM) for the reported period is $8.34 per bbl as compared to $31.81 per bbl registered in the year-ago period.

Route Mobile: The company’s net profit was down 9.1% to Rs 92.4 crore in Q1FY24 as against Rs 102 crore in the preceding quarter. Revenue was down 4.1% at Rs 967.4 crore in Q1FY24 as against Rs 1,008.6 crore in Q4FY23. Ebitda fell 6.6% QoQ to Rs 123.1 crore in Q1FY24 from Rs 131.8 crore in the preceding quarter.

Mahindra & Mahindra Financial Services (MMFS): The company reported a 58% rise in its standalone net profit to Rs 352.6 crore in the quarter ended June 2023 as compared to Rs 222.92 crore in the corresponding quarter last year. The revenue from operations was up 25% to Rs 3,125.4 crore during the quarter as compared to Rs 2,498.55 crore last year. The net interest income (NII) stood at Rs 1,675 crore, up 7% YoY, and net interest margin stood at 6.8%. The company’s loan book increased sequentially by 28% YoY to Rs 86,732 crore and disbursements rose 28% YoY to Rs 12,165 crore during the reported quarter.

Motherson Sumi Wiring India: The company’s net profit was down 2.3% YoY at Rs 123.1 crore in Q1FY24 as against Rs 126 crore in Q1FY23. Revenue rose 11.2% at Rs 1,858.8 crore in Q1FY24 as against Rs 1,670.9 crore in Q1FY23. Ebitda was down 4.3% at Rs 194 crore in Q1FY24 as against Rs 202.8 crore in Q1FY23.

Exide Industries: The battery manufacturer posted a net profit of Rs 224.1 crore in Q1FY24, up 10.7% from Rs 202 crore in Q1FY23. Revenue rose 5.6% to Rs 4,245.5 crore in Q1FY24 from Rs 4,021.7 crore in Q1FY23. Ebitda was up 13.1% at Rs 438.1 crore in Q1FY24 as against Rs 387.3 crore in Q1FY23.

Supreme Industries: The company’s net profit was up 1.3% at Rs 216.5 crore in Q1FY24 as against Rs 214 crore in Q1FY23. Revenue rose 7.4% to Rs 2,368.6 crore in Q1FY24 from Rs 2,206 crore in Q1FY23. Ebitda climbed 19.6% YoY at Rs 321.6 crore in Q1FY24 from Rs 269 crore in Q1FY23.

APAR Industries: The company reported a 61% jump in consolidated net profit to Rs 197 crore on a 22% increase in revenue from operations to Rs 3,773 crore in Q1FY24 over Q1FY23. Ebitda jumped 54% YoY to Rs 369 crore in Q1FY24. Its order book as on end of Q1FY23 stood at Rs 5,356 crore.

Intellect Design Arena: The company’s consolidated net profit rose 35.92% to Rs 93.47 crore on 18.12% increase in net sales to Rs 639.38 crore in Q1FY24 over Q1FY23. Ebitda was at Rs 155 crore in Q1FY24 as against Rs 116 crore in Q1FY23, a rise of 33% YoY. Meanwhile, the board has approved the appointment of Vasudha Subramaniam as the chief financial officer of the company, effective from 1 September 2023. She currently holds the position of Senior vice president and financial controller. The current chief financial officer, Venkateswarlu Saranu, will transition to a new role on the same date.

Ajanta Pharma: The company’s consolidated net profit jumped 19% to Rs 208.12 crore on 7.4% increase in net sales to Rs 1021.04 crore in Q1FY24 over Q1FY23. Ebitda stood at Rs 271 crore in Q1FY24, up 22% from Rs 222 crore in the eyar-ago period. During the quarter, total branded generic sales was up 6% to Rs 732 crore from Rs 688 crore in Q1FY23. Meanwhile, the board has approved first interim dividend of Rs 25 per share for FY24 and record date for this payout will be Friday ( August 4, 2023).

Go Fashion (India): The company said that ICRA has upgraded the company’s long-term to ‘[ICRA] A+ (Stable)’ from ‘[ICRA] A’. The agency has also upgraded the company’s short term rating to ‘[ICRA] A1+’ from ‘[ICRA] A1’. ICRA said that the ratings upgrade factors in the sustained healthy growth in the top line of Go Fashion (India) and healthy margins. The growth has been supported by its strong market position in the domestic women’s bottom wear segment as well as its continuous focus on widening its market presence through continuous store additions. ICRA expects GFIL’s revenue to witness a steady growth of 10-15% over the medium term, driven by the large untapped and large unorganised market, and continued diversification measures with around 120-130 exclusive brand outlets (EBOs) proposed to be added every year in the coming fiscals.

