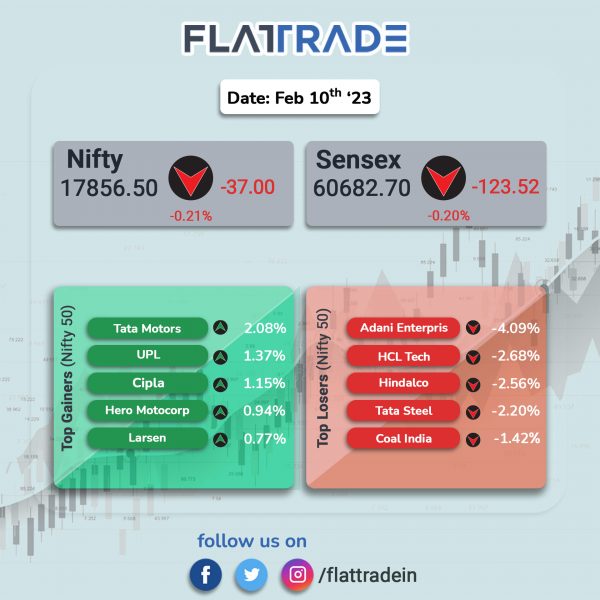

Benchmark stock indices fell tracking a decline in global stock markets as investors were concerned over looming US recession. The Sensex fell 0.20% and the Nifty 50 index was down 0.21%.

Broader market outperformed headline indices. The Midcap 100 index was up 0.24% and the BSE Smallcap rose 0.48%.

Top losers were Nifty Metal [-1.82%], Energy [-0.77%], Oil & Gas [-0.57%], FMCG [-0.4%] and IT [-0.39%]. Top gainers were Realty [1.36%], PSU Bank [0.41%], Media [0.39%] and Auto [0.36%].

Indian rupee rose 1 paise to 82.50 against the US dollar on Friday.

Stock in News Today

Mahindra and Mahindra (M&M): The automaker said that its standalone net profit stood at Rs 1,528 crore crore during the third quarter ended December 2022, up 14% from Rs 1,335 crore year-on-year. Its revenue from operations rose 41% YoY to Rs 21,654 crore in the October-December 2022 as compared to Rs 15,349 crore in the same quarter of the last year. Its total expenses rose to Rs 19,737 crore as against Rs 14,245 crore a year-ago. The company said that its auto and farm business achieved highest ever volumes in the third quarter of FY23 and farm market share during the quarter under review stood at 41%, up 160 bps from previous year.

Power Grid Corp Of India: The company’s board has approved raising Rs 2,200-crore on private placement basis for a period of 10 years. The base issues aggregates to Rs 1,700 crore with a green show option of Rs 500 crore. The bonds will be redeemable at par in 40 equal quarterly installments starting from May 17, 2023 till February 17, 2033.

Paytm: Chinese tech giant Alibaba has sold its entire stake of 3.4% equity Paytm in a block deal on Friday, reported news agency ANI. With this, Alibaba does not hold any stake in Paytm. The Chinese multinational in January had sold around 3.1% of 6.26% equity in Paytm. Shares of Paytm tanked 7.85% on Friday, though it made a weekly gain of 23.93%.

BEML: The state-owned company said its net profit fell 15.5% to Rs 66.3 crore in Q3FY23 as against Rs 78.5 crore in Q3FY22. Its revenue fell 11.7% to Rs 1,037 crore in Q3FY23 as against Rs 1,174.5 crore in Q3FY22. EBITDA fell 20.8% to Rs 91.6 crore in Q3FY23 as against Rs 115.6 crore in Q3FY22.

Dhanuka Agritech: The company reported a net profit of Rs 46.1 crore in Q2FY23, up 8.5% from Rs 42.5 crore in Q3FY22. Its revenue rose 10.2% to Rs 393.4 crore in Q3FY23 as against Rs 356.9 crore in Q3FY22. EBITDA fell 5.8% to Rs 51.9 crore in Q3FY23 as against Rs 55.1 crore in Q3FY22.

RateGain Technologies: The company said its net profit rose 1.5% to Rs 13.2 crore in Q3FY23 as against Rs 13 crore in Q2FY23. Its revenue was up 10.9% to Rs 138.2 crore in the reported quarter as against Rs 124.6 crore in the preceding quarter. EBITDA rose 29.5% to Rs 22.8 crore in the reported quarter as against Rs 17.6 crore in the preceding quarter of FY23.

West Coast Paper: The company posted a net profit of Rs 263.7 crore on Q3FY23 as against Rs 78 crore in Q3FY22. Revenue jumped 42.1% to Rs 1,239 crore in Q3FY23 as against Rs 872.2 crore in Q3FY22. EBITDA rose to Rs 461.2 crore in Q3FY23 as against Rs 160.3 crore in Q3FY22.

Abbott India: The pharma company said its net profit rose 24% to Rs 246.8 crore in Q3FY23 as against Rs 199 crore in Q3FY22. Its revenue was up 8.3% to Rs 1,326.5 crore in Q3FY23 as against Rs 1,224.4 crore in Q3FY22. EBITDA rose 17.7% at Rs 316.5 crore in Q3FY23 as against Rs 269 crore in Q3FY22.

Satia Industries: The company said its net profit was at Rs 64.8 crore in Q3FY23 as against Rs 28.9 crore in Q3FY22. Its revenue was at Rs 486.8 crore in Q3FY23 as against Rs 216.3 crore in Q3FY22. EBITDA stood at Rs 110.3 crore in the quarter under review as against Rs 39.1 crore in the year-ago period.

Venky’s India: The company’s net profit fell 23.6% to Rs 16.5 crore in Q3FY23 as against Rs 21.6 crore in Q3FY22. The company’s revenue was also down 5.7% to Rs 1,035.8 crore in Q3FY23 as against Rs 1,098.5 crore in Q3FY22. Its EBITDA fell 14% to Rs 27.6 crore in Q3FY23 as against Rs 32.1 crore in Q3FY22.

Vascon Engineers: The company has won order worth Rs. 77.42 crore from Vedanta for development of landscape, services and infrastructure for Cairn Oil & Gas Residential Complex at Barmer, Rajasthan. The order entails completing the project within 12 months after issuing the letter of award.

Alkem Labs: The company’s net profit fell 13.5% to Rs 454.7 crore in Q3FY23 as against Rs 525.6 crore in Q3FY22. Its revenue was up 16.1% to Rs 3041 crore in Q3FY23 from Rs 2619 crore in Q3FY22. The company’s EBITDA improve 20.2% to Rs 599 crore in the reported quarter from RS 498.4 crore in the year-ago period.