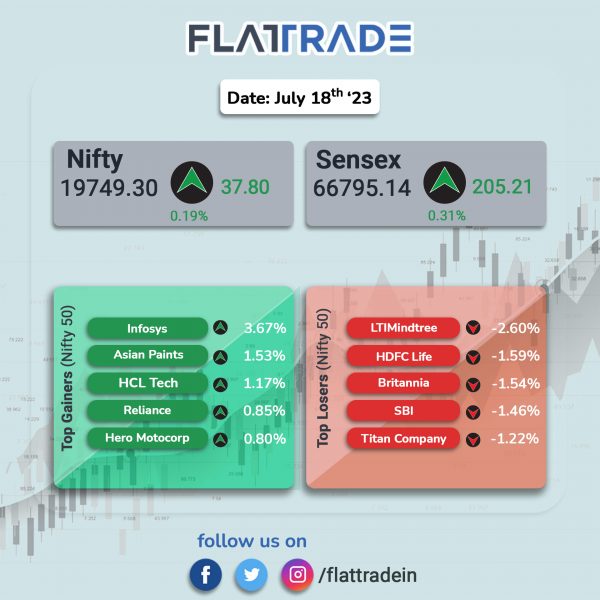

Sensex, Nifty extended gains on sustained foreign inflows amid positive global cues as well as rally is select index heavyweights. The Sensex rose 0.31% and the Nifty 50 index gained 0.19%.

In broader markets, the Nifty Midcap 100 index slipped 0.14% and the Nifty Smallcap 250 index dropped 0.72%.

Top gainers among Nifty sectoral indices were IT [1.06%], Energy [0.36%], Oil & Gas [0.17%]. Top losers were Media [-1.84%], PSU Bank [-1.23%], Realty [-0.85%], Metal [-0.83%], and Healthcare [-0.40%].

Indian rupee strengthened by 3 paise to 82.03 against the US dollar on Tuesday.

Stock in News Today

ICICI Prudential Life Insurance: The company has reported a 33% year-on-year rise in its standalone net profit at Rs 207 crore in Q1FY24 as against a profit of Rs 156 crore in the year-ago period. Its net premium income increased marginally year over year (YoY) by 2% to Rs 7,020 crore in the reported quarter from Rs 6,884 crore. In an exchange filing, the company stated that the Value of New Business (VNB), which represents the current value of future profits, was Rs 438 crore for Q1-FY2024 with a VNB margin of 30.0%.

Federal Bank: The private sector lender announced that the board of directors of Fedbank Financial Services (FedFina), a subsidiary of the bank, has proposed an initial public offering (IPO), following consents from its shareholders. The IPO will be undertaken by way of fresh issue and offer for sale, subject to market conditions, receipt of applicable approvals including that of Securities and Exchange Board of India (SEBI) and other considerations.

Hathway Cable & Datacom: The cable TV and internet provider has reported a 6.73% rise in consolidated net profit at Rs 22.36 crore in Q1FY24 as against Rs 20.95 crore posted in Q1FY23. Revenue from operations grew by 11.64% year-on-year to Rs 499.23 crore in the quarter ended June 2023. The company’s revenue from broadband business was at Rs 156.76 crore, down 0.26% YoY, while the cable television segment stood at Rs 342.47 crore, up 18.09% YoY, during the reported quarter.

HeidelbergCement India: The company’s net profit rose 1.4% year-on-year (YoY) to Rs 52.32 crore in the April-June 2023 quarter compared with Rs 51.60 crore in the same quarter last year. Revenue for the quarter rose 1% YoY to Rs 595.60 crore from Rs 589.90 crore. Ebitda for the quarter stood at Rs 92.60 crore against Rs 95.10 crore YoY, with Ebitda margin falling to 15.6% from 16.1%, down 52 basis points.

Godrej Agrovet: The company said that it has been allotted about 47,000 acres in Sangareddy district of Telangana, by the Department of Agriculture and Cooperation, Government of Telangana. The allotted area will be utilised by the company to expand cultivation of Oil Palm and to set up Oil Palm processing units.

Shriram Finance: The company said that the outstanding principal amount of $248,169,000 of 5.1% fixed rate senior secured notes has been fully redeemed. The redemption amount, together with interest was $25,44,97,309.50. The aforementioned notes had a tenure of 3 years and 6 months and had matured on 14 July 2023. The said notes were issued under the $3,500,000,000 Global Medium Term Note Programme (GMTN Programme) of the company.

Ganesh Housing Corp.: The company’s net profit jumped multifold times to Rs 161.3 crore in Q1FY24 as against Rs 13 crore in the year-ago period. Its revenue jumped to Rs 270.4 crore in Q1FY24 from Rs 42.5 crore Q1FY23. EBITDA rose to Rs 215 crore in the reported quarter from Rs 24.9 crore in the corresponding quarter last fiscal.

Havells India: Shares of electrical equipment and appliances maker surged over 5% after investment firm UBS projected a potential upside of up to 46% to the stock on expected revival in structural growth. UBS upgraded the company rating to ‘buy’ from its earlier rating ‘neutral’ and also raised its target price to Rs 1,900 per share, from Rs 1,360 earlier. The investment firm cited sustained revenue share gains, higher share of premium products and a turnaround at Lloyd is likely to help Havells move up the growth and profitability curve.

Rama Steel Tubes (RSTL): The company has entered into an MoU with JSW Steel for procurement of Hot Rolled Coils (HRC) used in manufacturing of RSTL’s steel tubes and pipes, distribution of HRCs produced by JSW Steel in the entire western region. The MoU will facilitate RSTL to procure 1,00,000 tons of HRC from JSW Steel on a pan-India basis to support its manufacturing of various steel tubes and pipes. The MoU will enable RSTL to have greater control on its procurement, supply chain while yielding competitive raw material cost.

Hindware Home Innovation: The company’s board has appointed Salil Kappoor as the chief executive officer (CEO) of the company with effect from 18 July 2023. Kappoor holds a graduate degree in B.Tech and is an MBA from Faculty of Management Studies (FMS), Delhi. He has over 30 years of experience and has served in leadership capacities in organisations such as LG Electronics, Samsung, Voltas, etc. During his latest stint, he was leading the Appliances Division at Orient Electric as the Business Unit Head.

Polycab India: The company’s consolidated net profit jumped 81.69% YoY to Rs 399.27 crore on 42.13% YoY increase in revenue from operations to Rs 3,889.38 crore in Q1FY24 over Q1FY23. EBITDA jumped 77% YoY to Rs 548.6 crore in Q4FY23 and EBITDA margin improved around 280 bps YoY to 14.1% driven by judicious price revisions, better operating leverage and favourable business mix.