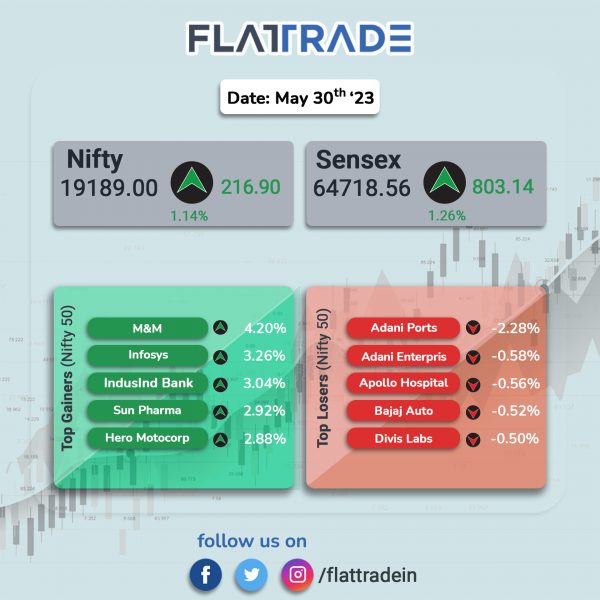

Benchmark equity indices closed at record highs owing to greater risk appetite and strong buying across sectors. The BSE Sensex touched an all-time high of 64,768.58, while Nifty50 touched a fresh high of 19,201.70 in intraday trading. The Sensex surged 1.26% and the Nifty 50 index advanced 1.14%.

In broader markets, the Nifty Midcap 100 rose 0.66% and the BSE Smallcap gained 0.515.

Top gainers were IT [2.5%], Auto [2.07%], PSU Bank [2.06%], Private Bank [1.17%], and Pharma [1.06%]. Nifty Metal index slipped 0.03%.

Indian rupee gained 3 paise to close at 82.03 against the US dollar on Friday.

Stock in News Today

Asset Management Companies (AMCs): Shares of four AMC stocks surged 8.15% to 12% after the stock market regulator Securities and Exchange Board of India (SEBI) deferred decision on overhaul in total expense ratio for mutual funds. According to media reports, Securities and Exchange Board of India (SEBI) has delayed its decision to streamline the total expense ratio (TER) for mutual funds. This comes after receiving new data from the mutual fund industry, indicating significant economies of scale.

Bharat Electronics (BEL): The company has received defence and non-defence orders worth Rs 2,191 crore. The orders include supply of long range guidance kit with warhead, airborne VHF/UHF communication jammers, battlefield surveillance radar systems, etc. With this, BEL has received orders worth Rs 8,091 crore till now in FY24.

HDFC Bank: The lender is likely to replace HDFC in the FTSE Global Equity indices but the eligibility screening will be done only in the next quarterly review in September 2023. “The eligibility screenings for HDFC Bank will be assessed in the subsequent quarterly review after the merger, including liquidity and minimum foreign headroom requirement screens as a constituent, as well as reviewing shares and Foreign Ownership Restriction attributed to the HDFC Bank,” FTSE said in a note. As a result, FTSE will continue with the current free float shares of HDFC in the indices and rename the constituent with the acquirer’s name HDFC Bank with no weight changes.

One97 Communications (Paytm): The financial services company announced its partnership with Shriram Finance for loan distribution. The company will offer its platform to Shriram Finance for merchant loans and consumer loans. Shriram Finance’s products will be made available on Paytm’s platform.

L&T Technology Services: The company has partnered with Palo Alto Networks to provide 5G and operations technology solutions to various enterprises in diverse verticals. Under the agreement, LTTS will become a Palo Alto Networks Managed Security Services Partner, delivering a suite of security services to end customers in industrial verticals. LTTS’ security solutions encompass 5G, OT and IT/OT Converged SOC services.

ABB India: The company said that it has received an order from John Cockerill India to provide electrification and automation systems for ArcelorMittal Nippon Steel India’s (AM/NS India) advanced steel cold rolling mill (CRM) in Hazira, Gujarat. ABB India will provide advanced electrification and automation systems, including the ABB Ability system 800xA distributed control system (DCS) and associated equipment and components, to support enhanced energy efficiency, optimized zinc consumption and high levels of corrosion resistance throughout the steel production process.

