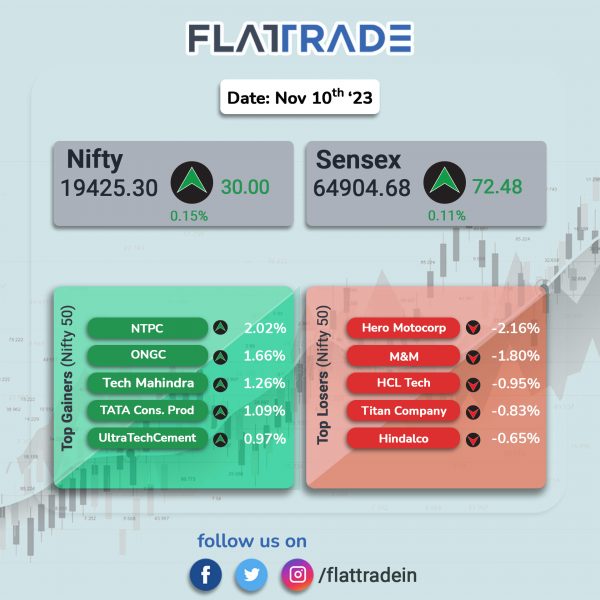

Benchmark indices closed higher with modest gains as investors bought select heavyweight stocks amid weak global cues after the Fed chair warned that the Fed won’t hesitate to hike interest rates if needed. The Sensex rose 0.11% and the Nifty gained 0.15%.

In broader markets, the Nifty Midcap 100 rose 0.48% and the BSE Smallcap jumped 0.37%.

Top gainers were Metal [0.7%], Oil & Gas [0.6%], Bank [0.31%], PSU Bank [0.27%], and Private Bank [0.26%]. Top losers were Media [-1.23%], Auto [-0.42%], IT [-0.26%], Pharma [0.16%], and FMCG [0.18%].

The Indian rupee fell 5 paise to 83.34 against the US dollar on Friday.

Stock in News Today

Reliance Industries (RIL): The conglomerate informed that it has allotted 20,00,000 Secured, Redeemable, Non-Convertible Debentures (NCDs) of the face value of Rs 1,00,000 each totalling Rs 20,000 crore on private placement basis. The coupon rate for the 10-year bonds is 7.79% per annum payable annually. The bonds is expected to be listed on BSE and NSE.

Hindustan Aeronautics (HAL): The public sector aerospace and defence company reported a consolidated net profit of Rs 1,236.67 crore in Q2FY24 from Rs 1,221 crore in the corresponding quarter of last fiscal. Its consolidated revenue from operations rose 9.5% YoY to Rs 5,635.7 crore in the quarter under review, compared to Rs 5,144.79 crore in the year-ago period. Ebitda fell 5.8% YoY to Rs 1527.7 crore in the quarter under review.

The company informed that a Joint Venture company with Safran Helicopter Engines SAS by name ‘SAFHAL HELICOPTER ENGINES PRIVATE LIMITED’ has been incorporated, to carry out business of design, development, certification, production, sale & support of helicopter engines. Initially, the JV company will manufacture engine for Indian Multi Role Helicopter (IMRH) & Deck Based Multi Role Helicopter (DBMRH) projects.

Further, the company inked a contract with Airbus for the establishment of Maintenance, Repair, and Overhaul (MRO) facilities dedicated to the A-320 aircraft. Under the agreement, Airbus will provide the A320 family tool package and offer specialised consulting services to HAL to set up an MRO. It will also offer HAL access to AirbusWorld, a digital platform that offers support, technical data and training solutions.

Bajaj Finance: The company’s board approved the issue and allotment of 12,104,539 equity shares of face value Rs 2 each to eligible qualified institutional buyers at the issue price of Rs 7,270 per equity share. The aggregate amount was Rs 8800 crore and the issue price of the QIP was at a 3.5% discount to the floor price of Rs 7,533.81 per share.

Hindalco Industries: The company’s consolidated revenue fell to 3.6% YoY to Rs 54,169 crore in Q2FY24 from Rs 56,176 crore in Q2FY23. Consolidated Ebitda was up 4.7% to Rs 5,612 crore in Q2FY24 from Rs 5,362 crore in Q2FY23. Consolidated net profit came in at Rs 2,196 crore in Q2FY24 as against Rs 2,205 crore in Q2FY23.

In the Aluminium (India) segment, upstream revenue was at Rs 7,878 crore and the upstream Ebitda stood at Rs 2,074 crore in Q2FY24. Downstream revenue was at Rs 2,629 crore and Downstream Ebitda jumped 16% quarter-on-quarter to Rs 171 crore. Revenue from the copper business rose 8% QoQ to Rs 12,441 crore Ebitda jumped 23% QoQ to Rs 653 crore.

Mahindra & Mahindra (M&M): The SUV manufacturer said its standalone net profit surged 67% to Rs 3,451.88 crore in Q2FY24 from Rs 2,068 crore recorded in Q2FY23. Revenue from operations increased 16.6% YoY to Rs 25,772.68 crore in the quarter under review. Ebitda grew by 24% YoY to Rs 4,397 crore in Q2FY24. During the quarter, M&M sold 2,12,078 vehicles, recording a growth of 18% YoY in Q2FY24 and total tractors sold in Q2FY24 stood at 89,101 units, down 4% YoY.

