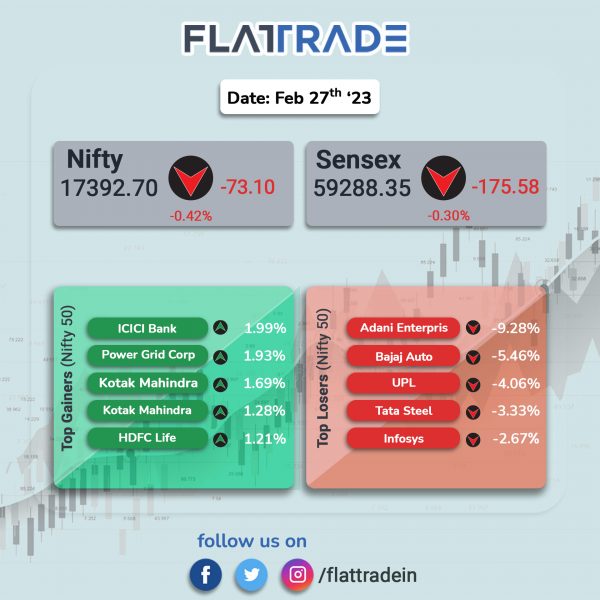

Benchmark equity indices recouped some losses but ended in the red due to negative sentiments and selling pressure in metals, IT and auto stocks. The Sensex closed 0.3% lower and the Nifty 50 index dropped 0.42%. The Nifty fell below the 200-day moving average in intraday since early October.

In broader markets, the Nifty Midcap 100 index fell 0.69% and the BSE Smallcap index tanked 1.28%.

Top losers were Media [-3.89%], Metal [-2.39%], IT [-1.95%], Auto [-1.51%], and Pharma [-0.78%]. Top gainers were Realty [2.18%], Bank [1%], Private Bank [0.86%], Financial Services [0.77%] and PSU Bank [0.73%].

Indian rupee fell 8 paise to 82.83 against the US dollar on Monday.

Stock in News Today

Dr Reddy’s Laboratories: The pharma company announced that it has entered into a definitive agreement to acquire the US generic prescription product portfolio of Australia-based Maybe Pharma Group. The portfolio includes approximately 45 commercial products, four pipeline products and 40 approved non-marketed products, including a number of generic products focused on women’s health.

Reddy’s will acquire the portfolio for an upfront payment of approximately $90 million in cash, contingent payments of up to $15 million (USD), consideration towards inventory and credits for certain accrued channel liabilities to be determined on the closing date. The closing of the transaction is subject to satisfactory completion of customary closing conditions including the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act), as amended.

Bharti Airtel: The telecom firm announced that it has crossed the 10 million unique 5G user mark on its network. Airtel was the first service provider to roll-out 5G services in the country in October 2022. Today, Airtel 5G Plus is available across all states in the country. The company is well poised to cover every town and key rural areas with Airtel 5G services by end of March 2024.

SpiceJet: The carrier’s board has approved to enter into a business transfer agreement with subsidiary SpiceXpress and Logistics (SXPL) to transfer its cargo business undertaking as a going concern on slump sale basis. Accordingly, cargo business shall be exclusively undertaken by SXPL effective 01 April 2023. The consideration for said transfer of cargo business undertaking shall be discharged by SXPL by issuance of securities in the combination of equity shares and compulsorily convertible debentures (CCDs) to the company for an aggregate amount of Rs 2,555.77 crore. This restructuring will substantially reduce the existing liabilities of the company and will help in fund raising for the business operations of the company.

Bharat Electronics Ltd. (BEL): The company has opened a new software development centre (SDC) in Visakhapatnam that will offer “Software as a Service” (SaaS) for various applications in the domains of both defence and non-defence. The SDC will be an extension of BEL’s Software Strategic Business Unit (SBU) at Bengaluru. The software division of BEL has successfully implemented many projects of national importance in the fields of defence, aerospace, e-governance, homeland security, etc., over the last many decades.

Dilip Buildcon: The company, through its joint venture, Dilip Buildcon-Skyway Infraprojects, has executed the EPC agreement with Madhya Pradesh Jal Nigam Maryadit for a project worth Rs 1,947.06 crore. The scope of the project involves engineering, procurement, construction, testing commissioning, trial run and operation and maintenance of various components of Rewa Bansagar Multi Village Scheme.

PVR: The theatre operator announced the opening of five screen multiplex at Ashoka One Mall in Hyderabad, Telangana. The five auditoriums having a seating capacity of 1274 with last row recliners are equipped with advanced laser projection for crystal-clear visuals and spectacular audio experience with Dolby Atmos technology. With this launch, merged entity now operates the largest multiplex network with 1658 screens at 356 properties in 113 cities (India and Sri Lanka).

Granules India: The pharma company announced that it has received approval from the USFDA for its abbreviated new drug and application (ANDA) for Losartan Potassium tablets. Losartan potassium tablets are indicated for the treatment of hypertension in adults and pediatric patients six years of age and older, to lower blood pressure. The current annual US market for Losartan Potassium tablets is approximately $336 million, according to MAT Dec 2022, IQVIA/IMS Health data.

Lemon Tree Hotels: The hospitality company has signed license agreement for a 110 room property in Kasauli, Himachal Pradesh under its brand Aurika Hotels & Resorts. The hotel is expected to be operational in November 2024. The property will feature 110 rooms and suites, Mirasa, all day dining restaurant. Ariva, bar, expansive banquet spaces spread over 3,000 sq. mtrs. and venues for private events and exclusive experiences. The recreational facilities will include a spa, a swimming pool, a fitness centre and a game room.

Kolte-Patil Developers: The real estate developer announced that its board has approved issuance of NCDs aggregating up to Rs 140 crore, on a private placement basis. The company will issue 14,000 secured, unlisted, redeemable, non- convertible debentures of face value Rs 1 lakh each.

Jai Balaji Industries: The company said that it is planning to expand its portfolio by entering into a cement business in addition to its existing business. Jai Balaji Industries is an integrated steel manufacturer with five facilities in Durgapur and Raniganj in West Bengal and Durg in Chhattisgarh.

Vishnu Chemicals: The company’s board at its meeting held on Monday has approved the investment proposal up to Rs 1000 crore for development of Green Field Project in the Gujarat and Andhra Pradesh by way of setting up Speciality Chemicals Integrated Plant over the next five years.