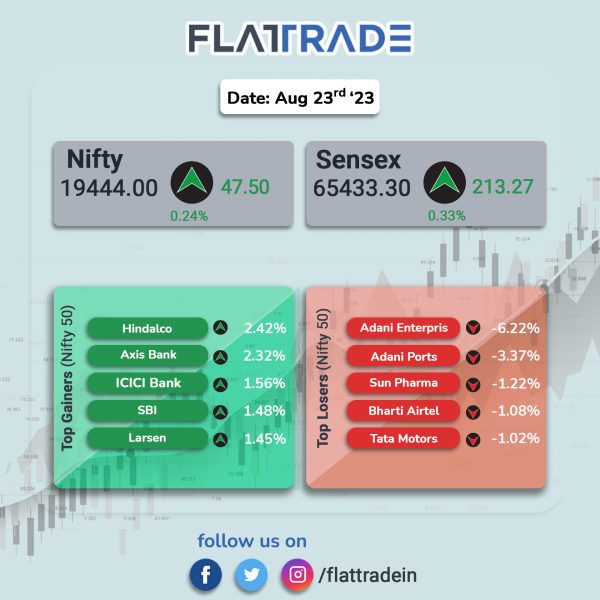

Benchmark stock indices closed higher, aided by gains in banking and financial services stocks. The Sensex rose 0.33% and the Nifty advanced 0.25%.

In broader markets, the Nifty Midcap 100 rose 0.39% and the BSE Smallcap jumped 0.6%.

Top gainers were PSU Bank [1.72%], Private Bank [1.26%], Bank [1.1%], Media [0.68%], and Realty [0.43%]. Top losers were Energy [-0.57%], FMCG [-0.49%], Oil & Gas [-0.31%], Metal [-0.13%], and Pharma [-0.13%].

The Indian rupee appreciated by 25 paise to 82.69 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): The company announced that its construction arm has secured new large orders for its power transmission & distribution business from UAE, Kuwait, Qatar and Saudi Arabia. As per L&T’ classification, the value of the ‘Large’ project is Rs 2,500 crore to Rs 5,000 crore.

Hindalco Industries: The company said that it plans to invest Rs 2,000 crore in a copper and e-waste recycling facility in India. Further, the company also plans to invest another Rs 2,000 crore in a project with Indian Railways for the Vande Bharat trains. The company is also looking at scaling up electric vehicle manufacturing in India, as the company is working closely with original equipment manufacturers (OEMs) to co-develop and manufacture critical components. Shares of the company closed 2.42% higher.

Tata Communications: The company’s Financial Resource Raising Committee has finalized the issue of non-convertible debentures (NCDs) worth Rs 1,750 crore. The company will issue 1,75,000 rated, unsecured, redeemable, listed NCDs with a face value of Rs 1 Lakh on private placement basis. The said debentures will be allotted on 29 August 2023 and will mature after three years from date of allotment. The NCDs are proposed to be listed on the wholesale debt market segment of the National Stock Exchange of India (NSE).

Meanwhile, the company has launched its cloud-based 5G roaming laboratory, which will enable mobile network operators to conduct trials of 5G standalone network use cases before introducing the service to their subscribers. The company said that it will harness the potential of 5G to help reimagine mobility experiences for mobile network operators.

NBCC: The company has sold its commercial space in the World Trade Centre, New Delhi for Rs 821 crore. The total area of the commercial space is 1.98 lakh square feet and 1.23 lakh square feet area having a sale value of 582 crore has been sold to private entities.

Spicejet: The airline company and its promoter Ajay Singh approached the Delhi High Court challenging a single-judge order which upheld an arbitral award asking them to refund Rs 579 crore plus interest to Kalanithi Maran. The appeals came up before a division bench of Justices Yashwant Varma and Dharmesh Sharma which initially listed it for hearing on September 15 as the counsel for Spicejet and Singh were not present.

Shriram Properties: The company and ASK Property Fund have announced a joint investment of Rs 206 crore in a residential project in Chennai. The company said the total saleable area is 1.9 million square feet and has an aggregate revenue potential of Rs.1,200 crores in next 5 years. The project comprises of about 1,900 residential units, predominantly targeting the mid-income group.

Rattanindia Enterprises: The company has appointed Ashok Kumar Sharma as CFO of the company with effect from August 24, 2023. Vinu Balwant Saini has resigned as CFO with effect from August 23, 2023.

KPR Mill: The company said in an exchange filing that the US fund house Fidelity has acquired over 1% stake in the company in the past week.

JB Chemicals And Pharmaceuticals: The company has received the USFDA approval For Doxepin Hydrochloride tablets, which is used to treat psychoneurosis symptoms.

TVS Supply Chain Solutions: The company shares got listed at Rs 207.05 apiece on NSE as against an issue price of Rs 197, up 5.10%. Shares hit a high of Rs 208.6 in intraday trade on the NSE, but closed at Rs 201 apiece.

Sealmatic India: The company has opened a sales & service center in Pune, Maharashtra. The service center aims to support customers in various industries, including OEM, oil & gas, petrochemical, power generation, and mining. It will provide local expertise in application engineering, troubleshooting, failure analysis, and other services. Further, the center will act as a regional hub for supporting sales for OEMs in India and other strategic countries in Asia.

Hinduja Global Solutions (HGS): The company said that it has forayed into the fast-growing enterprise solutions segment in India, leveraging its expertise in technology and domain knowledge gained through its B2C business. The new brand – CelerityX offers a portfolio of bespoke digital solutions for enterprise customers of any scale or strength.