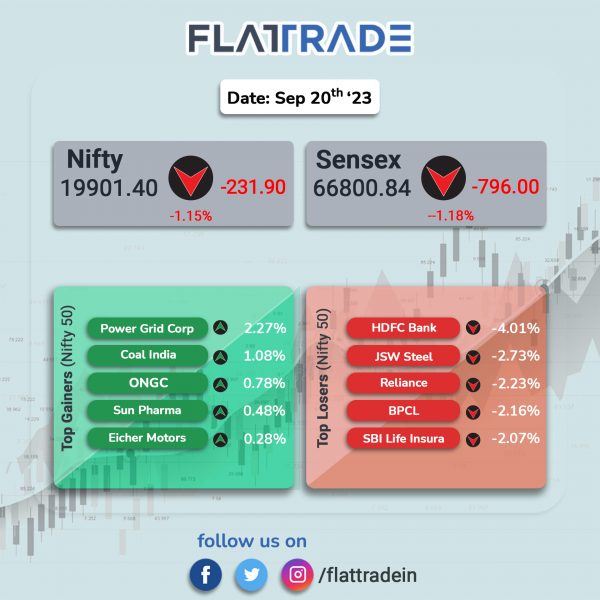

Benchmark indices tumbled over 1% due to negative global sentiments ahead of the Fed’s monetary policy decision. The Sensex fell 1.17% and the Nifty 50 index tanked 1.15%.

In broader markets, the Nifty Midcap 100 index dropped by 0.28% and the BSE Smallcap dropped by 0.5%.

Top losers were Metal [-1.63%], Financial Services [-1.49%], Bank [-1.29%], Private Bank [-1.2%], and PSU Bank [-1.18%]. All Nifty sectoral indices closed in the red.

The Indian rupee rose by 20 paise to 83.08 against the US dollar on Wednesday.

Stock in News Today

HDFC Bank: Brokerage firm Nomura has downgraded the lender’s rating to neutral from its earlier rating of buy. It has also cut the lender’s price target to Rs 1,800 from Rs 1,970 earlier. The brokerage firm cited four negative surprises after the HDFC Bank-HDFC merger for its downgrade that include lower net interest margin, higher cost-to-income ratio, uptick in non-performing assets. Shares of the company plunged over 4%.

Tata Consultancy Services (TCS): The IT major said that it has entered into a strategic partnership with BankID BankAxept AS, Norway’s national payment and electronic identity systems, to set up and manage an operations command center that will enhance the resilience, security and availability of the country’s critical financial infrastructure. As part of the agreement, TCS will build and manage a 24×7 operations command center at Oslo, Norway, for all BankID BankAxept AS users and clients. The new command center will enable immediate responses to any service disruption, security issues, or client requests that are related to Norway’s essential national payments and electronic identity verification systems.

ABB India: The company is working in partnership with SMS group, a specialist in plant construction, mechanical and electric and automation engineering for the metals industry, to provide all the MV motors and MV drives for ArcelorMittal Nippon Steel’s new hot strip mill in India. The scope also includes a large number of low voltage (LV) drives.

Adani Green Energy (AGEL): The company and TotalEnergies have entered into a binding agreement to create a new JV, equally owned by TotalEnergies and AGEL, with a 1,050 MW portfolio. The portfolio will comprise a mix of already operational (300 MW), under construction (500 MW) & under development assets (250 MW) with a blend of both solar & wind power. AGEL will contribute to the JV the assets and TotalEnergies an equity investment of 300 MUS$ which will further support their development.

Bajaj Finserv: The financial services company has allotted 50,000 secured redeemable non convertible debentures (NCDs) with a face value of Rs 1,00,000 each, aggregating up to Rs 500 crore on private placement basis.

Bharat Heavy Electricals (BHEL): The company said that Tajinder Gupta has been appointed as Director (Power) on the company’s board with effect from September 20, 2023.

Escorts Kubota: The company’s board has approved a proposal to set up a non-banking financial institution. The NBFC will be incorporated with an authorized capital of Rs 700 crore. The board has also approved the infusion of capital up to Rs 200 crore as and when required as per the business plan of the proposed company.

Power Grid Corporation of India: The company said that its board will meet on 25 September 2023 to discuss and consider issue of non-convertible bonds under private placement.

SJVN: The company announced that it has signed a memorandum of understanding (MoU) with PFC for financial assistance to various diversified portfolio of projects. The projects include renewable energy projects and thermal generation projects and total project cost of setting up the same is about Rs 1,18,826 crore. “The term loan financial assistance is tentatively proposed at 70% of the project cost, which may be increased for renewable energy projects as per project requirements,” SJVN said in a statement.

Venus Remedies: The company has secured marketing authorisation from Serbia for Gemcitabine and Docetaxel, widely used chemotherapy drugs beneficial in the treatment of various types of cancer. With this, the company has secured 511 marketing approvals for its oncology products across 66 countries.

GR Infraprojects: The company’s arm G R Yamuna Bridge Highway has bagged Rs 737.17 crore order from Ministry of Road Transport and Highways. The order entails construction of four lane highway in Uttar Pradesh.

Ashoka Buildcon: The company said that it has received award from Maharashtra State Electricity Distribution Company (MSEDCL) for loss reduction works at various circles in the state of Maharashtra aggregating to Rs 645.70 crore. The civil construction company received project for development of distribution infrastructure under revamped distribution sector scheme (RDSS).

EaseMyTrip.com: The company has introduced its specialised corporate travel business division. With this launch, the company aims to redefine the experience of business travel by offering bespoke solutions crafted to meet the intricate demands of the corporate world.

Godrej Properties: The realty company has allotted non-convertible debentures aggregating up to Rs 1160 crore on private placement basis.

Caplin Point Laboratories: The company’s subsidiary, Caplin Steriles, has been granted final approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) Norepinephrine Bitartrate Injection USP, a generic therapeutic equivalent version of (RLD), LEVOPHED injection of Hospira Inc. Norepinephrine Bitartrate Injection is used for restoration of blood pressure in adult patients with acute hypotensive states. According to IQVIATM (IMS Health), Norepinephrine Bitartrate Injection USP had US sales of approximately $40 million for the 12-month period ending June 2023.

RR Kabel: The shares of the company got listed on the bourses. Shares of the company opened at Rs 1180agains its issue price of Rs 1035 apiece. Shares of the company touched a high of Rs 1212.7 apiece and closed at Rs 1198.5 per share.