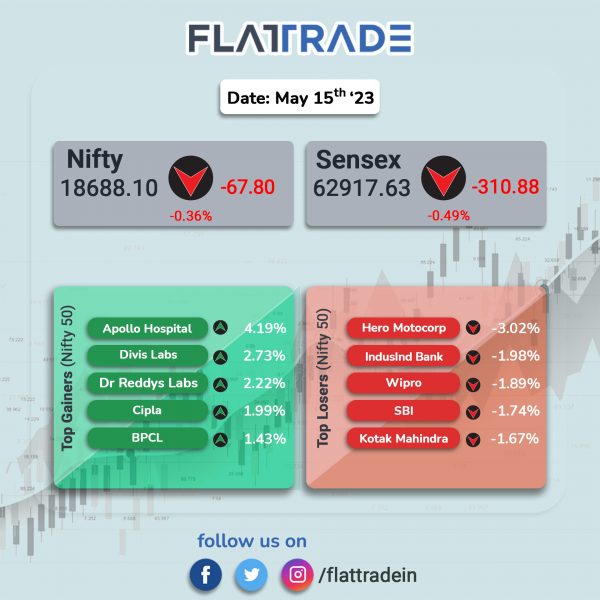

Benchmark equity indices closed lower as investor sentiments were dampened after the Fed hinted at two more rate hikes by the end of 2023. The Sensex fell 0.49% and the Nifty 50 index lost 0.36%.

In broader markets, the Nifty Midcap 100 index rose 0.21% and the BSE Smallcap gained 0.12%.

Top losers among Nifty sectoral indices were PSU Bank [-1.99%], Bank [-1.24%], Private Bank [-1.2%], Media [-1%], and Financial Services [-0.98%]. Top gainers were Pharma [1.42%], FMCG [0.54%], Auto [0.17%], Oil & Gas [0.14%].

Indian rupee fell 7 paise to 82.18 against the US dollar on Thursday.

India’s merchandise trade deficit rose to its highest level since December 2022 to $22.12 billion in May 2023, government data showed on Thursday. In April, the deficit stood at $15.24 billion. In December last year, India’s trade deficit was $23.76 billion. In May 2023, the imports fell 6.6% YoY to $57.1 billion, while the exports declined 10.3% YoY to $34.98 billion.

Stock in News Today

Cochin Shipyard: The company announced that its wholly owned subsidiary, Udupi Cochin Shipyard (UCSL) has secured an international order from Norway-based Wilson Shipowning AS, aggregating to Rs 580 crore. The shipbuilding company said that the order entails designing and construction of six new generation diesel electric 3800 DWT general cargo vessel. The contract is signed with an option for additional 8 vessels, it added.

Mahindra & Mahindra (M&M): The company announced that it has incorporated two new step-down subsidiaries, Gelos Solren and Furies Solren. Both the subsidiaries were incorporated with an authorized and paid-up share capital of Rs 20 lakh. The two new subsidiaries were incorporated for production and sale of power and generating electricity, distributed energy including rooftop solar installation for commercial, industrial, institutional and residential segment.

G R Infraprojects: The construction company emerged as L1 (lowest)bidder for tender invited by National Highways Authority of India (NHAI) for a road project amounting to Rs 1,085.47 crore in Uttar Pradesh. The scope of the project entails four laning from Kasganj Bypass end to Chandan Nagar in Uttar Pradesh on hybrid annuity mode – package 3. The construction is expected to be completed in 730 days from appointed date and the operation period is 15 years from the commercial operation date.

Laurus Lab: The company said that it has received Establishment Inspection Report (EIR) from US Food and Drug Administration (USFDA) for its Andhra Pradesh facility. The inspection was conducted by USFDA at aforementioned facility of the company from 6 February 2023 to 10 February 2023.

KPI Green Energy: The company announced that it has received commissioning certificate from Gujarat Energy Development Agency (GEDA) for capacity of 6.40 MWdc solar power project under its captive power producer (CPP) segment. The power from the said solar project would be supplied to Pashupati Cotspin (2 MWdc), M.S. Synthetics (1.40 MWdc), General Polytex (2.40 MWdc) and Rushabh Wire Industries LLP (0.60 MWdc).

Remedium Lifecare: The company said that its board will meet on June 23 to consider bonus share issue and stock split proposals, according to its regulatory filing. Apart from these, the board will consider and approve increasing of borrowing limit from Rs 50 crore to Rs 1000 crore by issuance of debt securities such as NCDs, bank term loans, etc.

Satin Creditcare Network: The company has raised Rs 30 crore via issuance of commercial papers (CPs). The commercial papers were issued and allotted on June 14 and it will have an interest rate of 9% and mature on July 31. The tenure of the CP is 47 days.

KRBL: The company said that it has commenced commercial production at its new plant at Anjar, Gujarat. The scrip extended gains for third consecutive session. It has added 3.62% in three sessions, from its recent closing low of Rs 344.15 recorded on 12 June 2023.

IndInfravit Trust: The company’s board has approved the allotment of 1,37,500 senior, secured, listed, rated, redeemable and NCDs of a face value of Rs 1,00,000 each aggregating to Rs 1,375 crore on private placement basis.

Vakrangee: Shares of the company turned ex-date for demerger today (June 15). Consequently, shareholders of Vakrangee on this date will be eligible to receive shares in VL EGovernance & IT Solutions, the new company that will be created as a result of the demerger. For every 10 Vakrangee shares held by shareholders, they will receive ine share in VL EGovernance & IT Solutions. The record date for the demerger is also today (June 15).

Som Distilleries & Breweries: The company said that its market share in Karnataka has reached 20.1% in May 2023. The market share of the company’s brands in Karnataka was 3.3% in the fiscal year 2019-2020. This rose to 6.9% in the fiscal year 2021-2022. The trend continued and Som Distilleries further experienced a momentous leap in market share as it rose 13.9% in the fiscal year 2022-2023.

Godrej Properties (GPL): The company has announced that it will acquire a 7.44 acre land parcel at New Alipore, a premium residential locality in Kolkata from West Bengal Housing Infrastructure Development Corporation. GPL will develop this land parcel as a luxury group housing project. The location offers excellent connectivity to all major social and commercial hubs of Kolkata city, the company said.

KIOCL: The company said that the operations of pellet plant unit of the company at Mangalore have been restarted with effect from June 15. Last month, the company had informed that the operations at the said plant would be shut down temporarily from May 13, 2023, to carry out preventive maintenance of the plant.

FDC: The USFDA has successfully completed its inspection at the company’s Aurgangabad and Roha facility with classification of no action needed (NAI). Based on the inspection, the said facilities are considered to be in an acceptable state of compliance with regards to current good manufacturing practice (CGMP).

Vikas Lifecare: The company’s wholly owned subsidiary, Genesis Gas Solutions, has received orders from Indraprastha Gas (IGL) for supplying ultra sonic gas meters. Ultra-Sonic Metering (USM) is the most advanced and accurate means of measurement of flow of liquids and gases and are entirely maintenance free.

Indraprastha Gas (IGL): The company said that Kamal Kishore Chatiwal assumed charge as managing director (MD) from Sanjay Kumar with effect from June 15. Sanjay Kumar ceased to be a director and MD effective from the same date as well. The gas distribution company informed that Chatiwal has been nominated as its MD by GAIL (India). Chatiwal is a B.Tech (Chemical Engineering) from IIT, Delhi, and has more than 32 years of experience in oil & gas sector.