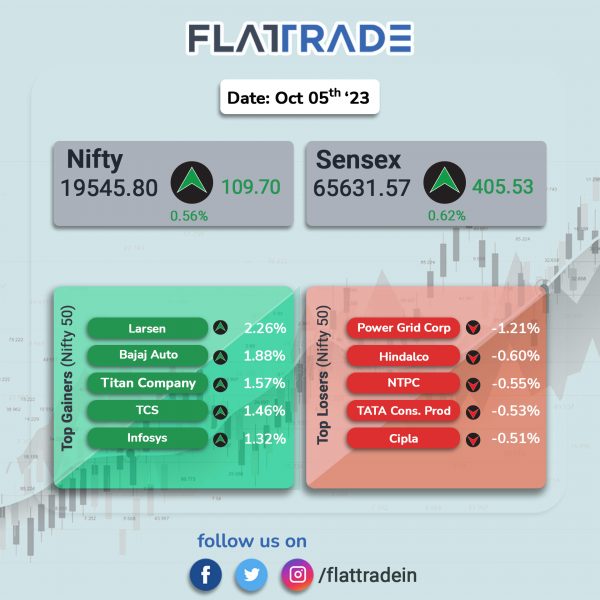

Benchmark equity indices closed higher as investors awaited the RBI’s monetary policy decision on Friday amid cooling international crude oil prices. The Sensex jumped 0.62% and the Nifty gained 0.56%.

In broader markets, the BSE Smallcap climbed 0.59% and the Nifty Midcap index closed flat.

Top gainers were Media [1.58%], IT [0.99%], Auto [0.85%], Bank [0.57%], Financial Services [0.51%]. Top losers were PSU Bank [-0.51%], Pharma [-0.3%], Metal [-0.25%], Energy [-0.19%], and FMCG [-0.1%].

The Indian rupee ended at 83.25 against the US dollar on Thursday as against its previous close of 83.24.

The seasonally adjusted S&P Global India Services PMI Business Activity Index stood at 61 in September compared with 60.1 in August. A reading above 50 indicates expansion of the sector, while a reading below 50 indicates contraction. The Composite PMI Output Index rose from 60.9 in August to 61 in September.

Stock in News Today

Bajaj Finance: The NBFC, in an exchange filing, said that its board has approved fundraising Rs 8,800 crore via Qualified Institutions Placement (QIP). The company’s board has also approved raising funds up to Rs 1,200 crore via warrants. The company will be seeking approval of the shareholders for the proposed QIP and warrants by convening an Extra Ordinary General Meeting.

Larsen & Toubro (L&T): The engineering conglomerate said its buildings and factories division has secured various orders in the large category. According to the company’s project classification, the value of the orders ranges between Rs 2500 crore to Rs 5000 crore. The business has secured an order to construct a residential township in Bengaluru and commercial towers in Hyderabad. The business has also bagged an order from the Indian Institute of Technology, Kanpur to construct a Super Specialty Hospital & Academic Block as part of the Gangwal School of Medical Sciences and Technology.

Hindalco Industries: The company has entered into a Memorandum of Understanding (MoU) with Odisha Mining Corporation for long-term supply of Bauxite ore for its proposed 2-million tonne alumina refinery and 150-MW captive power plant at Kansariguda in the Rayagada District. The total proposed investment of Rs 8,000 crore, which will be in two phases. The first phase of 1 million tonne is expected to be commissioned in FY27, at an investment of Rs 5,500 crore.

Tata Consultancy Services (TCS): The IT services company has been selected by the Georgia Department of Labor (GDOL) to replace its 1980s-era legacy platform with a proven, agile, secure, and scalable cloud-based unemployment insurance system that streamlines the claims process and ensures that eligible individuals receive prompt financial assistance and support.

Tata Elxsi: The technology services company announced a joint development of an automotive cyber security solution together with the Indian Institute of Science (IISc) under the framework of existing Memorandum of Understanding (MoU). The partnership aims to address the challenges in cybersecurity presented by complex in-vehicle networks of sensors and numerous advancements in software that define the modern driving experience.