HDFC: The mortgage lender has acquired 36.42 lakh shares or 0.51% more stake in HDFC ergo and raised its total holding to 50.51%.

Kalpataru Projects International: The company and its international subsidiaries have secured new orders worth Rs 1,008 crore. The orders include training and development contracts of Rs 635 Crores in Indian and overseas markets and contracts for civil works of buildings in India worth Rs 373 crore.

State Bank of India (SBI): The lender has appointed four directors on the central board of the bank. Ketan Shivji Vikamsey and Mrugank Madhukar Paranjape have been re-elected. Meanwhile, Rajesh Kumar Dubey and Dharmendra Singh Shekhawat are the new members.

Reliance Capital: Shares of the company gained after its creditors approved the resolution plan of IndusInd International Holdings Ltd. for the bankrupt firm. The Hinduja Group’s unit made the highest cash offer of Rs 9,661 crore in the second round of bidding and 99% of votes were in favour of IndusInd, according to a PTI report. Reliance Capital’s cash balance of over Rs 500 crore will also go to lenders, the report stated.

Shree Cement: The company announced the commencement of trial production at its clinker grinding unit at Digha & Parbatpur in Purulia district of West Bengal with cement capacity of 3 MTPA.

Sanghi Industries: The company informed that it has resumed its operations of cement plant located at Sanghipuram, Kutch in Gujarat. Earlier, on 14 June 2023, the company announced that it has halted operations due to the cyclone Biporjoy in the Arabian Sea.

Shivam Autotech: The company’s board will meet on July 2, 2023, to consider the non-convertible debentures (NCDs) issue.The board shall issue secured, redeemable, non-convertible debentures (NCD) on a private placement basis, subject to all necessary regulatory and statutory approvals.

Krsnaa Diagnostics: The company said that it has received letter of acceptance from National Health Mission, Assam, for establishment, operation and maintenance of laboratory diagnostic centres in Assam. As per the terms of the tender, the nature of this project will be establishment, operation and maintenance of laboratory diagnostic centres for collection, transportation, analysis and reporting of laboratory samples from the Government health facilities in the Assam.

AAVAS Financiers: The company said that its board has approved the issuance of non-convertible debentures (NCDs) aggregating up to an amount of Rs 150 crore on a private placement basis. Aavas Financiers is retail, affordable housing finance company, primarily serving low and middle income self-employed customers in semi-urban and rural areas in India.

Shaily Engineering Plastics: The company announced that its chief financial officer (CFO), Ashish Somani, has tendered his resignation on June 28 due to personal reasons. Somani will be relieved from his duties effective end of business hours on August 12. He will also cease to be key managerial personnel from the same date as well. The company said that it is in the process of appointing a new CFO and the same will be communicated in due course.

AU Small Finance Bank: The company said that its board has approved to raise Rs 5,000 crore by issuing equity shares and Rs 6,000 crore by debt instruments. The bank will raise funds by issuance of equity shares for an aggregate amount not exceeding Rs 5,000 crore through private placement or qualified institutions placement (QIP) or preferential allotment or through a combination thereof or any other alternative mode.

JK Tyre Industries: The company announced the completion of the first phase of the two-phased capacity expansion of their manufacturing facility located in Banmore, Madhya Pradesh (MP). The phase one expansion involved an investment of Rs 312 crore and it will increase the annual production capacity of the plant 39 lakh to 51 lakh units per annum. JK Tyre will make an additional investment of Rs 617 crore in the second phase that will increase the capacity by an additional 31% by April 2024.

Amrutanjan Health Care: the company announced that its board has approved a share buyback of up to Rs 28.80 crore at a price not exceeding Rs 900 per equity share via tender offer route. The company has proposed to buyback up to 3.20 lakh equity shares of face value of Re 1 each, representing 1.10% of the total number of equity shares in the total paid up equity capital of the company. The company has fixed July 13 (Thursday) as the record date for the purpose of determining the entitlement and the names of the equity shareholders who shall be eligible to participate in the buyback.

Shilpa Medicare: The company’s wholly owned subsidiary, Shilpa Biologicals, has received the marketing authorization permission for its Adalimumab 40 mg/0.4mL injection in pre-filled syringe (PFS). Adalimumab Injection is used for the treatment of Rheumatoid Arthritis for which the phase 3 clinical trial has been successfully completed in Q3 2022. This formulation will contribute to increased patient comfort based on reduced injection volume.