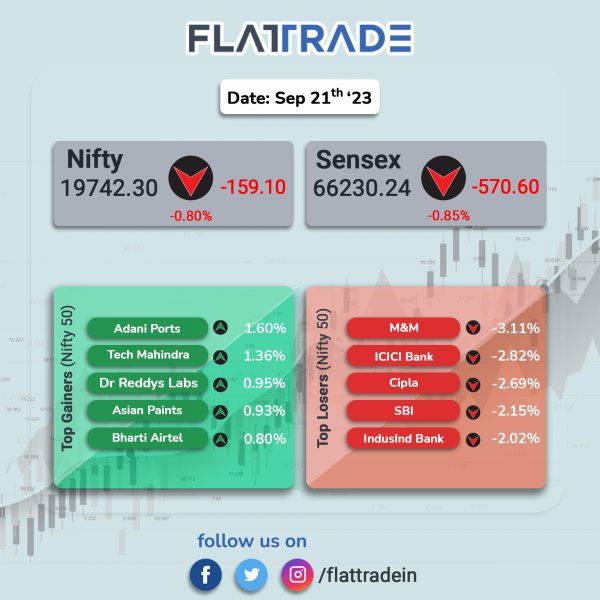

Benchmark equity indices closed lower as investors were worried over the Fed’s tighter monetary policy stance and worsening diplomatic ties between India and Canada. The Sensex fell 0.85% and the Nifty tanked 0.8%.

In broader markets, the Nifty Midcap 100 lost 0.89% and the BSE Smallcap was down by 0.98%.

Top losers were PSU Bank [-2.28%], Auto [-1.69%], Bank [-1.68%], Private Bank [-1.53%], and Financial Services [-1.44%]. All Nifty sectoral indices except Media [up 0.03%], ended in the negative zone.

The Indian rupee closed flat at 83.09 against the US dollar on Thursday.

Stock in News Today

Tata Power: The company’s subsidiary, Tata Power Renewable Energy (TPREL), has signed an agreement with Dugar Power to enter into Nepal’s rapidly evolving renewable energy sector. Under the agreement, the company will cater to Nepal’s diverse energy requirements, offering scalable solutions from 1 KW to MW levels. This opens up new horizons for TPREL to diversify its offerings, including supply cells & modules, engineering, procurement and construction (EPC), as well as Operations and maintenance (O&M) in Nepal.

HDFC Asset Management Company: The company has received the RBI approval for acquiring up to 9.5% stake in Federal Bank, Equitas Small Finance Bank, Karur Vysya, and DCB Bank.

BLS International: Shares of the company fell after the company announced that Indian visa services in Canada have been suspended till further notice with immediate effect. The company added that the impact of this move is negligible on the company’s financials as the Canadian visa issuance business contributes less than 2% to BLS International’s total annual revenue.

Manappuram Finance: The NBFC said that its board has approved the issuance of secured, non-cumulative, redeemable, listed, rated, non-convertible taxable debentures of face value of Rs 1 lakh for an aggregate amount of Rs 1,000 crore on private placement basis.

Canara Bank: The lender said that India Ratings and Research (Ind-Ra) has issued ‘IND AAA’ rating and ‘Stable’ outlook to the lender’s infrastructure bonds and Basel III Tier 2 instruments. In addition, CareEdge Rating has assigned CARE AAA and ‘Stable’ outlook to the lender’s infrastructure bonds.

Mahindra & Mahindra (M&M): The company said that Resson Aerospace Corporation, Canada, which is an associate of the company (‘Resson’) wherein the company holds 11.18% stake (on a fully diluted basis) through Class C preferred shares, had filed for a voluntary winding-up. Consequently, Resson has ceased to be in existence and has also ceased to be an associate of the company. Upon liquidation of Resson, the Company is entitled to receive approximately 4.7 million Canadian Dollars (equivalent to Rs 28.7 crore) as distribution of proceeds towards Class C preferred shares held by the company.

ABB India: The company has secured a complete power, propulsion and automation systems order for Samskip Group’s hydrogen-powered container vessels. ABB will deliver a comprehensive power distribution system for two newly built short-sea container ships of the global logistics company Samskip Group headquartered in Rotterdam, Netherlands. The vessels will be among the world’s first of their kind to use hydrogen as a fuel.

TVS Motor: The company announced the launch of India’s first ever electric two-wheeler racing championship on Thursday. The company said the initiative is a significant step forward in motor sports and reaffirms TVS Motor Company’s commitment to sustainable mobility solutions as it becomes the first Indian manufacturer to foray into the world of EV moto racing.

Lloyds Metals and Energy: The company said that it has installed and commenced DRI manufacturing facility with a rated capacity of 70,000TPA (2 X 95TPD) and a 4MW waste heat recovery boilers (WHRB) based power plant in Gadchiroli, Maharashtra. The company has commissioned the plant within 13 months of getting the environmental clearance (EC) from the State Environment Impact Assessment Department, Maharashtra.

TruCap Finance Limited (TRU): The company and HDFC Bank have commenced business under a co-lending partnership where TRU will leverage its Lending-as-a-Service model to offer quality credit solutions to under-served borrowers. Under this partnership, HDFC Bank and TRU will offer MSME business loans and gold loans to borrowers pre-dominantly in non-urban locations.

Spandana Sphoorty: The rural-focused microfinance lender announced that its board will meet on Monday (25 September 2023) to consider raising of funds through issuance of non-convertible debentures (NCDs), on a private placement basis.