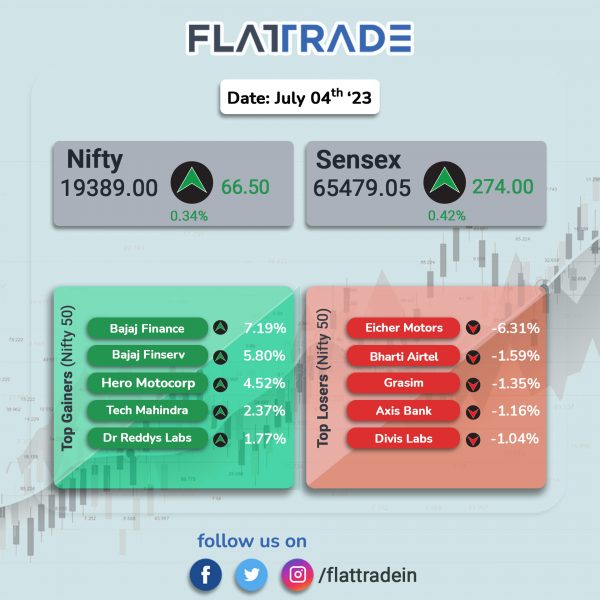

Benchmark equity indices closed higher, helped by gains in Bajaj twins, PSU Banks and technology-related stocks. The Sensex rose 0.42% and the Nifty gained 0.34%.

In broader markets, the Nifty Midcap 100 lost 0.2% and the BSE Smallcap inched up 0.05%.

Top gainers were PSU Bank [1.89%], IT [1.04%], Media [0.82%], Financial Services [0.79%], and Pharma [0.45%]. Top losers were Oil & Gas [-0.68%], Auto [-0.48%], Energy [-0.32%], and Realty [-0.18%].

Indian rupee fell 6 paise to 82.02 against the US dollar on Tuesday.

Stock in News Today

Hero MotoCorp: Shares of the two-wheeler maker jumped 4.21% after the company announced the commencement of bookings for its inaugural co-developed premium motorcycle, the Harley-Davidson X440. Bookings can be made online or at select Harley-Davidson dealerships and Hero MotoCorp outlets, with a booking amount of Rs 5000/-. The Harley-Davidson X440 comes in three variants with an introductory price starting from Rs 2.29 lakhs and deliveries will begin in October 2023. Meanwhile, Eicher Motors, which manufactures Royal Enfield motorcyles, tanked 6.31%.

NBCC (India): In an exchange filing, the company said that it has inked an MoU with Currency Note Press (CNP) under Security Printing and Minting Corporation of India Limited (SPMCIL), Maharashtra, for planning, designing and execution of upcoming works such as state of art museum, infrastructure development works like treatment plants etc. at Currency Note Press (CNP) Nasik. Separately, NBCC informed that the the Ministry of External Affairs (MEA) has sanctioned an amount of Rs 261.71 crore for the redevelopment of MEA Housing Complex (Old) at Kasturba Gandhi Marg, New Delhi.

L&T Finance Holdings (LTFH): Shares of the company fell 2.9% after a domestic broker Kotak Institutional Equities downgraded the stock to ‘sell’ from ‘reduce’. The broker stated that the company’s low short-term growth and subdued Return on Equity (RoE) present significant challenges that cannot be easily resolved. The broker also highlighted concerns about asset quality in specific segments.

Tanla Platforms: Shares of the company surged over 6% in intraday trade after the company announced that it has acquired ValueFirst Digital Media Pvt. Ltd. from US-based communications technology company Twilio. Earlier, it signed a definitive agreement with Twilio to acquire 100% equity of ValueFirst Digital Media for $42 million. The company had also signed a separate binding agreement to acquire 100% of ValueFirst Middle East FZC, the Middle Eastern arm of ValueFirst Digital Media, for Rs 20 crore. However, the company shares gave up most of its gains to close only 0.86% higher.

Anupam Rasayan: The speciality chemicals company said that it has signed a Memorandum of Understanding (MoU) with subsidiary of Tube Investments of India, 3xper Innoventure, for supply of targeted and identified new age pharma molecules. The identified products for active pharmaceutical ingredients (APIs) will be developed under the CRAMS (contract research and manufacturing services) and CDMO (contract development and manufacturing organisation) models, the company said in an exchange filing.

Karur Vysya Bank: The lender said that its total deposits increased by 13.75% to Rs 80,715 crore as on June 30, 2023, as against Rs 70,961 crore as on June 30, 2022. The bank’s total business stood at Rs 1,47,820 crore as on June 30, 2023, up 13.84% from Rs 1,29,851 crore recorded in the same period a year ago. Advances jumped 13.95% to Rs 67,105 crore as on 30 June 2023 from Rs 58,890 crore as on 30 June 2022.

HPL Electric & Power: The company announced that it has received orders worth Rs 903 crore for supplying smart meters. With this, HPL’s total pending pipeline order book stood at over Rs 2,250 crore, the company said in a statement. The company said that their smart meters can significantly enhance demand-side energy efficiency by providing real-time data on energy consumption to both consumers and energy providers.

Rama Steel Tubes: The company said that it has registered a sales volume of 48,437.69 tons in Q1FY24 compared to 29,833.96 tons in Q1FY23, recording a growth of 62% on YoY basis.

Zydus Lifesciences: The drug maker has received the final approval from the United States Food and Drug Administration (USFDA) for Oxcarbazepine tablets. Oxcarbazepine is used alone or with other medications to treat seizure disorders (epilepsy). The product will be manufactured at the group’s formulation manufacturing facility in Baddi, Himachal Pradesh (India). Oxcarbazepine tablets had annual sales of $105 million in the US, according to IQVIA MAT May 2023.

G R Infraprojects: The company announced that it has executed the engineering procurement and construction (EPC) agreement with the East Coast Railway. The scope of the project entails construction of tunnel work between Adenigarh – Purunakatak, consisting of tunnel‐T4, T5, T6 & T7 and allied works of Khurda – Bolangir new rail line project in east coast railway. The cost of the project is Rs 587.59 crore. The completion period for T-4 is 30 months, T‐5 & T‐6 is 18 months and T-7 is 24 months.

HMA Agro Industries: Shares of the company debuted on the BSE and NSE on Tuesday. It opened at Rs 625 apiece and hit a high of Rs 667 per share. However, it closed at Rs 585.65, which was almost same as its final issue price of Rs 585 per share.

V-Mart Retail: The clothing retailer said its revenue from operations during Q1FY24 grew 16% year-on-year to Rs 678 crore, according to its regulatory filing. It also said it opened nine stores and closed one store during the first quarter. With this, the total number of stores stood at 431 stores as on June 30, 2023.

Eris Lifesciences: The company’s wholly owned subsidiary, Eris Oaknet Healthcare Private Limited, has transferred all the dermatology trademarks to the company that had been previously acquired from Glenmark Pharmaceuticals Limited for Rs 339.68 crore.

Quick Heal Technologies: The company’s board has approved the appointment of Vishal Salvi as Chief Executive Officer (CEO) of the company effective July 3, 2023.