Sona BLW Precision Forgings: The auto components maker said its consolidated net profit increased by 475 to Rs 112 crore in the April-June 2023 quarter. The company had posted a net profit of Rs 76 crore in the same period of last fiscal. Revenue from operations rose to Rs 731 crore in the first quarter of the current fiscal as against Rs 584 crore in the year-ago period. Ebitda increased by 47.37% to Rs 202.5 crore in the reported quarter from Rs 137.4 crore in the year-ago period. The company’s board approved an investment of Rs 99.7 crore for capacity expansion at its Chennai plant from 4 lakh to 6 lakh electric vehicle traction motors. and also decided to add a new capacity of 5 lakh units of printed circuit board assembly by FY2025.

Arvind: The textile company said that its net profit fell 31.4% YoY to Rs 69.7 crore in Q1FY24 from Rs 102 crore in the corresponding quarter of last year. Its revenue also declined 21.2% to ₹1,853.3 crore in Q1FY24 from ₹2,352.1 crore in Q1FY23. Revenue from textiles was Rs 1,418.11 crore in the June quarter and the same from advanced material was Rs 341.96 crore. Total expenses in the quarter under review were Rs 1,774.36 crore, down 20.58% compared to the year-ago period.

Supreme Petrochem: The petrochemical company’s net profit slumped 63.4% to Rs 69.26 in Q1FY24 as against Rs 189.15 crore recorded in Q1FY23. Revenue from operations was at Rs 1,221.48 crore in the quarter ended 30 June 2022, down 17.7% from Rs 1,484.18 crore in Q1FY23. Ebitda stood at Rs 90.5 crore in the first quarter of FY24, a decline of 64% from Rs 251.7 crore reported in Q1FY23.

Macrotech Developers (Lodha): The real estate developer’s consolidated net profit dropped 34.1% to Rs 178.40 and revenue from operations dropped 39.6% to Rs 1,617.40 crore in Q1FY24 over Q1FY23. The company reported pre-sales of Rs 3,350 crore in Q1FY24, a growth of 17% YoY. Collections decreased by 8.4% YoY to Rs 2,400 crore during the quarter. Adjusted Ebitda stood at Rs 460 crore, down 48.89% YoY in Q1FY24.

Sundram Fasteners: The company reported 6.2% decline in consolidated net profit to Rs 127.60 crore in Q1FY24 from Rs 136.02 crore in Q1FY23. Net sales remained flat at Rs 1410.76 crore in the first quarter of FY24. The domestic sales for the quarter ended June 2023 were at Rs 821.97 crore, up 3% YoY from Rs 798.50 crore in the year-ago period. The export sales for the reported quarter stood at Rs 347.99 crore in Q1FY24, down 14% YoY from Rs 405.76 crore during the same peroid last fiscal. Ebitda declined by 8% to Rs 197.31 crore in Q1FY24 from Rs 214.86 crore in Q1FY23.

Ipca Laboratories: The Competition Commission of India (CCI) granted the approval to Ipca Laboratories for acquiring 59.38% stake in Unichem Laboratories. Ipca Laboratories will acquire up to 1,83,05,495 equity shares of Rs 2 each representing aggregate 26% of the fully diluted voting equity share capital of Unichem Laboratories for cash at a price of Rs 440 per equity share. Earlier, in April 2023, Ipca Laboratories entered into a definitive share purchase agreement (SPA) for acquisition of 2,35,01,440 fully paid-up equity shares of Rs 2 each, constituting 33.38% of the paid up equity share capital of Unichem Laboratories from one of its promoter shareholder at price of Rs 440 per equity share aggregating to Rs 1,034.06 crore.

RailTel Corp: The public sector enterprise reported a 48.5% jump in consolidated net profit at Rs 38.39 crore in Q1FY24 from Rs 25.85 crore posted in Q1FY23. Revenue from operations grew by 24.1% YoY to Rs 467.61 crore in the quarter ended June 2023. The company’s revenue from Telecom Services stood at Rs 291.68 crore (up 6.54% YoY) and revenue from Proiect Work Services was at Rs 175.93 crore (up 70.67% on YoY) during the period under review.

LT Foods: The company reported 44% jump in net profit to Rs 137 crore on a 10% increase in total revenue to Rs 1,789 crore in Q1FY24 over Q1FY23. Ebitda improved by 27% YoY to Rs 224 crore, while Ebitda margin rose by 167 bps YoY to 12.5% in the first quarter of FY24. LT Foods said that its Basmati and Other Specialty rice business for Q1 FY’24 was up by 24% on YoY basis on account of increased investment in brand and marketing and subsequent gain in market share.