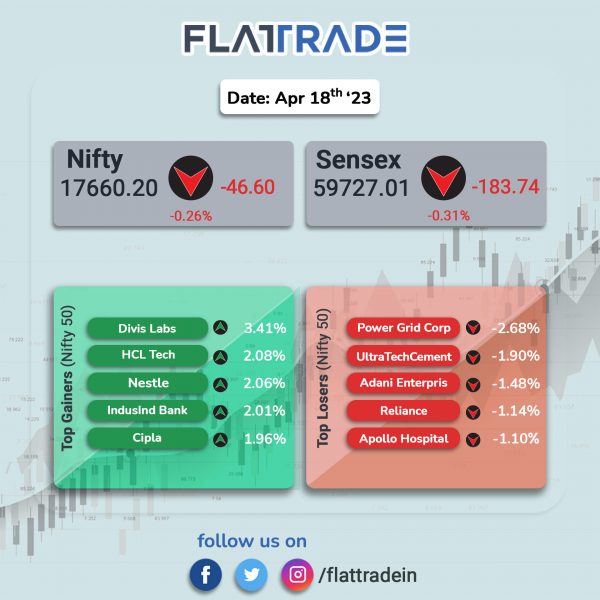

Benchmark equity indices fell as investors booked some profits and also due to losses in some index heavyweights. The Sensex fell 0.31% and the Nifty dropped 0.26%.

In broader markets, the Nifty Midcap 100 index rose 0.76% and the BSE Smallcap gained 0.22%.

Top gainers among Nifty sectoral indices were Pharma [1.64%], Realty [1.04%], PSU Bank [0.76%], IT [0.59%], and Metal [0.25%]. Top losers were Energy [-0.65%], Media [-0.33%], FMCG [-0.33%], Financial Services [-0.33%], and Oil & Gas [-0.27%].

Indian rupee fell 7 paise to 82.04 against the US dollar on Tuesday.

Stock in News Today

Tata Chemicals: Shares of the company slipped nearly 7% in intraday trade, after the company announced 3-4% price cuts across India for light and dense soda ash effective from April 17, 2023. The cut comes amid falling soda ash prices in China since mid-March, as the market reacts to unexpected news of substantial capacity addition in Inner Mongolia from May 2023.

Tata Steel: The company said it is in talks to raise as much as $400 million, Bloomberg reported citing people familiar with the matter. The debt could have a tenor of about five years and the proceeds would be used for capital expenditure, said the sources. The lenders include Bank of America Corp., HSBC Holdings Plc, JPMorgan Chase & Co. and Mitsubishi UFJ Financial Group Inc.

Schaeffler India: The company said that its net profit rose 5.9% to Rs 219.4 crore for the quarter ended March 2023 as against Rs 207.1 crore in the year-ago period. Its revenue was up 8% to Rs 1,693.6 crore in the reported quarter from Rs 1,567.5 crore in the corresponding quarter last fiscal. EBITDA rose 2% to Rs 314.7 crore in the reported quarter as against Rs 308.4 crore. Margin stood at 18.6% in the quarter under review as against 19.7% in the year-ago period.

Crisil: The rating agency reported a consolidated profit of Rs 145.8 crore in the first quarter of FY23, up 19.8% from the year-ago period. The net profit margin for the quarter ended March 31, 2023 came in at 20.38%, down six basis points (bps) from 20.44% in the corresponding period of the last fiscal. Consolidated revenue from operations increased by 20.2% YoY to Rs 714.9 crore for March 2023 quarter driven by growth in both rating services as well as research, analytics and solutions businesses. Crisil follows January-December financial year.

Ramco Systems: The company said it has secured a deal from Shearwater Health for implementing global payroll & operational HR solution. With this partnership, Ramco will digitally transform the HR and payroll operations for Shearwater Health’s 4000+ employees. It can be deployed on-cloud, on-premise, or as a managed service and is used by more than 500 customers globally. The solution also includes innovative features such as AI and machine learning, context-sensitive pop-ups, and voice-based transactions on Google Assistant and Alexa.

Quick Heal Technologies: The company reported a consolidated net loss of Rs 6.64 crore in Q4FY23 as against a net profit of Rs 28.09 crore posted in Q4FY22. Revenue from operation slumped 52.5% to Rs 49.28 crore in Q4FY23 from Rs 103.71 crore recorded in the same period a year ago. The company posted a negative EBITDA of Rs 16.17 crore in Q4FY23 as against a positive EBITDA of Rs 34.88 crore in Q4FY22. With respect to its future outlook, the company said that it is planning to expand its footprint globally by extending retail and enterprise services to international clients. The firm is investing heavily into enterprise solutions, which offers a significantly larger market opportunity and is expected to grow 3 times faster than the retail market.

Goa Carbon: The petrochemical company said that the operations at its Bilaspur unit in Chhattisgarh have resumed. Earlier, the unit was shut down by the company for maintenance work since 19 January 2023. Goa Carbon is engaged in the manufacture and sale of calcined petroleum coke.

Vipul Organics: The company said that its board will meet on 21 April 2023 (Friday) to consider raising funds via preferential issue. The company said in an exchange filing that it will use the funds for business expansion and to meet the working capital requirements. Vipul Organics is engaged in manufacturing & trading of dyes, organic pigments & organic intermediates.

Avalon Technologies: The electronic manufacturing services company made a weak stock market debut. Shares of the company fell to a low of Rs 387.15 apiece on the NSE. Shares closed at Rs 398 as against a issue price of Rs 436 per share.