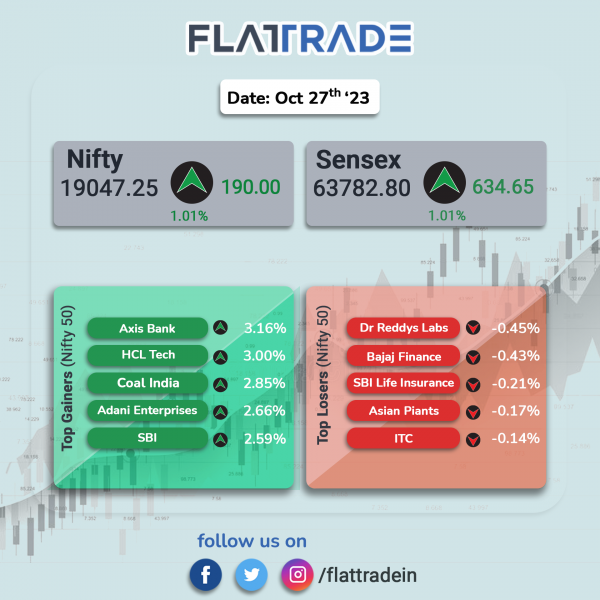

Dalal Street ended higher on positive global cues and broad-based buying across sectors. The Sensex rose 1% and the Nifty gained 1.01%.

In broader markets, the Nifty Midcap 100 soared 1.54% and the BSE Smallcap surged 1.88%.

Top gainers were PSU Bank [4.11%], Media [2.58%], Realty [1.95%], Auto [1.35%], and Oil & Gas [1.28%]. All Nifty sectoral indices closed in the green.

The Indian rupee closed at 83.24 against the US dollar on Friday.

Global brokerage firm JP Morgan has upgraded India to ‘overweight’ from ‘neutral’ earlier on account of cyclical and structural reasons. JP Morgan has recommended that investors use the near-term correction or dip as an opportunity to add stocks to their portfolio. It also noted that, historically, the Indian market has risen ahead of general elections.

Stock in News Today

Maruti Suzuki India (MSI): The company’s standalone net profit surged 80.28% to Rs 3,716.5 crore in Q2FY24 from Rs 2,061.5 crore recorded in Q2FY23. The rise in the net profit was attributed to softening of commodity prices, cost reduction efforts and higher non-operating income. Net sales grew by 24.49% YoY to Rs 35,535.1 crore during the quarter under review. The company sold a total of 552,055 units in Q2FY24, up 6.7% from 517,395 vehicles sold in the same period a year ago. The auto major’s sales in the domestic market stood at 482,731 units (up 6.28% YoY) and export market was at Rs 69,324 units (up 9.7% YoY) during the period under review.

Reliance Industries Limited (RIL): The company’s telecom arm, Reliance Jio Infocomm, announced the rollout of its JioSpaceFiber satellite broadband service during the India Mobile Congress event. The satellite broadband aims to extend high-speed internet access to previously untapped regions in India. Jio will collaborate with Luxembourg-based satellite communications company SES to tap into the latest medium earth orbit (MEO) satellite technology.

Dr Reddy’s Laboratories: The company’s consolidated net profit rose 33% YoY to Rs 1,480 crore in the July-September period. Revenue from operations in the second quarter of current fiscal increased 9% YoY to Rs 6,880 crore. Its Ebitda stood at Rs 2,181 crore in the September quarter, up 13% YoY. Ebitda margins in the reported quarter stood at 31.7%. Segment-wise, revenue from the global generics business jumped 9% year-on-year to Rs 6,110 crore, primarily driven by North America and Europe. The US sales were at Rs 3,170 crore, up 13% YoY. India sales stood at Rs 1,190 crore, up 3% YoY due to pricing and new launches.

Bajaj Finserv: The company’s consolidated net profit surged 23.89% YoY to Rs 1,928.96 crore in Q2FY24 and 25.09% YoY increase in total income to Rs 26,022.66 crore. Gross NPA stood at 0.91% in Q2FY24 as against 1.17% in the year-ago period. Net NPA was at 0.31% in Q2FY24 as against 0.44% in the year-ago period. Assets under management (AUM) in Q2FY24 was at Rs 290,264 crore compared with Rs 218,366 crore in the year-ago period.

ACC: The cement manufacturer said that its consolidated revenue was up 11% at Rs 4,434.7 crore in Q2FY24. Its Ebitda rose 33.53 times year-on-year to Rs 549.3 crore in Q2FY23. Ebitda margin stood at 12.39% in Q2FY24 as against 0.41% in Q2FY23. Consolidated net profit was Rs 387.9 crore in Q2FY24 as against a net loss of Rs 87.3 crore in Q2FY23. Power and fuel costs declined 33% YoY to Rs 886.6 crore.

