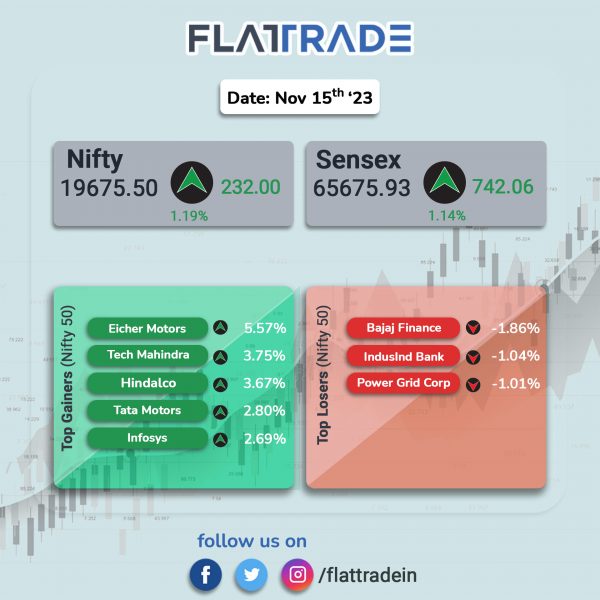

Dalal Street ended higher as investors sentiments were boosted by lower-than-expected retail inflation numbers from India and the US. The Sensex soared 1.14% and the Nifty 50 index surged 1.19%.

In broader markets, the Nifty Midcap 100 index jumped 0.96% and the BSE Smallcap gained 1.12%.

Top gainers were Realty [2.95%], IT [2.59%], Auto [1.73%], Oil & Gas [1.63%], and Metal [1.17%]. All Nifty sectoral indices closed in the green.

The Indian rupee appreciated by 20 paise to 83.14 against the US dollar on Wednesday.

Stock in News Today

ONGC: India’s oil and gas producer plans to invest about Rs 1 lakh crore in setting up two petrochemical plants to convert crude oil directly into high-value chemical products as it prepares for energy transition, PTI news agency reported citing top company officials. The company plans to raise petrochemical capacity to 8.5-9 million tonnes by 2030.

Cipla: The company said that Cipla (EU) Limited, UK and Meditab Holdings Limited, Mauritius, wholly owned subsidiaries of the company have completed the sale of entire 51.18% stake held in Cipla Quality Chemical Industries Limited (CQCIL), Uganda, for final consideration amount of $25 million. Accordingly, CQCIL has now ceased to be a subsidiary of the Company with effect from 14th November, 2023.

Siemens Ltd: Siemens AG will buy 18% stake in its Indian subsidiary, Siemens Ltd, for €2.1 billion in cash. With this purchase, Siemens AG will increase its stake to 69% and the stake will be acquired from Siemens Energy, whose stake in Siemens Ltd will reduce to 6% from 24% now. Siemens Ltd is a joint venture between Siemens Energy and its parent Siemens AG.

Gland Pharma: The company said it has received tentative approval from the United States Food and Drug Administration (USFDA) for Angiotensin II Injection, 2.5 mg/mL Single Dose Vial. Gland Pharma will launch the product with its marketing partner on receipt of final approval. The Angiotensin II Injection, 2.5 mg/mL Single Dose Vial has US sales of approximately $38 million for twelve months ending in September 2023, according to IQVIA.

Rajesh Exports: The company posted a consolidated net profit of Rs 45.3 crore profit in Q2FY24, down 88% from Rs. 373 crore in the corresponding period last year. Its revenue from operations declined 52.6% YoY to Rs.38,066 crore in Q2FY24 from 80,270 crore in Q2FY23. The company said its consolidated Ebitda fell 88% to Rs 50 crore in Q2FY24 from Rs 413 crore in Q2FY23. Shares of the company closed 8% lower after the company posted weak earnings.

Narayana Hrudayalaya: The company said its consolidated revenue from operations was up 14.3% at Rs 1,305.2 crore in Q2FY24 as against Rs 1,141.6 crore in Q2FY23. Consolidated Ebitda was up 26.4% at Rs 308.1 crore in Q2FY24 compared with Rs 243.7 crore in Q2FY23. Consolidated net profit was up 34.2% at Rs 226.7 crore in Q2FY24 as against Rs 168.9 crore in Q2FY23.

ASK Automotive: The company shares were listed at Rs 303.3 apiece on the NSE, 7.55% premium to IPO price of Rs 282. The shares hit a high of Rs 316.7 per share and closed at Rs 310.10 per share.

Knowledge Marine & Engineering Works: The company’s subsidiary, Knowledge Dredging Co. W.L.L., Bahrain, has received a Letter of Intent from Nass Corporation B.S.C. for supply and sale of Dredged Marine Sand for 3.01 Million Bahraini Dinar (approx. equivalent to Rs 66.38 crore) for a period of 5 years. The work shall commence from Q3 of FY 2023-2024.

Elegant Marbles & Grani Industries: The company’s board has approved buyback of up to 6,97,000 fully paid-up equity shares of face value of Rs 10 each at Rs 385 per share payable in cash for an aggregate buyback consideration not exceeding Rs 26 crore, which is 24.88% of the paid-up share capital and free reserves of the company. The stock trades at ₹330 on the BSE, up by 0.11%.

AIA Engineering: The company informed that the company has now subscribed additional 3,65,328 shares along with Vega ME in the ratio of 1% by the Company and 99% by Vega ME.