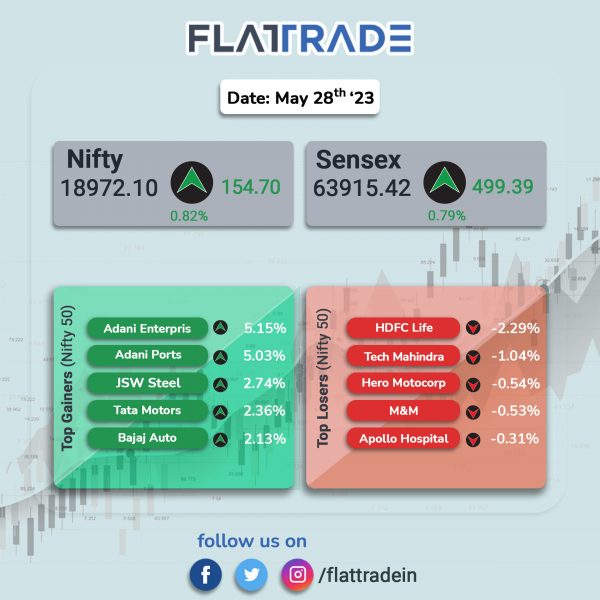

Domestic benchmark indices closed at record highs aided by strong buying across all sectors except Media. During the day, the Sensex touched a record high of 64,050.44, and the Nifty hit a high of 19,011.25 in intraday trading. However, both indices pared some gains with the Sensex closing 0.79% higher and the Nifty 50 index gaining 0.82%.

In broader markets, the nifty Midcap 100 rose 0.63% and the BSE Smallcap inched up 0.08%.

Top gainers were Pharma [1.46%], Metal [1.36%], Energy [1.11%], Oil & Gas [0.78%], and FMCG [0.57%]. Top loser was Media [-0.67%].

Indian rupee closed at 82.05 against the US dollar on Wednesday.

Stock in News Today

Adani Group: GQG, IHC and other investors bought Adani Group shares worth nearly $1 billion in today’s block deal. Top gainers among Adani Group stocks were Adani Transmission [5.15%], Adani Ports [5.03%], Adani Transmission [5.94%], and Adani Total Gas [2.03%].

BEML: The company has secured orders worth Rs 385 crore from Bharat Dynamics (BDL) and Bharat Electronics (BEL) for the supply of high mobility vehicles, according to its exchange filing.

TVS Motor: The two-wheeler manufacturer has joined hands with Zomato to accelerate last mile green deliveries. The collaboration will across strategic areas such as product, charging ecosystem, sustainability targets and digital integrations. As part of this strategic partnership, TVS Motor will deploy over 10,000 electric scooters over a course of two years.

InterGlobe Aviation (IndiGo): Shares of the carrier rose 4.17% to hit a fresh 52-week high of Rs 2635.15, taking the market capitalisation of the company past Rs 1 lakh crore. Nonetheless, the share price retreated to close at Rs 2621.10 per share, up 3.61% higher to Tuesday’s closing price.

Artefact Projects: Shares of the company rose after it bagged two project with contracted fees of Rs 9 crore. The company has been awarded two projects by the National Highway Authority of India for its consultancy services. The projects include construction of Agra Bypass of Yamuna Expressways in the district of Mathura on EPC mode, in Uttar Pradesh and construction of left out portion of Agra Inner Ring Road on EPC mode in Mathura.

Sheela Foam: Shares of the company jumped 8.65 in intraday trade after media reports stated that the company would acquire 100% stake in Kurlon Enterprise for a cash consideration of Rs 3,250 crore. The reports further stated that the acquisition will help the company to nearly double its market share to 35-40% from 20-25%.

Shalby: The company has signed an agreement with Divine Super Specialty Hospital to establish a franchise‐owned Shalby managed hospital in Ranchi. Divine Super Specialty Hospital is a leading hospital in Ranchi having capacity of 60 beds. As per the terms of the agreement, the company will provide their expertise, operational guidance, specialist doctor services, supply chain and learning & development support to facilitate the establishment and smooth functioning of the hospital.

Pearl Global Industries (PGIL): Shares of the company rallied over 7% after the company announced that it has acquired 55% stake in Pearl GT Holdco for consideration of $550,000. The acquisition is expected to be completed on or before 10 July 2023 and the acquisition will be funded through internal accruals. With this buyout, the company is exploring near shore manufacturing opportunities in the Central America region. This strategic initiative aims to add value to the company’s growth by diversifying its manufacturing capabilities and expanding its geographical reach.

Hariom Pipe Industries: The company said that it has completed installation and commencement of production of MS pipe mills, galvanised pipe mill and cold roll mill located at Mahabubnagar district. With this, the total installed capacity of MS Pipes has risen to 1,32,000 MTPA from the current 84,000 MTPA. The total installed capacity of this galvanised pipe mill is 1,20,000 MTPA.

Kamdhenu Ventures: The paint company’s board has approved a bonus issue of one equity share for every one existing equity share held by the shareholders in the company, as on the record date. The company said that the record date shall be intimated separately in due course. Further, the company’s board of directors approved increase in the authorized share capital of the company from Rs 24.55 crore to Rs 36.50 crore.