SBI Life Insurance: The company’s net profit rose marginally to Rs 380 crore in the quarter ended September 2023, compared with Rs 377 crore in the year-ago period. Net premium income during the second quarter increased 22% year-on-year (YoY) to Rs 20,050 crore as against Rs 16,477 crore in the corresponding quarter of previous year. Gross Written Premium (GWP) rose 21% to Rs 33,730 crore, mainly due to 28% growth in single premium and 17% growth in renewal premium. Value of New Business (VoNB) stood at Rs 2,360 crore in the first half with 12% growth.

Ujjivan Small Finance Bank: The lender reported 11% YoY rise in net profit at Rs 328 crore and 39% YoY increase in total income at Rs 1,580 crore in Q2FY24. Net interest income (NII) of the bank jumped by 24% YoY to Rs 823 crore in Q2FY24, while Net interest margin (NIM) stood 8.8%. Gross NPA aggregated to Rs 585.80 crore as on 30 September 2023 compared with Rs 928.86 crore as on 30 September 2022. Gross NPA ratio was 2.35% in the reported quarter as against 5.06% in the year-ago period.

Indian Overseas Bank (IOB): The company reported 24.58% YoY rise in net profit at Rs 624.58 crore and 18.50% YoY jump in total income at Rs 6,935.21 crore in Q2FY24. Operating profit stood at Rs 1677.12 crore in Q2FY24, up 12.24% from Rs 1494.18 crore in the corresponding quarter last year. Net interest margin (NIM) improved to 3.12% in Q2FY24 compared to 2.79% registered in the same period a year ago. Gross NPA declined to 4.74% in the reported quarter compared to 8.53% in the year-ago period. Total deposits stood at Rs 2,73,093 crore (up 4.34% YoY), while gross advances came in at Rs 2,61,728 crore (up 9.22% YoY) in Q2FY24.

Quick Heal: The company said that it has reduced its value of investment in L7 Defense Limited, Israel, to nil. It said that L7 Defense has not been able to break even in past two quarters and has been facing severe liquidity crunch. The company stated that the current geo-political situation in Israel further casts uncertainty on the future operations of L7 Defense. Hence, it has recorded a fair value loss of Rs 12.55 crore in Other Comprehensive Income (OCI).

Suzlon Energy: The company said that it has bagged an order for the development of a 50.4 W wind power project for Juniper Green Energy Private Limited. Suzlon will install 16 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower of their new product with a rated capacity of 3.15 MW each. The project is located at Dwarka district in Gujarat and is expected to be commissioned in 2025.

Schaeffler India: The company reported a consolidated revenue of Rs 1853.6 crore during July-September 2023 quarter, up 5.53% from Rs 1,756.43 crore in the year-ago period. Consolidated Ebitda rose 6.7% to Rs 340.4 crore in the reported quarter from Rs 319.04 crore in the same period last year. Consolidated net profit rose 8.07% to Rs 232.76 crore in the quarter under review as against Rs 215.36 crore in the corresponding period last year.

Adani Energy Solutions: The company has commissioned 2500 MW Green Evacuation 400 kv system in Tamil Nadu. The company announced the successful commissioning of the Karur Transmission Ltd (KTL) project. The project includes the establishment of the 400/230 kV, 1000 MVA Karur Pooling Station and an associated transmission line spanning 8.51 circuit kilometers (CKM) in Tamil Nadu. With a transformation capacity of 1,000 MVA (megavolt-amperes), this project will facilitate the evacuation of power from renewable sources in the Karur/Tiruppur Wind Energy Zone.

Optiemus Infracom: The company’s board has accorded its approval for commencement of new business namely “Optiemus Unmanned Systems” (“OUS”) with the launch of technologically-sophisticated, high-precision drones that have been designed to get manufactured in India. The company will invest Rs 25 crore in OUS.

Shriram Finance: The company’s net profit increased 13% YoY to Rs 1,751 crore in the quarter ended September 2023 driven by strong demand for vehicle loans. The company’s NIM improved to 8.93% in the reported quarter from 8.26% in the year-ago period.

Cipla: The company posted a net profit of Rs 1,130.91 crore, up 43.3% from Rs 788.90 crore during the corresponding quarter of FY23. It posted revenue from operations at Rs 6,678.15 crore, up 14.6% as against Rs 5,828.54 crore during Q2FY23. The total income during the quarter under review was at Rs 6,854.47 crore and total expenditure during Q2FY24 stood at Rs 5,260.24 crore.

TTK Prestige: The company’s consolidated revenue fell 13.4% to Rs 729.47 crore in Q2FY24 from Rs 842.35 crore. Consolidated Ebitda fell 31.71% to Rs 80.83 crore in Q2FY24 as against Rs 118.37 crore in Q2FY23. Consolidated net profit dropped 30.12% at Rs 59.04 crore in Q2FY24 as against Rs 84.49 crore in Q2FY23.

ZF Commercial Vehicle: The company’s consolidated revenue was up 25.08% at Rs 991.69 crore in Q2FY24 as against Rs 792.83 crore in Q2FY23. Consolidated Ebitda rose 35.24% to Rs 145.47 crore in Q2FY24 from Rs 107.56 crore in Q2FY23. Consolidated net profit was up 53.96% YoY at Rs 105.68 crore in Q2FY24 from Rs 68.64 crore in Q2FY23.