NHPC: The state-owned company announced that the Teesta-V Power Station (510 MW) and Teesta-VI HE Project (500 MW) situated in Teesta Basin were affected due to flash flood in Sikkim. The company also informed that considering the emergent situation, all units of Teesta-V Power Station have been shut-down. The company said that the assets and loss of profit of the power station is fully insured under mega Insurance policy and a detailed assessment of losses/ damages suffered will be carried out after water level recedes.

Sobha: The realty company said that its total sales jumped 48.1% to Rs 1,723.8 crore in Q2FY24 from Rs 1,164.2 crore in Q2FY23. Total sales volume stood at 16.86 lakh square feet (sft) in Q2FY24, a rise of 26.13% from 13.36 lakh square feet recorded in Q2FY23. Average Price realization was at Rs. 10,223 per sft, 17.4% rise in Q2FY24 from Rs 8,709 crore in Q2FY23.

Piramal Enterprises: The company announced that Vikram Bector who was the President and Group Chief Human Resources Officer and a Senior Management Personnel of the company, has ceased to be an employee with effect from the closing hours of 29 September 2023. Further, Manjul Tilak designated as Chief Human Resources Officer, Financial Services, shall form part of the Senior Management Personnel (SMP) of the company with effect from October 1, 2023.

Havells India: The company has unveils Dual Mode Micro Inverter (DMMI) equipped with MPPT-based solar charge controller. The DMMI is backed by four US patents and is equipped with an MPPT-based solar charge controller, which efficiently converts DC current from solar panels into AC current.

Macrotech Developers (Lodha): In an exchange filing, the realty company said it has achieved its best ever quarterly pre-sales performance of Rs 35.3 billion in Q2FY24. With this company has achieved 48% of its FY24 pre-sales guidance despite no new locations being launched in the first half of the fiscal. Collections were Rs 27.5 billion for Q2FY24, up 16% from Rs 23.8 crore in the year-ago period. The company’s net debt declined to Rs 67.3 billion during Q2FY24 from Rs 88 billion in Q2FY23.

Poonawalla Fincorp: The company said that its total disbursements during Q2FY24 stood at about Rs 7750 crore, up 149% YoY and 10% QoQ compared to disbursements of Rs 3,110 crore in Q2FY23. Assets Under Management (AUM) grew by 53% YoY to approximately Rs 20,110 crore as on 30 September 2023. The company continues to have ample liquidity of approximately Rs 3800 crore as of end of September 2023.

Cholamandalam Investment And Finance: The financial services company plans to raise approximately Rs 4,000 crore through QIP and CCDs. The company will issue 16,949,152 equity shares at an equity issue price of Rs 1,180 and 2,00,000 CCDs (compulsorily convertible debentures) at an issue price of Rs 100,000 per CCD.

Equitas Small Finance Bank: The company said that its gross advances surged 37% to Rs 31,231 crore as on 30 September 2023 as against Rs 22,779 crore as on 30 September 2022. Total deposits grew 42% YoY to Rs 30,839 crore in Q2FY24, while CASA deposits fell 1% YoY Rs 10,349 crore. CASA ratio stood at 34% in the quarter ended September 2023 as compared to 48% in the same period last fiscal.

CSB Bank: The Kerala-based old private sector bank said its total deposits rose 21% YoY to Rs 25,438.38 crore in Q2FY24 from Rs 20,986.61 crore posted in corresponding quarter last year. CASA deposits stood at Rs 7,443.97 crore as on 30 September 2023, up 3.49% from Rs 7,192.81 crore in the year-ago period. The bank’s gross advances increased 27.22% to Rs 22,468.40 crore in Q2FY24 compared with Rs 17,661.02 crore in Q2FY23.

OnMobile Global: The company has partnered with Robi, Bangladesh’s fastest 4.5G network, to launch its casual mobile gaming product, Challenges Arena. The gaming product promises to boost engagement and ensure customer retention, marking a significant milestone in Robi Telecom’s journey to provide top-notch services to its customers.