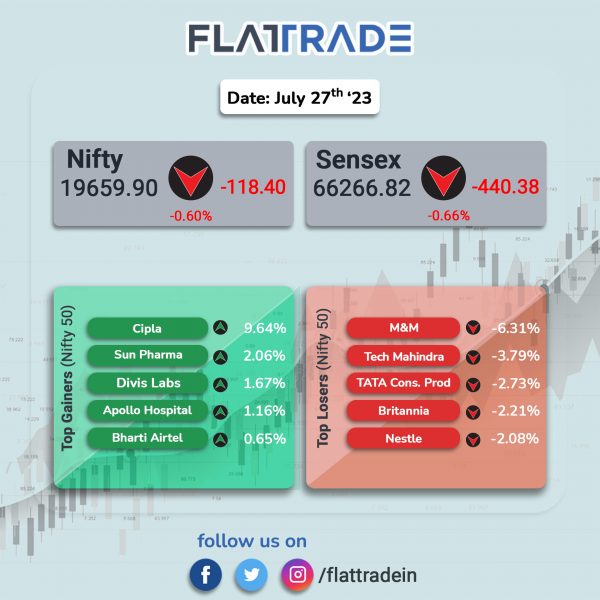

Benchmark equity indices closed lower amid significant volatility after the US Fed hiked interest rates in-line with the markets’ expectations by 25 bps. The Sensex fell 0.66% and the Nifty was down 0.6%.

In broader markets, the Nifty Midcap 100 rose 0.27% and the BSE Smallcap rose 0.07%.

Top gainers among nifty sectoral indices were Pharma [3.05%], Realty [2.12%], and PSU Bank [0.5%]. Top losers were Auto [-1.21%], Private Bank [-1.03%], Oil & Gas [-0.97%], Bank [-0.83%], and Financial Services [-0.78%].

Indian rupee rose 6 paise to 81.94 against the US dollar on Thursday.

Stock in News Today

Nestle India: The FMCG major on Thursday reported a net profit of Rs 698.34 crore for the quarter ended June 2023, up 37% YoY over Rs 510.24 crore reported by the company in the corresponding quarter of the previous financial year. Total sales for the reported quarter rose 15% YoY to Rs 4,619.5 and domestic sales grew by 14.6% YoY. Nestle, which follows a January-December financial year, reported a 6.5% contribution in its quarterly sales from its e-commerce vertical with sustained growth momentum.

Bajaj Finserv: The company reported a 48.4% year-on-year (YoY) rise in consolidated net profit for the quarter ended June 2023 to Rs 1,942.63 crore. Its revenue from operations rose nearly 47% YoY to Rs 23,280 crore. All subsidiaries of the company registered strong performance that helped push Bajaj Finserv’s profit to an all-time high.

Its subsidiary Bajaj Finance recorded its highest-ever quarterly increase in customer franchise of 3.84 million and the highest-ever new loans booked of 9.94 million in the June quarter. Bajaj Finance reported an over 32% YoY rise in consolidated net profit to Rs 3,437 crore, while net interest income increased 26% to Rs 8,398 crore. The assets under management (AUM) as of June 30, stood at Rs 2.70 lakh crore, up 32% from the year-ago period. The company recorded the highest-ever quarterly increase in its AUM of Rs 22,718 crore.

Its general insurance subsidiary, Bajaj Allianz General Insurance, reported a gross written premium of Rs 3,834 crore, up 23% from the year-ago period. The net earned premium for the quarter stood at Rs 1,938 crore, compared to Rs 1,852 crore a year ago. The underwriting loss for the quarter stood at Rs 42 crore, compared with a loss of Rs 61 crore a year ago. The AUM, represented by cash and investments, stood at Rs 28,611 crore fro the quarter ended June 2023, compared to Rs 25,362 crore a year ago.

Meanwhile, Bajaj Allianz Life Insurance Co’s gross written premium declined 7% YoY to Rs 4,058 crore. The new business premium was Rs 2,159 crore, compared to Rs 2,917 crore a year ago. Renewal premiums in the quarter increased by 31% on year to Rs 1,899 crore. Bajaj Allianz’s AUM, represented by total investments, stood at Rs 95,317 crore as of June 30, up 15% YoY.

Kalpataru Projects International: The company announced that it has secured new orders worth Rs 2,261 crore. The company has bagged an order in the T&D business worth Rs 2,036 crore in overseas markets. It has also secured a cross country oil & gas pipeline project in India of Rs 225 crore.

Shriram Finance: The company reported a 26.6% jump in its consolidated net profits for the April-June 2023 quarter at Rs 1712.19 crore, the company said. The company had posted a consolidated net profit of Rs 1,351.62 crore during the corresponding quarter of last year. The consolidated total income during the quarter under review grew to Rs 8,292.53 crore from Rs 7,138.25 crore registered a year ago. Its net interest income for the reported quarter increased to Rs 4,576.61 crore from Rs 4,044.42 crore registered in the same period of last year. As on June 30, 2023, the total assets under management stood at Rs 1.93 lakh crore, the company said.

HFCL: The telecom equipment maker reported a 42.3% YoY increase in net profit at Rs 75.56 crore in Q1FY24 compared to Rs 53.1 crore in the same quarter last fiscal. Revenue from operations came in at Rs 995.19 crore, down 5.3% YoY compared to Rs 1051.02 crore reported a year-ago period. During Q1FY24, the company has significantly increased revenue from international business to Rs 176.23 crore, a growth of 156% YoY. Ebitda for Q1FY24 stood at Rs 159.62, up 23.01% YoY.

Syngene International: The company reported a 26% YoY jump in net profit at Rs 93 crore in Q1FY24 and its revenue from operations rose 26% YoY to Rs. 832 crore. Ebitda rose 25% YoY to Rs 235 crore in Q1FY24 and its margin dropped 20 basis points to 28.3% during the reported quarter.

