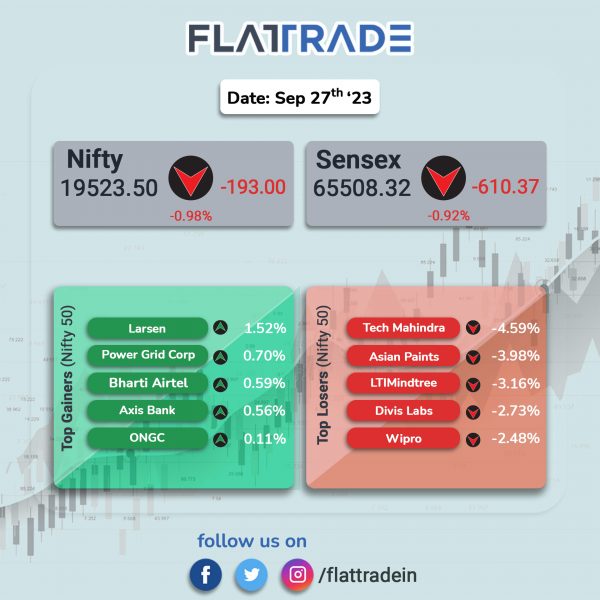

Benchmark equity indices closed lower due to a slump in IT stocks and select index heavyweights amid monthly F&O expiry and higher oil prices. The Sensex tanked 0.92% and the broader Nifty 50 index tumbled 0.98%.

In broader markets, the Nifty Midcap 100 slumped 1.32% and the BSE Smallcap fell 0.34%.

Top losers were IT [-2.19%], FMCG [-1.91%], Media [-1.4%], Auto [-1.17%], PSU Bank [-1.13%]. All Nifty sectoral indices closed negatively.

The Indian rupee rose 5 paise to 83.19 against the US dollar on Thursday.

India’s current account deficit (CAD) narrowed to USD 9.2 billion (1.1% of GDP) in Q1FY24, from USD 17.9 billion (2.1% of GDP) in Q1FY23, but it was higher than USD 1.3 billion (0.2% of GDP) in the preceding quarter, according to data released by the Reserve Bank of India.

Stock in News Today

ICICI Lombard General Insurance Company: The insurer informed the exchange that it has received Rs 1,728 crore demand notice for non-payment of tax in certain supplies between July 2017 and March 2022. The company has received a show cause cum demand notice from the Directorate General of GST Intelligence, Pune Zonal Unit under Section 73(1) of the Central Goods and Services Tax Act. The company said it will be filing a response to the notice within the prescribed timelines.

Multi Commodity Exchange of India (MCX): The company announced the launch date for new commodity derivatives platform (CDP), which will go live from Tuesday, October 3, 2023. It added that mock session ahead of the launch has been fixed on October 2, 2023. The CDP platform would interface with members for providing risk management, collateral management, and settlement of related services to members and market participants.

Dr Reddy’s Laboratories: The company’s board has approved the incorporation of a wholly-owned subsidiary with an authorized and paid-up share capital of Rs 10 lakhs. The proposed subsidiary will carry on the business related to medical nutrition, specialized nutrition, nutraceuticals, vitamins, minerals, herbals and supplements, and related foods or drugs.

Indian Hotels Co.: The company announced that it has received an upgrade in credit rating for bank facilities of Rs 393 crore. The rating was revised to ‘CARE AA+; Stable/ CARE A1+’ from ‘CARE AA; Positive /CARE A1+’. The upgrade in the rating is based on the recent developments including operational and financial performance of IHCL for FY2023 and and Q1 FY2024.

Apollo Tyres: The company announced that the Securities Appellate Tribunal (SAT) has quashed an order passed by SEBI in its entirety and directed SEBI to refund the penalty amount to the company within four weeks from the date of its order. In November 2018, SEBI had imposed a penalty of Rs 65 lakh on the company for the alleged violation pertaining to share buyback.

Coforge: The IT company announced that it has received income tax demand notice of Rs 82.93 crore for the financial year 2019-20. The company added that the notice will not have a material adverse effect on its financial statement.

Barbeque Nation Hospitality: The QSR company and Red Apple Kitchen Consultancy (Red Apple) have entered into share subscription and purchase agreement to jointly acquire 53.26% stake in Blue Planet Foods (Blue Planet). Blue Planet operates a chain of pan-Indian restaurants under the brand name ‘SALT’. SALT is a smart casual dining restaurant serving authentic Indian cuisine.

Rallis India: The company said that it has launched a new insecticide Benzilla, which is a cutting-edge product powered by patented BPX technology from Japan that is expected to boost yields and benefit farmers. The company further said that the product will cater to domestic market.

Rane (Madras): The company’s board has approved setting up of a wholly owned subsidiary in Mexico viz., Rane Automotive Components Mexico S de R.L. de C.V. (RACM). RACM will establish a greenfield manufacturing facility to manufacture steering and linkage auto components catering to customers in Mexico and North American Region.

Apar Industries: The company said that its board has approved fundraising through equity or debt on private placement basis in one or more tranches for an aggregate amount not exceeding Rs 1,000 crore.

Yatra Online: Shares of the company got listed at Rs 127.50 apiece on the NSE, a decline of 10.21% to the issue price of Rs 142 apiece. Shares hit a high of Rs 138.55 apiece and closed at Rs 135.9 per share.