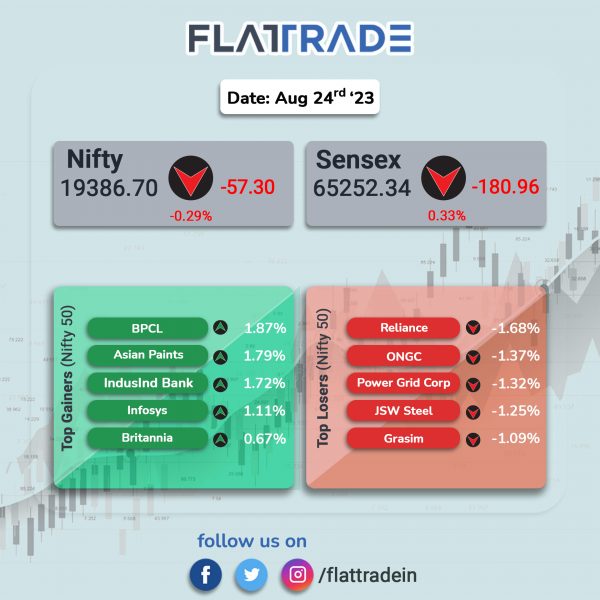

Benchmark stock indices closed lower due to selling pressure in select index heavyweights, while Midcap index ended with modest gains. The Sensex fell 0.28% and the Nifty dropped 0.29%.

In broader markets, the Nifty Midcap 100 rose 0.24% and the Nifty Smallcap lost 0.35%.

Top gainers were IT [0.61%], FMCG [0.29%], Realty [0.2%], and Media [0.18%]. Top losers were PSU Bank [-0.65%], Pharma [-0.58%], Oil & Gas [-0.56%], Metal [-0.34%], and Auto [-0.25%].

The Indian rupee strengthened by 10 paise to close at Rs 82.58 against the US dollar on Thursday.

Stock in News Today

Tata Power: The company’s step-down subsidiary, Tata Power EV Charging Solutions, has joined hands with Zoomcar for offering seamless EV charging infra solutions. This collaboration aims to promote Tata Power’s EZ Charge points on the Zoomcar platform and will focus on supporting existing and aspiring EV owners along with Zoomcar’s existing customers.

Coforge: The company has launched Coforge Quasar, a Gen AI Platform designed to build Enterprise AI capabilities. Coforge Quasar comes pre-loaded with a comprehensive set of 100+ APIs, readily available for integration. The platform features a modular and scalable architecture, and boasts an array of 100+ pre-built cognitive as well as generative use cases, facilitating the creation of out-of-the-box solutions.

Torrent Pharma: The drug maker informed that the US drug regulator has issued an establishment inspection report (EIR) for its manufacturing facility at Dahej in Gujarat. The company received the establishment inspection report (EIR) stating that the inspection has now been successfully closed by the USFDA. The United States Food and Drug Administration (USFDA) inspected the facility from 17 May 2023 to 25 May 2023.

Suzlon Energy: The company announced that it has received an order for the development of a 31.5 MW wind power project for Integrum Energy Infrastructure. Suzlon will install 15 units of their S120 – 140m wind turbine generators (WTGs) with a hybr id lattice tubular (HLT) tower and a rated capacity of 2.1 MW each in Maharashtra and Karnataka. The project is expected to be commissioned in May 2024.

Zydus Lifesciences: The company said that it has received final approval from US Food and Drug Administration (USFDA) for Zinc Sulfate Injection and Pharmacy Bulk Package Vials. Zinc Sulfate Injection is indicated in adult and paediatric patients as a source of zinc for parenteral nutrition when oral or enteral nutrition is not possible, insufficient, or contraindicated. Zinc Sulfate Injection and Pharmacy Bulk Package Vials had annual sales of $ 17.1 million in the United States (IQVIA MAT June 2023).

Gland Pharma: The drug maker announced that it has received the establishment inspection report (EIR) from the US drug regulator for its Dundigal facility, indicating closure of the inspection. The inspection was concluded with one observation.

RailTel Corporation of India: The company said that it has received a work order worth Rs 27.9 crore from Kerala State Information Technology Infrastructure. The contract is for the supply, installation, testing, commissioning and maintenance of ISP hardware, software and license for Kerala Fibre Optic Network (KFON). The project is likely to to executed within 90 days.

Ramkrishna Forgings: The company has received a contract worth Rs 156 crore from Eurasian farm equipment customer. The company will supply transmission and engine components over a period of four years.

Spicejet: The Delhi High Court on Thursday ordered SpiceJet chairman and managing director (CMD) Ajay Singh to pay Rs 100 crore to Kalanithi Maran by September 10, Moneycontrol reported. The failure to pay may result in the Singh’s arrest, the Court said. Singh was summoned to the Court after Maran filed an application stating that SpiceJet had not filed an affidavit of assets and liabilities in 2020. Maran also claims that the budget airlines owes him Rs 393 crore as of August 3 and had sought that 50% of the airline’s daily revenues go towards this payment.

Gujarat Ambuja Exports (GAEL): The company has received the green signal from the Gujarat Pollution Control Board for setting up a milling plant in Gujarat. The company has received the consent on 23 August 2023 to set up a 900 tons per day (TPD) greenfield corn wet milling plant at Himmatnagar in Gujarat. With this, GAEL will have a combined maize processing capacity of 6,000 TPD at five locations.

Ipca Laboratories: The US drug regulator has classified the company’s Piparia (Silvassa) formulations manufacturing facility as Voluntary Action Indicated (VAI). The US Food Drug and Administration inspected Piparia (Silvassa) formulations manufacturing facility from 18 April, 2023 to 26 April, 2023, which inspection resulted into 3 observations under USFDA Form 483.

Sprayking Agro Equipment: The company’s board has approved raising Rs 17.38 crore through convertible warrants on preferential basis. Sprayking Agro Equipment has approved the issuance of 8.4 lakh convertible warrants on a preferential basis to foreign investors, Nexpact and AG Dynamic Fund. The warrants are priced at Rs 207 per warrant, with a premium of 7.76% charged to the new investors.

Muthoot Fincorp: The company has launched a digital platform, offering various financial services to its customers through a single application. The app is named ‘Muthoot FinCorp ONE’, and the company will provide services including MSME and gold loans, along with investments in products such as Digital Gold and NCDs. The platform also facilitates utility and loan payments for various purposes. Its Forex services encompass multi-currency cards, cash transactions, and 24×7 international transfers. Furthermore, the company has announced plans to launch insurance products on its platform very soon.