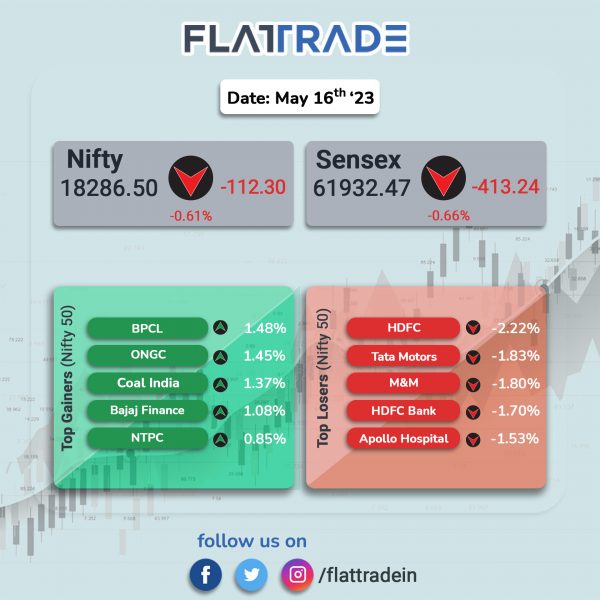

Sensex, Nifty ended lower as a few index heavyweights declined after investors booked profits. The Sensex fell 0.66% and the Nifty dropped 0.61%.

In broader markets, the Nifty Midcap 100 index rose 0.26% and the BSE Smallcap rose 0.12%.

Top Nifty sectoral losers were Media [-1.38%], Auto [-0.93], Financial Services [-0.74%], Private Bank [-0.58%], and Bank [-0.38%]. Top gainers were PSU Bank [0.72%] and IT [0.18%].

Indian rupee gained 9 paise to close at 82.21 against the US dollar on Tuesday.

Stock in News Today

Indian Oil Corp (IOC): The oil marketing company reported a 52% growth in its consolidated net profit at Rs 10,841 crore for the quarter ended March 2023. It was Rs 7,089 crore in the year-ago period. Revenue from operations jumped 10% YoY to Rs 2.3 lakh crore in the March quarter, compared with Rs 2.09 lakh crore in the corresponding quarter of last year. The board has also recommended a final dividend of 30% for FY23, which is Rs 3 per equity share, subject to the approval of the shareholders at the annual general meeting (AGM). The dividend would be paid within 30 days from the date of the declaration at the AGM.

Bank of Baroda (BoB): The lender reported 168% rise in net profit at Rs 4,775 crore for the fourth quarter of FY23, as against a net profit of Rs 1,779 crore in Q4FY22. The bank reported net interest income (NII) at Rs 11,525 crore in Q4FY23 as against Rs 8,611.7 crore in Q4FY22. The gross net performing asset (GNPA) was reported at Rs 36,764 crore, as against Rs 41,857.5 crore in third quarter of FY23. The lender’s total revenue stood at Rs 29,322.74 crore in the March 2023 quarter against Rs 20,695.90 crore in the same period last year. The board has recommended a dividend at Rs 5.50 per equity share for the FY23 subject to shareholders’ approval.

Cipla: The pharma company said that it has entered into a binding term sheet to sell its entire stake of 51% held in Saba Investment, UAE (Saba), to Shibam Group Holding, UAE. The sale has been executed for a consideration of $6.50 million. With this deal, Saba and its subsidiaries viz Cipla Middle East Pharmaceuticals FZ LLC, UAE (CME) and Cipla Medica Pharmaceutical and Chemical Industries, Yemen (Cipla Medica), will cease to be subsidiaries of the company, Cipla said in a statement.

Sona BLW Precision Forgings: The company said that it has signed a technology licensing agreement with Equipmake, a UK-based technology company that has developed high-performance electric powertrains. Under the agreement, Equipmake will license certain patented spoke motor and inverter technology in the power range of 100kW to 440 kW to Sona Comstar to manufacture and sell EV Powertrains, sub systems, and components for electric cars, buses, commercial vehicles and off-road vehicles. Sona Comstar will lead the business development and customer sales in India, Thailand and select South Asian countries, while Equipmake will lead the sales in the rest of the world. The companies expect the production of these systems to commence in 2025.

Jubilant Ingrevia: The company said its net profit was down 23.8% at Rs 52.3 crore in Q4FY23 as against Rs 69 crore in Q4FY22. Revenue fell 11.6% to Rs 1,145 crore in Q4FY23 as against Rs 1,295.8 crore in Q4FY22. Ebitda was down 28.4% at Rs 102 crore in Q4FY23 as against Rs 142.4 crore in Q4FY22.

Granules India: The drugmaker said its net profit was up 7.7% at Rs 119.6 crore in Q4FY23 as against Rs 111 crore in Q4FY22. Revenue rose 16.1% to Rs 1,195.5 crore in Q4FY23 as against Rs 1,030 crore in Q4FY22. Ebitda rose 18.3% to Rs 228.1 crore in Q4FY23 as against Rs 192.8 crore in Q4FY22.

Kajaria Ceramics: The company’s net profit rose 12.8% to Rs 108 crore in Q4FY23 as against Rs 95.8 crore in Q4FY22. Revenue was up 9.4% at Rs 1,204.8 crore in Q4FY23 as against Rs 1,101.8 crore in Q4FY22. Ebitda rose 6.1% at Rs 175.9 crore in Q4FY23 as against Rs 165.8 crore in Q4FY22.

