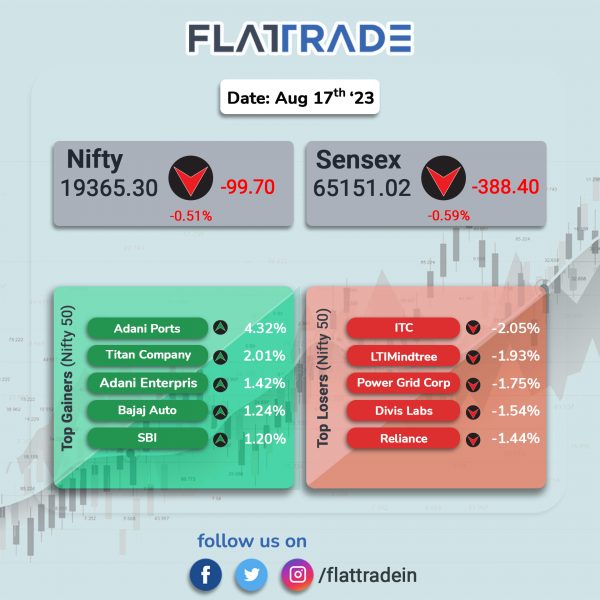

Domestic benchmark equity indices fell on Thursday due to risk-off sentiment as the Fed’s minutes hinted at further interest rate hikes to tame inflation and Chinese economic data showed the country’s economy slowing down at a faster pace. The Sensex fell 0.62% and the Nifty lost 0.51%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index rose 0.25% and the BSE Smallcap advanced 0.19%.

Top losers were FMCG [-0.89%], Oil & Gas [-0.83%], IT [-0.49%], Media [-0.4%], and Healthcare [-0.34%]. Top gainers were Consumer Durables [1.79%], PSU Bank [1.43%], and Realty [0.12%].

The Indian rupee fell 14 paise to 82.84 against the US dollar on Thursday.

Stock in News Today

HDFC Bank: The private sector lender has launched its life insurance and AMC arms in GIFT City located in Ahmedabad, Gujarat. HDFC Life International will offer US dollar-denominated life and health insurance solutions for NRIs as well as the global Indian diaspora. HDFC AMC International will offer fund management and advisory solutions.

Oil and Natural Gas Corporation (ONGC): The PSU said it plans to invest Rs 1 lakh crore by end of 2030 in low-carbon energy opportunities including renewable energy and green hydrogen. The state-owned company said it is in an advanced stage of crafting collaborations with leading players in the energy space on various low-carbon energy opportunities including renewables, green hydrogen, green ammonia and other derivatives of green hydrogen. It also said it is planning to set up two green-field oil to chemicals plants in India.

Dilip Buildcon: The construction company has bagged an irrigation project worth Rs 699 crore Madhya Pradesh Water Resource Department. The company received a letter of acceptance via joint venture with Vijay Kumar Mishra Construction Private. Ccording to the agreement, the irrigation project is expected to be completed within 36 months.

Inox Wind: The company said that its promoter and promoter group entities have infused a sum of Rs 500 crore in Inox Wind. The funds were raised by way of equity share sale of IWL by its promoter and promoter group entities through block deals on the stock exchanges. The funds will be utilized for the repayment of IWL’s existing debt.

Rashtriya Chemicals And Fertilizers (RCF): The company has received environmental clearance from Ministry of Environment, Forest and Climate Change for nano-urea fertilizer plant in Mumbai, Maharashtra. The company plans to set up the plant at its Trombay Unit Industrial Area, with a total capacity of 27,375 KL per annum.

Ramkrishna Forgings: The company has bagged a business contract worth 16 million euros (approx. Rs 145 crore) from a European Original Equipment Manufacturer under a long-term agreement for a period of four years. With this development, the company expects to strengthen its foothold in Europe by expanding its product range and contributing to the efficiency and performance of vehicles in the region, the company said in a statement.

Venus Remedies: The company has launched its flagship R&D drug, Elores, in the $1.4-billion pharmaceutical market in Oman. The drug is clinically proven to be one of the best drugs against ICU infections and it is effective against bacterial strains resistant to the last-resort carbapenem class of antibiotics. The launch of Elores in Oman is expected to open the doors for the entry of the novel antibiotic adjuvant entity in other important Gulf Cooperation Council (GCC) member countries.

Spandana Sphoorty Financial: The company’s board has approved the issuance non-convertible debentures (NCDs) up to Rs 75 crore with green shoe option of Rs 25 crore on a private placement basis. The NCDs will have an interest rate of 10.6% and it will be allotted on August 24, 2023. The NCDs will mature on February 24, 2025. The debentures are proposed to be listed on Bombay Stock Exchange (BSE).

Greaves Cotton: The company announced that its subsidiary, Greaves Finance, has partnered with Ather Energy to offer financing solutions with buyback for Ather two-wheelers. The partnership with Ather Energy will grant their customers exclusive access to a diverse range of financing solutions customised to cater to their individual needs and preferences. Ather Energy’s customers will have the exclusive privilege of accessing five curated financing schemes from evfin, which is the brand of Greaves Finance.

Pdilite Industries: The company announced that it has appointed Manish Dubey as its chief marketing officer (CMO). Previously, Dubey held the position of Chief of Marketing & E-Commerce at ICICI Prudential Life Insurance.

Dr Agarwals Eye Hospital: The company said it has raised $80 million from TPG and Temasek to expand network to 300 hospitals. The company said the funds will be used for the company’s expansion plans, aiming to increase its current network of 150+ centers to over 300+ centers within the next three years. The company will be investing more than 1200 crore to set up hospitals across India and Africa.