CarTrade Tech: The company’s consolidated net profit zoomed 132.44% to Rs 12.97 crore i Q2FY24 as against Rs 5.58 crore recorded in Q2FY23. Net revenue stood at Rs 147.94 crore in Q2FY24, up 44.35% from Rs 102.49 crore in Q2FY23. Adjusted Ebitda was at Rs 31.91 crore in Q2FY24, up 3.81% from Rs 30.74 crore in Q2FY23. Adjusted EBITDA margin reduced to 22% in Q2FY24 compared to 30% recorded in the corresponding quarter previous year. The company’s revenue from consumer was at Rs 45.28 crore (up 22.11% YoY) while revenue from remarketing at Rs 51.91 crore (up 1.57% YoY) in Q2FY24.

Suven Pharmaceuticals: The company’s consolidated net profit jumped 10.42% to Rs 79.56 crore in Q2FY24 as compared with Rs 72.05 crore posted in Q2FY23. Its revenue from operations stood at Rs 231.05 crore in Q2FY24, down 17% from Rs 278.40 crore in Q2FY23. Ebitda fell 1.9% to Rs 98 crore during the quarter under review from Rs 99.90 crore posted in Q2FY23. Ebitda margin improved to 42.4% in Q2FY24 compared with 35.9% in the year-ago period. Revenue from Pharma CDMO business stood at Rs 148.3 crore in Q2 FY24, up 36.81% YoY and specialty chemical CDMO business declined 63.7% YoY to Rs 55 crore in Q2FY24.

ESAF Small Finance Bank: The lender had a strong stock market debut. The company shares got listed at Rs 71 apiece on NSE as against an issue price of Rs 60, a premium of 18.33%. Shares hit a high of Rs 74.8 and low of Rs 68.55 per share. Finally, the shares closed at Rs 69.05 apiece.

Jubilant Foodworks: The company informed that the commissary at Adinarayana Hosahalli Industrial Area, Doddaballapura Taluk, Bengaluru Rural District, Karnataka, has commenced the commercial production.

Ipca Laboratories: The company consolidated revenue from operations stood at Rs 2,034 crore in Q2FY24, up 27% YoY from Rs 1,601 crore in Q2FY23. Its consolidated Ebitda rose 23.3% YoY to Rs 321.3 crore in Q2FY24 over Rs 260.6 crore in Q2FY23. Its consolidated net profit was at Rs 145.1 crore in Q2FY24 as against Rs 143.9 crore in Q2FY23.

Shyam Metalics: The company’s consolidated revenue from operations fell 4.7% to Rs 2,941 crore in Q2FY24 from Rs 3,085 crore in Q2FY23. Its consolidated Ebitda was at Rs 307 crore in Q2FY24, up 26% from Rs 244 crore in Q2FY23. Its consolidated net profit jumped to Rs 482 crore in Q2FY24 as against Rs 111 crore in Q2FY23.

NBCC India: The company’s consolidated revenue was down 1% to Rs 2,053 crore in Q2FY24 from Rs 2,074 crore in Q2FY23. Its Ebitda tumbled 27.9% to Rs 95.5 crore in Q2FY24 as against Rs 133 crore in Q2FY23. The company reported a consolidated net profit of Rs 81.9 crore, down 16.2% from Rs 97.7 crore in Q2FY23.

Rail Vikas Nigam (RVNL): The company’s consolidated revenue was up 0.1% at Rs 4,914 crore in Q2Fy24 from Rs 4,909 crore in Q2FY23. Its Ebitda fell 5.6% to Rs 298.3 crore in Q2FY24 from Rs 316 crore in Q2FY23. The company’s net profit was up 3.5% at Rs 394.4 crore in Q2FY24 from Rs 381.2 crore in Q2FY23.

Torrent Power: The company’s consolidated revenue rose 3.5% to Rs 6,961 crore in Q2FY24 from Rs 6,703 crore in Q2FY23. Its consolidated Ebitda rose 4.9% to Rs 1,221 crore in Q2FY24 from Rs 1,164 crore in Q2FY23. The company reported a consolidated net profit of Rs 543 crore, up 12.1% to Rs 484 crore in Q2FY23.

NCC: The company’s consolidated revenue from operations grew 40% to Rs 4,719.61 crore in Q2FY24 from Rs 3,373.43 crore in Q2FY23. Its consolidated Ebitda fell 2.1% to Rs 303.74 crore in Q2FY24 from Rs 310.13 crore in Q2FY23. The company’s consolidated net profit fell 37.1% to Rs 86.5 crore in Q2FY24 from Rs 137.5 crore in Q2FY23.

BEML: The state-owned company said that its consolidated revenue from operation rose 14% to Rs 917 crore in Q2FY24 from Rs 805 crore in Q2FY23. Its consolidated surged 47% to Rs 61.5 crore in Q2FY24 from Rs 41.8 crore in Q2FY23. Its consolidated net profit jumped over three times to Rs 51.8 crore in Q2FY24 from Rs 16.3 crore in Q2FY23.

Hinduja Global Solutions: The IT-enabled services company’s consolidated revenue from operations rose 4.1% to Rs 1,180 crore in Q2FY24 from Rs 1,133 crore in Q2FY23. Its consolidated Ebitda jumped 27% to Rs 97.5 crore in Q2FY24 from Rs 76.8 crore in Q2FY23. The consolidated net profit was up 10.8% at Rs 18.4 crore in Q2FY24 as against Rs 16.6 crore in Q2FY23.

Graphite India: The company said its consolidated revenue fell 3.9% to Rs 793 crore in Q2FY24 from Rs 825 crore in Q2FY23. Its consolidated Ebitda loss was at Rs 30 crore in Q2FY24 as against consolidated Ebitda of Rs 102 crore in Q2FY23. The company’s consolidated net profit soared more than nearly nine times to Rs 802 crore in Q2FY24 from Rs 92 crore in Q2FY23.