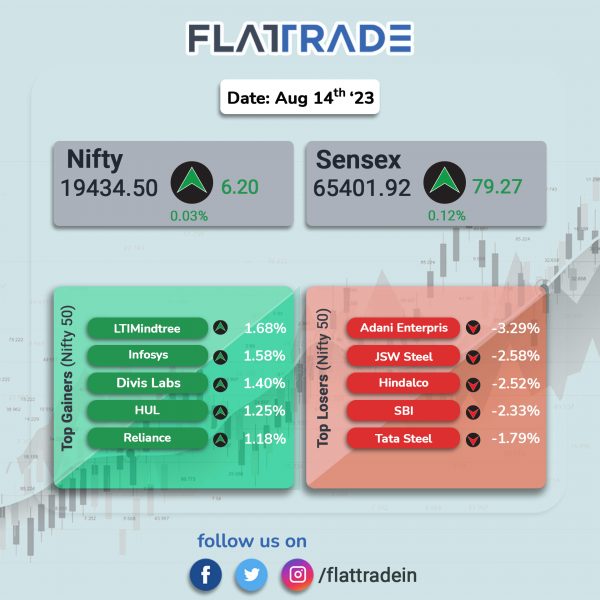

Benchmark equity indices closed marginally higher, helped by gains in IT and FMCG stocks. The Sensex closed 0.12% higher and the nifty 50 index gained 0.03%.

In broader markets, the Nifty Midcap 100 fell 0.17% and the BSE Smallcap dropped 0.5%.

Top gainers were Media [0.87%], IT [0.68%], and FMCG [0.49%]. Top losers were Metal [-2.14%], PSU Bank [-0.71%], Realty [-0.66%], Healthcare [-0.42%], and Consumer Durables [-0.41%].

The Indian rupee fell 10 paise to 82.95 against the US dollar on Monday.

India’s inflation based on wholesale price index (WPI) came in at (-)1.36% in July as against (-)4.12% in June on account of the rising food prices, according to the data released by the central government. The WPI inflation stood at (-)3.48% per cent in May. Meanwhile, CPI inflation data is expected to be released later in the evening on August 14, 2023.

Stock in News Today

Adani Group: The stock market regulator Securities and Exchange Board of India (SEBI) filed an application with the Supreme Court requesting for 15 more days to submit a report on the Adani-Hindenburg Case. SEBI told the apex court that it has completed investigating 17 out of the 24 transactions it had taken up for probe.

Larsen & Toubro (L&T): The company said that its Buildings & Factories (B&F) business of L&T Construction has recently secured ‘significant’ orders in India and Bangladesh. As per L&T’s classification, the value of the said contract lies between Rs 1,000 crore to Rs 2,500 crore. The orders include construction of a cricket stadium at Varanasi, Uttar Pradesh, on a turnkey basis, and construction of Hi-Tech IT Parks at four locations across Bangladesh.

Divi’s Laboratories: The company’s consolidated revenue dropped 21% to Rs 1,778 crore in Q1F24 from Rs 2,255 crore in Q1FY23. Consolidated net profit was down 49% to Rs 356 crore in Q1FY24 from Rs 702 crore in Q1FY23. Consolidated Ebitda fell 41% to Rs 504 crore in Q1FY24 as against Rs 848 crore in Q1FY23.

Spicejet: The carrier reported a standalone net profit of Rs 204.56 crore in Q1FY24 as against a net loss of Rs 788.83 crore in Q1FY23. The company’s standalone revenue from operations declined 18.5% to Rs 2,001.74 in Q1FY24 from Rs 2,456.76 crore in Q1FY23. Its standalone EBITDA in Q1FY24 stood at Rs 525 crore as against an EBITDA loss of Rs 393 crore in Q1FY23.

Adani Ports and SEZ (APSEZ): The company said that Deloitte Haskins has resigned as the statutory auditor of the company, citing differences of opinion. APSEZ further said that the resignation of its statutory auditor, Deloitte Haskins & Sells. Deloitte cited a lack of a wider audit role as auditors of other listed Adani portfolio companies as the reason for its decision.

Power Finance Corporation (PFC): The company said that its board has approved the issue of bonus shares to the shareholders in the ratio of 1:4, i.e. one bonus equity share for every four existing equity shares held by its shareholders as on record date. PFC has recorded a 31% rise in consolidated profit after tax at Rs 5,982 crore in Q1FY24 compared with Rs 4,580 crore in Q1FY23. The company’s total income rose by 13% YoY to Rs 21,001 crore during the quarter under review. Net NPA stood at 1% in Q1FY24 as against 1.57% in Q1FY23.

Sun TV Network: The company’s net profit increased by 18.53% YoY to Rs 582.80 crore in Q1FY24 and revenue rose 10.38% YoY to Rs 1,317.78 crore in the reported quarter. Its EBITDA was up 2.96% at Rs.786.46 crore in Q1FY24 from Rs 763.83 crore in Q1FY23. The company’s advertisement revenue aggregated to Rs 339.10 crore, down 1.19% YoY, and domestic subscription revenue stood at Rs 435.34 crore, up 6.02% YoY during the period under review. The company’s board has approved an interim dividend of Rs 6.25 per share for FY24.

Ramkrishna Forgings: The company announced that it has secured a business contract worth $13.65 million per year for supplying rear axle and transmission components. The awarded contract pertains to the production and supply of rear axle and transmission components for Class 5, 6, and 7 vehicles. With this, the company is strategically expanding its footprint in North America to strengthen its position within the light vehicle sector.

