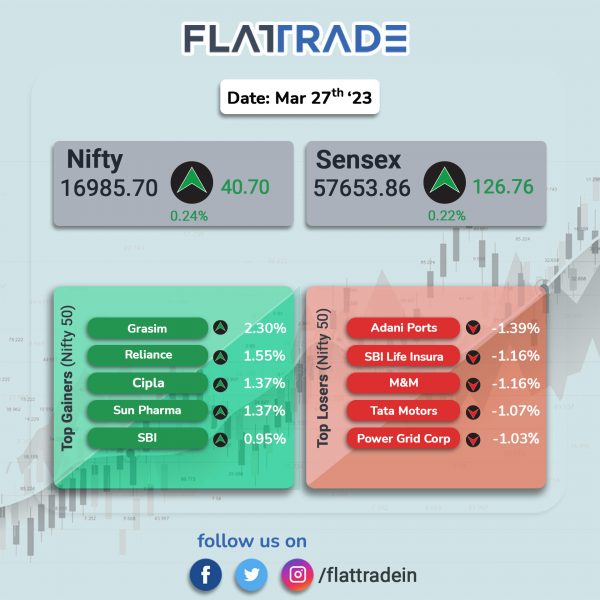

Benchmark equity indices closed higher, aided by gains in index heavyweights such as RIL, SBI, Kotak Mahindra Bank, etc. The Sensex gained 0.22% and the Nifty rose 0.24%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index fell 0.47%, while BSE Smallcap tanked 1.5%.

Top gainers among Nifty sectoral indices were Pharma [1.08%], FMCG [0.28%], and PSU Bank [0.26%]. Top losers were Realty [-1.16%], Auto [-0.65%], Energy [-0.44%], and Private Bank [-0.17%].

Indian rupee strengthened by 11 paise to 82.37 against the US dollar on Monday.

Stock in News Today

Housing Development Finance Corporation (HDFC): The NBFC announced that its board has approved issuance of non-convertible debentures (NCDs) aggregating Rs 57,000 crore, in various tranches, on a private placement basis. The board also announced an increase in the overall borrowing powers of the corporation from Rs. 6-lakh-crore to Rs. 6.50-lakh-crore

Larsen & Toubro (L&T): The infrastructure conglomerate announced that its Power Transmission & Distribution business has secured ‘large’ orders in India and overseas. As per L&T classification, the value of the large project is Rs 2,500 crore to Rs 5,000 crore. The order includes a major transmission system expansion works to integrate renewable energy (RE) projects in RE potential zones in Gujarat and to evacuate power from solar energy zones in Rajasthan, the company said.

RattanIndia Enterprises: The company’s subsidiary, Revolt Motors, announced opening of 15 new dealerships across the country for its AI enabled electric motorcycle RV400. The company has also started taking booking for these 15 new dealerships, according to its regulatory filing.

Arvind SmartSpaces: The company announced that it has sold out the entire inventory of second phase of its residential plotted development project, Arvind Greatlands in Devanahalli, Bengaluru, within 7 hours of launch. The inventory consisted of more than 150 units valued at more than Rs 100 crore.

J Kumar Infraprojects: The company said that its joint venture (JV), J Kumar – MEPL received letter of acceptance (LoA) from Brihanmumbai Municipal Corporation (BMC) to construct sewer tunnel. The total cost of project is Rs 515.26 crore. J Kumar Infraprojects’ share in the contract is 60% or Rs 309.15 crore. The project shall be executed within 42 months from the date of commencement of work.

Manappuram Finance: The company said that is considering various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore / offshore securities market by public issue, on private placement basis or through issuing commercial papers. The company’s board may consider and approve issuances of debt securities during the month of April 2023, based on the prevailing market conditions.

ISGEC Heavy Engineering: The company received order worth Rs 197.25 crore from Maharashtra State Power Generation (MAHAGENCO) for renovation of electrostatic precipitators (ESPs) at Chandrapur thermal power, Maharashtra. The scope of the project includes complete design, engineering, supply, assembly, erection, commissioning and performance guarantee testing for ESP retrofitting/upgradation of 2×500 MW units of Chandrapur U-5&6 thermal power station on engineering, procurement and construction (EPC) basis.

Morepen Laboratories: The company announced successful completion of US drug regulator’s inspection of API facility at Baddi in Himachal Pradesh. The facility has been cleared by the USFDA on 24th March 2023 without any adverse observation, according to its exchange filing.

Mahindra Logistics: The company and Ascendas-Firstspace will set up a new one million square feet of multi-client warehouse park in Talegaon, Pune. The entire development will be spread over three phases with the first phase of 0.5 million sq. ft. to be operational by the end of 2023-24. The facility will also host MLL’s first Automation Technology Centre that focuses on development and deployment of automation technologies on artificial intelligence, internet of things (IoT), robotics & automation, ARVR, AGVs, and block-chain.

Lupin: The company has received tentative approval from the USFDA for the generic version of Valbenazine Capsules, know as, Ingrezza Capsules of Neurocrine Biosciences. The inspection was conducted from March 20 to March 24, 2023 at its Pithampur facilities.

Tilaknagar Industries: The company said that the sales of its leading brand, Courrier Napoleon Brandy have crossed the one-million cases mark for current financial year. With this development, Courrier Napoleon Brandy is the second brand from the company’s portfolio, after Mansion House Brandy, to enter the ‘Millionaire’ club. Courrier Napoleon Brandy has registered significant growth in FY 2023 and in two of its largest markets, Kerala and Puducherry, the brand has witnessed more than 40% and 88% growth, respectively.

FDC: The pharma company said that the USFDA successfully completed its inspection at its Raigad active pharmaceutical ingredients (API) facility with no observations. The USFDA conducted the inspection from March 20 to March 24.