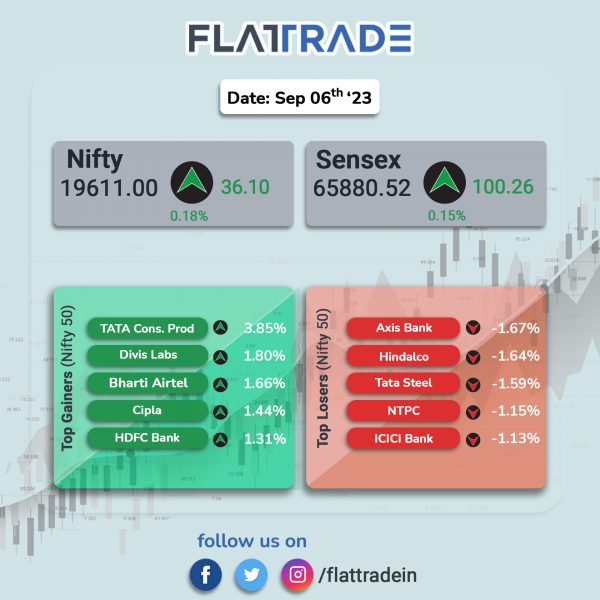

Benchmark indices closed moderately higher, aided by gains in select index heavyweights amid concerns over weakening global economic growth. The Sensex rose 0.15% and the Nifty jumped 0.18%

Broader markets underperformed headline indices. The Nifty Midcap 100 index inched up 0.08% and the BSE Smallcap fell 0.04%.

Top gainers were FMCG [1%], Pharma [0.9%], and Oil & Gas [0.77%]. Top losers were Nifty PSU Bank [-1%], Reality [-0.96%], Metal [-0.79%], Private Bank [-0.43%], Bank [-0.28%].

The Indian rupee depreciated by 9 paise to 83.14 against the US dollar on Wednesday.

Stock in News Today

Tata Steel and ABB India: Tata Steel and ABB India have signed a memorandum of understanding (MoU) and will work together to co-create innovative models and technologies to help reduce the carbon footprint of steel production. The two companies will focus on system-level assessments of the steel manufacturer’s plants and production facilities for evaluation and co-development of short and long-term options for energy efficiency, decarbonization and circularity.

Adani Total Gas: The company has announced that it has received a work order form Ahmedabad Municipal Corporation to operate a 500 tonnes per day (TPD) capacity of bio-CNG (CBG) plant located in Ahmedabad. The work order includes designing, building, financing and operating a 500 TPD capacity of bio-CNG plant. The order will be executed on a public-private partnership (PPP) model at Pirana or Gyaspur in Ahmedabad for a concession period of 20 years.

HCLTech: The company announced that it has been selected by Elders, a leading Australian agribusiness, to accelerate digital transformation across Elders’ business operations. Under the multi-year IT services partnership, HCLTech will provide managed IT services and a diverse portfolio of IT capabilities to Elders, including the ability to harness HCLTech’s AI offerings and other industry-leading opportunities.

Tata Power: The company’s subsidiary, Tata Power Renewable Energy (TPREL), has entered into a power purchase agreement with Tata Motors to develop a new 12MWp on-site solar project at latter’s Pune commercial vehicle manufacturing facility. The solar project is to be commissioned within six months after the power purchase agreement (PPA) gets signed.

Mahindra & Mahindra Financial Services (MMFS): The company said that it has executed a master agreement for co-lending with State Bank of India (SBI) for providing priority sector loans and periodical assignments of loan portfolios. MMFS shall act as the service provider and SBI as the escrow agent under the said agreement. The arrangement entails collections to be managed by MMFSL and SBI will pay certain service charges to MMFS based on a pre-agreed formula and subject to certain terms and conditions.

Best Agrolife: The company said that its wholly owned subsidiary, Seedlings India, has received a patent from the Indian Patent Office, Government of India. The company has received patent for invention entitled ‘synergistic pesticidal composition comprising pymetrozine, dinotefuran and sutiable strobilurin fungicide’ for the term of 20 years commencing from 14 February 2022.

Gensol Engineering: The company’s board approved a 2:1 bonus share issue. The company will issue two bonus equity shares for each equity share held and the bonus shares will be credited within two months from the date of approval by the board.

Syrma SGS Technology: The company has acquired a 51% stake in Johari Digital Healthcare (JDHL) for a considerations of Rs 229.5 crore. JDHL is a manufacturer of electro-medical devices, focusing on therapeutic areas such as aesthetics, diagnostics, physiotherapy, life sciences among others.

Power Grid: The company said that it has been declared a successful bidder under Tariff Based Competitive Bidding to establish Inter-State Transmission System Project in Rajasthan.

Ind-Swift Laboratories: The board has approved the slump sale of Active Pharmaceutical Ingredients and CRAMS Business of the company to Synthimed Labs at a total enterprise value of Rs 1,650 crore. The equity value of the transaction is worth Rs 850 crore, considering an approximate debt of Rs 800 crore, subject to other adjustments in accordance with the terms of the business transfer agreement (BTA).