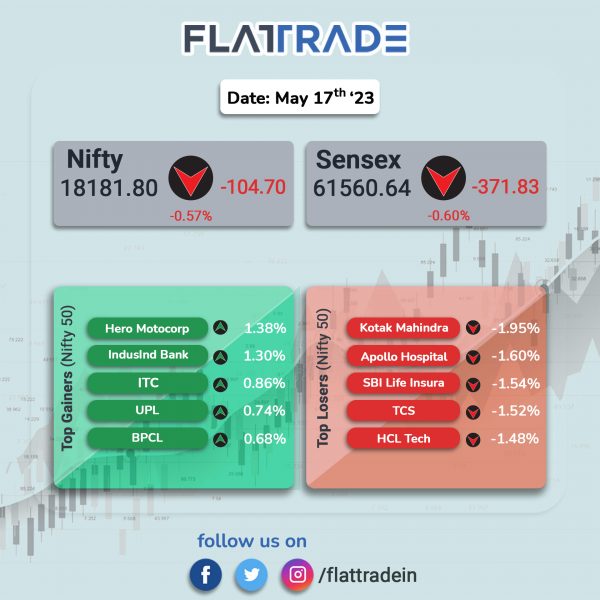

Benchmark equity indices ended lower due to weak global sentiments amid ongoing US debt ceiling negotiation. The Sensex fell 0.6% and the Nifty dropped 0.57%.

In broader markets, the Nifty Midcap 100 index fell 0.09%, while the BSE Smallcap index rose 0.25%.

Top losers were Media [-2.09%], Realty [-1.33%], IT [-0.97%], Metal [-0.89%], and Financial Services [-0.71%]. Meanwhile, Nifty Auto index closed 0.09% higher and Nifty FMCG inched up 0.06%.

Indian rupee fell 18 paise to 82.38 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): The infrastructure behemoth said that the buildings & factories (B&F) business of L&T Construction has secured ‘significant’ EPC orders in India. The business has won an order from a developer to construct residential towers in Thane, Mumbai. The scope of the work includes construction of core and shell works for 5 towers comprising ground, 5 podiums, 54 floors and allied parking areas. The project is to be executed within stringent timelines.

Further, it has also secured an order from a client to construct commercial office space in Bengaluru with an approximate built-up area of 16 lakhs sq. ft. The project is scheduled to be completed in 18 months. As per L&T’s classification, the value of the said contract lies between Rs 1,000 crore to Rs 2,500 crore.

Jubilant FoodWorks: The QSR chain operator’s standalone net profit tumbled 59.07% to Rs 47.52 crore in Q4FY23 as against Rs 116.09 crore in Q4FY22. Revenue from operations rose 8.16% to Rs 1252.31 crore in Q4FY23 from Rs 1157.88 crore in Q4FY22. Ebitda declined 12.9% to Rs 252.2 crore in Q4FY23 as compared with Rs 289.7 crore in corresponding quarter last year. Domino’s has expanded its network strength to 1,816 stores across 393 cities. On full year basis, the company’s net profit decline 18.58% to Rs 356.21 crore despite of 17.66% jump in revenue from operations to Rs 5,095.99 crore in FY23 over FY22. Shares of the company closed 3.09% higher.

Devyani International: The QSR (Quick Service Restaurant) company said its net profit was down 20.4% at Rs 60.7 crore in Q4FY23 as against Rs 76 crore in Q4FY22. Revenue rose 27.8% at Rs 755 crore in Q4FY23 as against Rs 590.7 crore in Q4FY22. Ebitda rose 10.7% YoY at Rs 154.6 crore in Q4FY23 as against Rs 139.6 crore in Q4FY22. Same-store sales growth (SSSG) of KFC was 1.9%, Pizza Hut stood at negative 3.2% and Costa Coffee was 42.6% in Q4 FY23. As on 31 March 2023, the company operates 543 KFC stores, 510 Pizza Hut stores and 112 Costa Coffee stores across its portfolio. Shares of the company dropped 4.15% lower.

