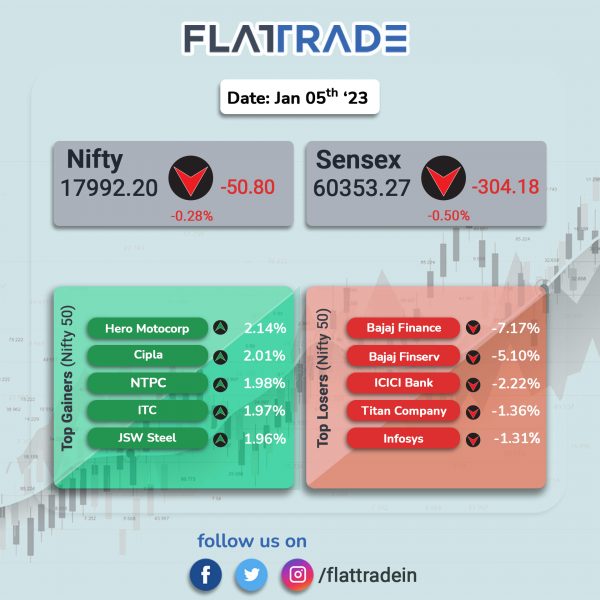

Benchmark indices fell as gains in FMCG, Pharma, Auto and Oil & Gas were offset by losses in banking, financials services and insurance stocks. The Sensex fell 0.50% and the Nifty 50 index was down 0.28%.

In broader markets, the Nifty Midcap 100 was up 0.50% and the BSE Smallcap ended flat.

Among Nifty sectoral indices top gainers were FMCG [1.55%], Oil & Gas [1.46%], Auto [1.35%], Pharma [1.03%] and Metal [0.83%]. Top losers were Financial Services [1.18%], Bank [-0.81%] and Private Bank [-0.79%]

Indian rupee rose 25 paise to 82.55 against the US dollar on Thursday.

Stock in News Today

Bajaj Finance and Bajaj Finserv: Shares of Bajaj Finance tanked 7.17% and Bajaj Finserv tumbled 5.1% after Bajaj Finance posted weaker-than-expected quarterly business updates. Bajaj Finance said that new loans in October–December quarter of FY23 stood at 7.8 million, up 5.4% from the year-ago period. Its asset under management (AUM) has jumped 27% YoY to Rs 2.30 trillion in Q3FY23, from 1.81 trillion in Q3FY22. Its deposit book has also swelled to Rs 43,000 crore as of December 2022, up 41% YoY. The company has also recorded its highest ever quarterly increase in customer franchises at 3.1 million in Q3FY23 and its customer franchises stood at 66 million as of end of December 2022.

Tata Power: The Tata Group company said it will compute and claim tariff from the beneficiaries based on the Central Electricity Regulatory Commission order that grants compensation for emergency supply from its Mundra plant.

IndusInd Bank: The lender has partnered with British Airways and Qatar Airways to introduce a unique multibranded credit cards powered by Visa. The multi-branded credit card will be launched and made available to consumers in the first quarter of FY2024 and it will be available in the Infinite variant of Visa. Customers will be able to collect Avios, the rewards currency for British Airways Executive Club and Qatar Airways Privilege Club, by signing up and choosing their preferred loyalty programme.

Godrej Consumer Products: The FMCG company said that despite the demand softness in India, it expects to deliver double-digit sales growth backed by low single-digit volume growth in Q3 FY23. The growth is broad-based and led by around double-digit sales growth in both Home Care and Personal Care. During the quarter, the Indian FMCG sector witnessed slow growth driven by poor rural consumption and a slowdown post the festive season.

Arvind Fashions: The company said in an exchange filing that Piyush Gupta has resigned from the position of chief financial officer (CFO) of the company effective from close of business hours on 5th January 2023, due to personal reasons. Girdhar Kumar Chitlangia has been appointed as the Chief Financial officer of the company with effect from 6th January 2023, based on the recommendation of the Nomination and Remuneration Committee of the company.

Suryoday Small Finance Bank: The lender has recorded 48% jump in total deposits to Rs 4,684 crore in Q3FY23 from Rs 3,170 crore in Q3FY22. The bank’s CASA ratio declined to 13.9% at the end of Q3FY23 as against 19.2% in the same period last year. Gross advances rose by 11% to Rs 5,409 crore in Q3FY23 from Rs 4,872 crore in Q3FY22. Disbursements for the quarter stood at Rs 1,265 crore, up 13% YoY. Collection efficiency in Q3 FY23 was 110.4% as against 86.5% in Q3 FY22.

Poonawalla Fincorp: The company registered 116% YoY jump in total disbursements to approximately Rs 3,980 crore in Q3FY2. Consolidated assets under management (AUM) stood at Rs 19,550 crore at the end of Q3FY23, recording a growth of 28% YoY and 5% QoQ. The NBFC’s disbursements soared 116% YoY and rose 7% QoQ, with 100% disbursements through organic route compared to 97% organic disbursements in Q2 FY23.

Lupin: The drug manufacturer announced that it has launched a novel fixed-dose triple drug combination (FDC) of Indacaterol, Glycopyrronium and Mometasone for managing inadequately controlled asthma amongst patients, under the brand name Difizma in India. It will help in the management of inadequately controlled asthma by improving lung function, providing better symptom control and reducing exacerbations. Difizma is the only FDC that has been approved by the Drug Controller General of India (DCGI) for the treatment of inadequately controlled Asthma.

BF Investment: Shares of the company was locked in a 10% lower circuit of Rs 413.65 on the BSE on Thursday after the company’s board delayed the promoter’s delisting proposal. The company in an exchange filing said that the delisting proposal was not approved by the board. The beneficiary position data (BENPOS) of the company showed that one of the members of the promoter and promoter group of the company had sold 400 equity shares of the Company on 29 June 2022.

Grasim Industries: The company has incorporated a new wholly-owned subsidiary named Grasim Business Services which will provide business support services including staffing solutions.

TTK Prestige: The company informed the exchanges that it will be increasing its investment in Ultrafresh Modular Solutions. The stake in the company will be raised from 40.9% to 51% with the additional investment of Rs 9.99 crore.