MaxHealth: The company reported a net profit at Rs 251 crore in Q4FY23 as against Rs 124 crore in the year-ago period. Revenue was up 29.6% at Rs 1,214.5 crore in Q4FY23 as against Rs 937.1 crore in q4fy. Ebitda was up 63.2% at Rs 340.4 crore as against Rs 208.6 crore in the year-ago period.

TV Today: The company’s net profit fell 83.7% at Rs 5.8 crore in Q4FY23 as against Rs 36 crore in Q4FY22. Revenue fell 10.4% to Rs 217.1 crore in Q4FY23 as against Rs 242.3 crore in Q4FY22. Ebitda fell 56.1% to Rs 21.3 crore in Q4FY23 as against Rs 48.5 crore in Q4FY22.

Mukand: The company’s net profit stood at Rs 125.4 crore in Q4FY23 as against Rs 54 crore in Q4FY22. Revenue fell 1.2% at Rs 1,312.4 crore as against Rs 1,328.5 crore in the year-ago period. Ebitda loss stood at Rs 378.5 crore as against Ebitda profit of Rs 84.9 crore in the year-ago period.

Safari Industries (India): The company’s net profit zoomed to Rs 38.1 crore in Q4FY23 as against Rs 2.4 crore in Q4FY22. Revenue rose 57.2% at Rs 302.7 crore in Q4FY23 as against Rs 192.5 crore in Q4FY22. Ebitda stood at Rs 58.3 crore in Q4FY23 as against Rs 16.9 crore in Q4FY22.

Prakash Industries: The company’s net profit was up 10.1% at Rs 58 crore in Q4FY23 as against Rs 52.7 crore in Q4FY22. Revenue declined 12.7% to Rs 1,010.5 crore in Q4FY23 as against Rs 1,157.4 crore in Q4FY22. Ebitda inched up 0.2% to Rs 108.2 crore in Q4FY23 as against Rs 108 crore in Q4FY22.

AurionPro: The company reported a net profit up 32.1% at Rs 25.1 crore in Q4FY23 as against Rs 19 crore in Q4FY22. Revenue rose 38.7% to Rs 190.7 crore in Q4FY23 as against Rs 137.5 crore in Q4FY22. Ebitda jumped 33.3% to Rs 40.4 crore in Q4FY23 as against Rs 30.3 crore in Q4FY22.

MPS: Shares of the company was locked in upper circuit of 20% after the company’s consolidated net profit jumped 45.65% to Rs 32.13 crore on 16.5% rise in revenue from operations to Rs 127.46 crore in Q4FY23 over Q4FY22. Ebitda stood at Rs 45.64 crore in Q4FY23, up by 44.4% from Rs 31.61 crore posted in corresponding quarter last year. On full year basis, the company’s consolidated net profit jumped 25.33% to Rs 109.19 crore on 11.62% rise in revenue from operations to Rs 501.05 crore in FY23 over FY22.

Repro India: Shares surged over 18% in intraday trade after investor Madhuri Madhusudan Kela purchased stake in the company through bulk deals on Tuesday. In two days, the stock price has jumped over 43%. According to the NSE’s bulk deal data on Monday, Madhuri Kela acquired 4.75 lakh shares, representing 3.73% equity, in the company. Meanwhile, Harit Exports purchased 1,00,000 shares, accounting for 0.79% equity. On the other hand, Malabar India Fund sold 5,12,000 shares, equivalent to 4.02% equity. As of 31st March 2023, Malabar India Fund held a 4.56% stake in the company.

Jupiter Wagons (JWL): The company said it has successfully concluded a qualified institutional placement (QIP) of Rs 125 crore. The company said its QIP got an overwhelming response from investors, including Tata Mutual Fund, Ananta Capital, and ITI Mutual Fund. The funds raised through QIP will be used for the acquisition of Stone India, working capital optimization, and other corporate purposes.

SKF India: The company said that it has entered into a share holders’ agreement with Clean Max Taiyo for further acquisition of 26% stake in Clean Max for a consideration of Rs 4.21 crore. The board of SKF India in November 2022 had approved investment by way of equity participation (26%) in special purpose vehicle company for commissioning a captive project (wind + solar) via open access for Bangalore plant. Accordingly, SKF India in March 2023, had executed a share purchase agreement with Clean Max Taiyo and and Clean Max Enviro Energy Solutions for acquiring 2,600 fully paid-up equity shares (equivalent to 26% stake) of Clean Max Taiyo. The acquisition will help SKF to reduce its energy costs, achieve 100% renewable energy sourcing and reduce GHG emissions.

Suryoday Small Finance Bank: The bank reported a net profit of Rs 38.91 crore in Q4FY23 compared with a net loss of Rs 48.12 crore in Q4FY22. Total income jumped 41.65% to Rs 363.41 crore in Q4 FY23 as against Rs 256.55 crore in Q4FY22. The bank has recorded 34.2% jump in total deposits to Rs 5167 crore in Q4FY23 from Rs 3,850 crore in Q4 FY22. Disbursement stood at Rs 1,684 crore, up 71.8% YoY. Net NPA ratio stood at 1.5% in Q4FY23 as against 5.9% in Q4FY22. On a full year basis, the company reported net profit of Rs 77.70 crore in FY23 as compared with net loss of Rs 93.03 crore in FY22. Total income increased 23.73% YoY to Rs 1,281.10 crore in FY23.