Adani Ports and Special Economic Zone (APSEZ): The company said that it has handled rail cargo of 120.51 MMT in FY23, up 22% from a cargo volume of 98.61 MMT handled in FY22. Under the General-Purpose Wagon Investment Scheme (GPWIS) of Indian Railways, cargo handled by rail has grown by 62% YoY. Mundra Port handled over 15,000 container trains in FY23.

Sterlite Technologies: The company’s net profit stood at Rs 65 crore in Q4FY23 as against a net loss of Rs 22 crore in Q4FY22. Revenue was up 25% at Rs 1,872 crore in Q4FY23 as against Rs 1,497 crore in Q4FY22. Ebitda was up 71% at Rs 280 crore in Q4FY23 as against Rs 164 crore in Q4FY22. The board recommended a final dividend of Rs 1 per share.

Hester Biosciences: The company’s consolidated revenue rose 19% YoY at Rs 67 crore in Q4FY23 as against Rs 56 crore in Q4FY22. Consolidated net profit fell 41% YoY to Rs 4.5 crore in Q4FY23 as against Rs 7.7 crore in Q4FY22. Operating profit rose 13% YoY to Rs 12 crore in Q4FY23 as against Rs 10 crore in Q4FY22.

Timken India: The company said its net profit fell 13.8% to Rs 104.5 crore in Q4FY23 as against Rs 121.3 crore in Q4FY22. Revenue rose 20.2% to Rs 802.5 crore in Q4FY23 as against Rs 667.4 crore in Q4FY22. Ebitda fell 15% to Rs 152.9 crore in Q4FY23 as against Rs 179.8 crore in Q4FY23.

Paradeep Phosphates: The company said its net profit slumped 72% to Rs 10 crore in Q4FY23 from Rs 35.7 crore in Q4FY22. Revenue rose 91.9% to Rs 3,643.9 crore in Q4FY23 as against Rs 1,898.8 crore in Q4FY22. Ebitda fell 2.1% to Rs 90.6 crore in Q4FY23 as against Rs 92.5 crore in Q4FY22.

Man Industries (India): The company said it has secured new orders worth approximately Rs 500 crore. With this latest development, the company’s total order book stood at approximately Rs 2300 crore to be executed in 6-8 months. Man Industries (India) is engaged in manufacturing & coating of large diameter carbon steel pipes, infrastructure, realty & trading.

Zydus Wellness: The company’s consolidated net profit registered 6.92% rise in consolidated net profit to Rs 145.61 crore and 11.76% jump in net sales to Rs 709.90 crore in Q4FY23 over Q4FY22. Ebitda rose 2.2% to Rs 144.6 in Q4FY23 from Rs 141.5 crore in corresponding quarter last year. The board has recommended a final dividend of Rs 5 per equity share, subject to approval of shareholders.

CCL Products (India): The company’s consolidated net profit surged 61.84% YoY to Rs 85.29 crore and net sales rose 38.23% YoY to Rs 520.08 crore in Q4FY23 over Q4FY22. For the full year, CCL’s net profit rose 31.58% to Rs 268.88 crore on 41.67% increase in net sales to Rs 2071.22 crore in Fy23 over FY22. The company’s board recommended a final dividend of Rs 2.50 per share.

Eris Life: The company’s net profit was down 18.5% YoY at Rs 65.4 crore in Q4FY23 as against Rs 80.2 crore in Q4FY22. Revenue was up 31.6% YoY at Rs 402.7 crore in Q4FY23 as against Rs 305.9 crore in Q4FY22. Ebitda was up 22.6% YoY at Rs 118.7 crore in Q4FY23 as against Rs 96.8 crore in Q4FY22.

Rail Vikas Nigam: The company along with Ganapathi Engineers Works, Hubli, emerged as the lowest bidder for a Rs 81.22 crore order from the South Central Railway. The project entails building an automatic block signalling system in Balharshah-Makudi section of Secunderabad Division of the railway.