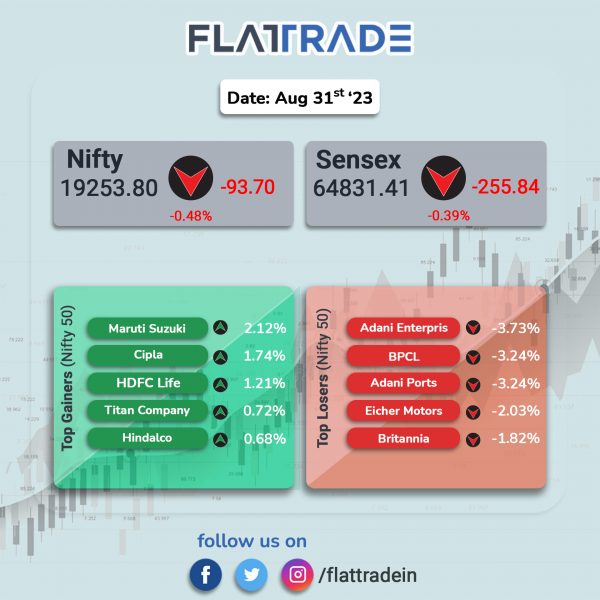

Benchmark indices pare early gains to end lower, dragged by losses in bank and financial services stocks. The Sensex fell 0.39% and the Nifty lost 0.48%.

In broader markets, the Nifty Midcap 100 index rose 0.11% and the BSE Smallcap jumped 0.79%.

Top losers were PSU Bank [-1.33%], Oil & Gas [-1.04%], Energy [-0.91%], FMCG [-0.82%], and Bank [-0.55%]. Top gainers were Realty [0.65%] and IT [0.2%].

The Indian rupee fell by 4 paise to 82.78 against the US dollar on Thursday.

Stock in News Today

Maruti Suzuki India (MSI): Shares of the company touched a new lifetime high of Rs 10,065 apiece in intraday trade as investor and analysts awaited the release of monthly sales figures. Investors were buoyed by global brokerage J.P. Morgan’s analysis that placed India’s largest automaker on the positive catalyst watch.

Adani Group: The conglomerate has denied a new report by OCCRP which levelled charges against the group for using ‘opaque investments’ through Mauritius. The group had issued a press statement before the market opened today citing that these news reports appear to be yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report. Shares of all Adani Group companies declined over 5% in intraday trade.

Jio Financial Services: Shares of the company rose 5% for the third day in a row to close at Rs 233.5 per share on the NSE. Shares of the company have risen 12.68% this week.

Tata Power: The company said Tata Power Renewable Energy through its subsidiary TP Alpha (SPV) has signed a power delivery agreement with Sanyo Special Steel Manufacturing India (SSMI) for setting up of 28.125 MW (AC) captive solar plant in Aachegaon in Maharashtra. Tata Power Renewable Energy is a subsidiary of Tata Power Company. The solar plant is projected to produce an annual electricity of 61.875 million units (MUs) which would meet the energy requirement of steel manufacturing unit of ‘SSMI’. The overall capacity of the Aachegaon facility is 120 MWp AC and the project will be commissioned by the end of this fiscal.

DCX Systems: The company has signed a joint venture agreement with ELTA Systems for the purposes of developing, producing and distributing obstacle detection solutions based on radar and optics technology for railway industry. ELTA and DCX will incorporate a jointly owned, private limited liability Israeli company (JVC) for the purposes of developing, producing and distributing, globally, obstacle detection solutions based on radar and optics technology for railway industry.

Zydus Life: The drug maker announced that it has received final approval from the United States Food and Drug Administration (USFDA) for Isotretinoin capsules. Isotretinoin capsules is used to treat severe cystic acne, which is also known as nodular acne. The said drug is equivalent to reference listed drug, Accutane capsules. According to IQVIA MAT July 2023, Isotretinoin capsules had annual sales of $165 million in the United States.

Nazara Technologies: Shares of the company rose over 8% in intraday trade after the company said it is considering to raise funds by issuing equity shares on a preferential basis. Earlier, the company had decided to raise funds through the issue of equity shares. The board had also approved raising its authorised share capital from Rs 30 to Rs 50 crore.

Epigral (formerly Meghmani Finechem Ltd): The company has announced its expansion into chlorinated polyvinyl chloride (CPVC) compounds with the CPVC compound manufacturing plant, which is is expected to be commissioned by Q4FY24 at Dahej, Gujarat, and will have a capacity of 35,000 TPA. With this expansion, the company will cater to both, CPVC Resin and CPVC compound customers in the country.

Zen Technologies: The company has secured an order worth Rs Rs 72.29 crore from the Ministry of Defence, Government of India. Zen Technologies provides military training and anti-drone solutions. It delivers simulators, equipment, and systems. Its dedicated R&D facility, recognized by the Ministry of Science and Technology, has filed over 130 patents, with 50+ granted. Shares of the company jumped over 3% in intraday trade on the NSE.

Ultramarine & Pigments: The company said that its wholly-owned subsidiary Ultramarine Specialty Chemicals has successfully commissioned Pigments project-phase 2 at Andhra Pradesh lndustrial Park located at Naidupet, SPSR Nellore. The commercial production of the plant has commenced on 31 August 2023, the company added. The total capacity of Phase 2 is 2800 MT and the capacity commissioned till date is 550 MT, the company said in a exchange filing.

Aeroflex Industries: The company had a strong stock market debut on Thursday. On the NSE, shares of the company opened at Rs 190 as against an issue price of Rs 108 apiece. The shares hit a high of 196.35 during the session and closed at Rs 163.25 apiece.

NMS Resources Global: The company said that it has received an order worth Rs 37.19 lakh for modernization works at ROC Chennai of CSS Phase-II, Tamil Nadu. NMS Resources Global said it has received a work order for modernization works at ROC Chennai of CSS Phase-II, Tamil Nadu. The order was granted by Bharat Electronics, a government enterprise under the Ministry of Defence.

Kokuyo Camlin: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL A/Stable/CRISIL A1’ ratings on the bank facilities of the company. CRISIL said that the ratings continue to reflect the established brand of the company in the stationery industry in India, its improving profitability and a healthy financial risk profile.

Sportking India: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL A/Stable/CRISIL A1’ ratings on the bank facilities of the company. CRISIL stated that the ratings continue to reflect the strong position of Sportking in the compact cotton yarn industry, its large scale of operations and healthy financial risk profile.

Gallantt Ispat: The company announced that it has received the delivery of one railway rake out of the two rakes purchased by it, and the same would help in bringing down freight costs and improve efficiency. The company had stated that owning railway rakes would boost up loading of iron ore and coal (primary raw materials of the company) from origin (port, mining area etc.) to its manufacturing facilities.

Greenply Industries: The company informed that the unit of Greenply Gabon SA, a step-down wholly owned subsidiary of the company, located at West Africa has resumed its manufacturing operations. The NKOK SEZ, Gabon, West Africa unit had been partially affected due to the present political unrest in Gabon. “As per the information available with us, the military has asked the businesses to resume normal operations today itself and is working on restoring normalcy,” said the company. Greenply further said that it doesn’t see any significant incremental impact on the financial performance of the unit due to the present situation at Gabon.