Lupin: The USFDA has completed the GMP inspection of the company’s Unit-2 manufacturing facility in Mandideep, India, without any observations. The inspection by the USFDA was conducted from August 7 to August 11.

Voltas: The leading air-conditioning company has recorded a consolidated net profit of Rs 129.4 crore for June FY24 quarter, rising 18.2% from the year-ago period. Revenue from operations for the quarter under review rose 21.4% YoY to Rs 3,360 crore. EBITDA increased 4.8% YoY to Rs 185.4 crore in Q1FY24, but margin dropped 90 bps to 5.5% over last year. The company said unitary cooling products and electro-mechanical projects & services segments rose 16.3% and 49.3%, respectively.

ABB India: The company has posted a 101% YoY rise in profit at Rs 296 crore for quarter ended June 2023. Revenue during the quarter grew by 22% YoY to Rs 2,509 crore on the back of superior revenue mix and capacity utilization. Orders for the quarter stood at Rs 3,044 crore, up 10% YoY. Meanwhile, the company’s board has approved a special dividend of Rs 5.5 per share.

Rail Vikas Nigam (RVNL): The state-owned railway company has posted a consolidated net profit of Rs 343 crore in Q1FY24, up 15.3% YoY, helped by strong sales. Revenue from operations jumped 20% YoY to Rs 5,571.6 crore during the same period.

Finolex Cables: The cables manufacturer has recorded a 34.1% YoY in consolidated net profit at Rs 160.4 crore in Q1FY24, driven by improved turnover. Revenue for the quarter stood at Rs 1,204.3 crore, a rise of 18.6% over the year-ago period.

Surya Roshni: The company said it has bagged orders worth Rs 171.16 crore from BPCL and HPCL. BPCL has given orders worth Rs 163 crore for CGD project on pan India basis, and HPCL has allotted orders worth Rs 8.16 crore for supply of 3LPE coated line pipe also for CGD project in West Bengal.

Uno Minda: The company has commissioned its new electric vehicle (EV) systems plant under subsidiary Uno Minda Buehler Motor (UMBM) in Bawal, Haryana. The plant will manufacture traction motors/ BLDC motors for EV 2-wheeler and 3-wheeler. UMBM has already received orders from OEMs and is expected to start supplies by the third quarter of the current fiscal.

GE Power India: The company has received an order from Steag Energy Services India, for renovation & modernization of Unit -3 boiler of 4X600 MW thermal power plant of Vedanta at Jharsuguda in Odisha. The order will be executed within 10 months.

Amara Raja Batteries: The battery manufacturer has recorded a consolidated net profit of Rs 192 crore in Q1FY24, up 45.5% over a year-ago period. Revenue from operations rose by 6.7% YoY to Rs 2,795.5 crore, aided by healthy volume growth registered in the automotive after-market as well as from the telecom and UPS segments.

Timken India: The ball and roller bearing manufacturing company has reported a net profit of Rs 90.1 crore in Q1FY24 for quarter ended June FY24, down 23.6% compared to corresponding quarter of previous fiscal, impacted by weak operating performance and tepid growth in topline. Revenue from operations during the quarter at Rs 717.6 crore increased by 2.6% over a year-ago period. The company will shut its Jamshedpur plant during August 25 and September 3 due to low demand and better demand planning for production efficiency.

NMDC: The state-run iron ore company has recorded a net profit of Rs 1,650 crore in Q1FY24, a 12% growth over corresponding quarter of FY23. Revenue from operations during the quarter grew by 13% YoY to Rs 5,395 crore, but average sales realisation fell by 20% to Rs 4,850 per tonne during the same period.

Jindal Steel & Power: The company has registered consolidated profit of Rs 1,691.8 crore in Q1FY24, down 15% from the corresponding period last fiscal. Revenue from operations for the quarter came in at Rs 12,588.3 crore, declining 3.5% on-year.

Muthoot Finance: The gold loan financing company has reported a standalone net profit of Rs 975 crore in Q1FY24, a jump of 22% over the same period last fiscal. Total revenue grew by 21% YoY to Rs 3,026 crore during the same period. The company has received board approval for infusion of Rs 400 crore in its subsidiary – Muthoot Money.

City Union Bank (CUB): Tamil Nadu-based private sector lender has recorded a net profit of Rs 227 crore for quarter ended June FY24, rising 1% over a year-ago period. The company said that higher provisions and contingencies weighed on profitability. Net interest income dropped to Rs 523 crore in Q1FY24, from Rs 525 crore in Q1FY23. Net NPA jumped 15 bps QoQ to 2.51% in Q1FY24.

Indian Railway Finance Corporation (IRFC): The company’s net profit declined 6.32% to Rs 1,556.57 crore in Q1FY24 compared with Rs 1,661.58 crore in Q1FY23. Total revenue from operations rose 18.69% YoY to Rs 6,679.17 crore in Q1FY24. Total expenses jumped 29.21% YoY to Rs 5,124.45 crore in Q1FY24 compared with Rs 3,965.88 crore in Q1FY23.

AstraZeneca Pharma: The company’s consolidated revenue was up 27.17% YoY at Rs 295.46 crore in Q1FY24 as against Rs 232.33 crore in Q1FY23. Consolidated net profit rose 167.29% to Rs 53.86 crore in Q1FY24 as against Rs 20.15 crore in Q1FY23. Ebitda was up 1.4% at Rs 67.23 crore in Q1FY24 as against Rs 27.96 crore in Q1FY23.