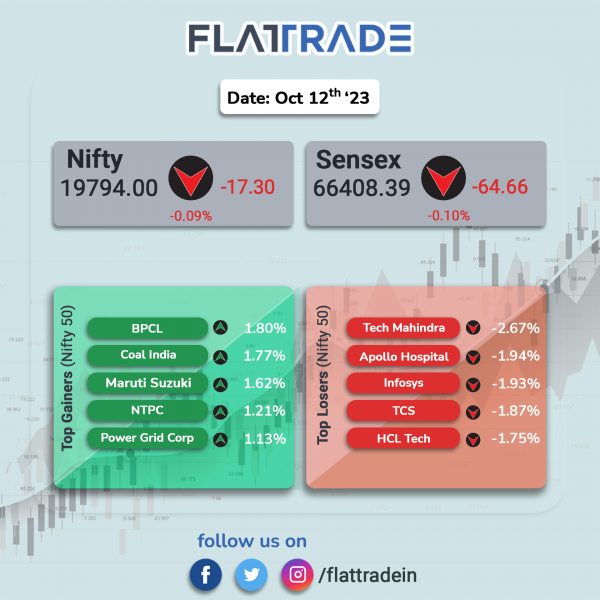

Benchmark equity indices slipped as IT stocks fell after TCS reported lower-than-expected earnings. The Sensex fell 0.09% and the Nifty 50 index dropped 0.09%.

In broader markets, the Nifty Midcap 100 index rose 0.17% and the BSE Smallcap 0.6%.

Top losers were IT [-1.67%], Realty [-0.18%], and PSU Bank [-0.09%]. Top gainers were Media [3.02%], Oil & Gas [1.11%], Auto [0.78%], Metal [0.75%], and Energy [0.64%].

The Indian rupee fell 4 paise to 8.24 against the US dollar on Thursday.

Stock in News Today

HDFC Asset Management Company (HDFC AMC): The company’s net profit grew 20.17% YoY to Rs 437.56 crore and total income rose 17.92% YoY to Rs 765.22 crore in Q2FY24. The AMC had a quarterly average assets under management of Rs 5,24,700 crore as of end of September 2023 compared to Rs 4,29,300 crore in the year-ago period.

Sula Vineyards: The wine producer announced double-digit sales growth during the second quarter and the first half of current financial year. Sula Vineyard’s own brands registered a net revenue growth of 14% YoY to Rs 116.2 crore in Q2FY24 from Rs 102 crore in the year-ago period. The wine tourism business’ net revenues rose 26% YoY to Rs 12.1 crore, and the first half of the financial year grew 19% YoY to Rs 23.6 crore.

Sterlite Technologies: The company has signed an agreement with Hygenco for sourcing of green hydrogen for its manufacturing plants. Hygenco, which is a homegrown green hydrogen solutions provider, will build-own-operate the Green Hydrogen facility for STL for 20 years.

K.P. Energy: The company has received new order from Aditya Birla Renewable Energy for development of Balance of Plant of 23.1MW wind capacity forming part of the wind-solar hybrid power project (comprising 23.1MW wind and 11MW Solar) to be connected to existing 140MW power evacuation facility at Fulsar PSS. KP Energy will be responsible for providing a range of services, including Engineering, Procurement, Construction, and Commissioning (EPCC) for the project.

Plaza Wires: Shares of the company got listed at Rs 76 apiece on NSE as against the issue price of Rs 54 at a premium of 40.74%. Shares of the company rose to a high of Rs 80.2, and closed at the same price.

Life Insurance Corporation of India (LIC): The insurer has reduced its stake in Shipping Corporation of India (SCI) from 6.032% to 3.991%. After this stake sale, LIC holds about 1.85 crore equity shares in SCI.

Mphasis: The company has been named as the Digital Consulting Partner of the International Cricket Council (ICC) ICC to deliver enhanced and innovative digital experiences for cricket fans around the world.

Lloyds Metals & Energy: The company has incorporated a new 100% wholly owned subsidiary (WOS) in the name of Lloyds Surya (LSPL). The new company will carry on the business as an energy company that offers, generates and distributes solar, wind, and hydro power as well as other renewable energy sources and offer allied activities.

JTL Industries: The company reported a 33.5% rise in consolidated net profit to Rs 29.82 crore and 37.2% increase in revenue from operations to Rs 502.10 crore in Q2FY24 over Q2FY23. Sales volume rose by 56.8% to 81,686 MT in Q2FY24 from 52,102 MT in Q2FY23. EBITDA improved by 16.4% to Rs 37.41 crore in Q2FY24 over Q2FY23. EBITDA margin in the second quarter was 7.45% as against 8.79% in the same period last year.

Antony Waste Handling Cell: The company announced the commissioning of its Waste to Energy power plant and commencement of commercial sale of power to Pimpri Chinchwad Municipal Corporation.

Crompton Greaves Consumer Electricals: The company has launched a new product – Cavelo – in the Well Glass (Industrial Lighting) category catering to the domestic market.

Aurionpro Solutions: The company has bought Omnifin, a loan management system, catering to more than 45+ banks and financial institutions in the domestic market, from A S Software Services Pvt. Ltd., a company based in Noida, India. The total deal value is about Rs 82 crore, which is to be paid in cash.