Cipla: The drug maker reported a 45.1% YoY jump in net profit to Rs 996 crore in the quarter ended June 2023, led by sales growth across key geographies of US, India and South Africa. The company reported a net profit of Rs 686 crore in the year-ago period. Revenue from operations rose 17.7% YoY to Rs 6329 crore in Q1FY24 compared to Rs 5375 crore in Q1FY23. Ebitda rose 31% YoY to Rs 1,494 crore and Ebitda margin expanded 230 basis points to 23.6%. The US business, which contributes 29% of Cipla’s revenue, reported the highest ever revenue of $222 million and 43% YoY growth driven by robust momentum in differentiated portfolios.

REC: The company reported growth of 21% in consolidated net profit at Rs 2,968.05 crore in Q1FY24, compared to Rs 2,454.16 crore in the corresponding period last year. The company’s revenue from operations stood at Rs 11,087.56 crore in Q1FY24, registering a rise of 16.7%, compared to Rs 9,497.45 crore in the year-ago period. The company’s board declared an interim dividend of Rs 3 per equity share of Rs 10 each for fiscal 2023-24, the company said in an exchange filing. The record date for the dividend is set as August 14, 2023. The board also proposed seeking shareholder’s approval for increasing the company’s borrowing limit from Rs 4.5 lakh crore to Rs 6 lakh crore in any foreign currency equivalent from $16 billion to $20 billion – from domestic and international markets, according to its regulatory filing.

Schaeffler India: The company reported a revenue of Rs 1,829.14 crore in April-June 2023 quarter, up 4.59% from Rs 1,748.83 crore in the year-ago period. Ebitda rose 6.34% to Rs 342 crore in the reported quarter from Rs 321.73 crore in the corresponding quarter of last year. Net profit rose 5.09% to Rs 237.28 crore in the reported quarter as against Rs 225.75 crore in the year-ago period.

SIS: The company’s consolidated revenue rose 11.14% YoY at Rs 2,976.73 crore in Q1FY24 from Rs 2,678.18 crore in Q1FY23. Ebitda rose 15.35% to Rs 139 crore in Q1FY24 from Rs 120.72 crore in Q1FY23. Consolidated net profit grew 8.48% YoY to Rs 89.50 crore in Q1FY24 from Rs 82.54 crore in Q1FY23.

Tata Teleservices (Maharashtra): The company’s net loss widened to Rs 301.18 crore in Q1FY24 as against a net loss of Rs 295.10 crore in Q1FY23. Revenue from operations stood at Rs 285.51 crore in Q1FY24, up 7.14% from Rs 266.48 crore recorded in the same period a year ago. Ebitda grew by 6.35% to Rs 127.20 crore in Q1FY24 from Rs 119.61 crore registered in Q1FY23. Operating profit margin improved to 30.92% in Q1FY24 from 28.96% reported in Q1FY23.

Vesuvius India: The company’s board approved a proposal for a capex of approximately Rs 87.70 crore for setting up a new manufacturing plant of monolithics refractory at Anakapalli, Andhra Pradesh. Anakapalli monolithics refractory has an existing capacity of 120,000 tonne per annum and the company has proposed capacity addition of 120,000 tonne per annum, to meet the growing demand. Meanwhile, the company reported a 77.5% surge in net profit to Rs 52.24 crore in Q2CY23 from Rs 29.43 crore in Q2CY22. Revenue from operations increased 22.8% YoY to Rs 402.14 crore for the quarter ended June 2023. Total expenditure spiked 16.32% YoY to Rs 343.41 crore during the quarter ended June 2023.

Ion Exchange (India): The company reported a 18.7% increase in consolidated net profit to Rs 33.27 crore on 25.3% jump in net sales to Rs 479.22 crore in Q1FY24 over Q1FY23. Total expenditure spiked 22.74% YoY to Rs 440.36 crore in June quarter 2023. Segment-wise, revenue from Engineering segment grew 41.87% YoY to Rs 287.09 in Q1FY24, while revenue from Chemicals segment jumped was nearly flat at Rs 146.08 crore in Q1FY24 compared to Rs 145.81 crore in Q1FY23. Revenue from Consumer Products segment rose 19.54% to Rs 60.33 crore in Q4FY23 compared with Rs 50.47 crore in n the same period a year ago.

Jet Airways: The Supreme Court has directed the grounded airline to reinstate its 169 employees with full back wages, according to a report by The Economic Times (ET). The court was hearing an appeal filed by the Bharatiya Kamgar Karmachari Mahasangh, which was representing the workmen against the airline. “A workman who has worked for 240 days in an establishment would be entitled to be made permanent, and no contract/settlement which abridges such a right can be agreed upon, let alone be binding,” the top court ruled.

Dr Lal PathLabs: The company’s consolidated net profit jumped 43.15% to Rs 82.6 crore in Q1FY24 from Rs 57.7 crore recorded in Q1FY23. Revenue from operations grew by 7.62% to Rs 541 crore in the quarter ended June 2023. Normalised EBITDA jumped 22.7% to Rs 154 crore during the quarter as against Rs 125 crore reported in Q1 FY23.

Sterlite Technologies (STL): The company’s consolidated net profit from continuing operations rose to Rs 63 crore in Q1FY24 from Rs 22 crore in corresponding quarter of last year. Revenue from operations increased by 2.35% to Rs 1,522 crore in Q1FY24 from Rs 1,487 crore in Q1FY23. Ebitda climbed to Rs 235 crore in Q1FY24 from Rs 165 crore posted in Q1FY23. EBITDA margin stood at 15% in Q1FY24 as against 11.1% in the corresponding quarter previous year. The company’s order book stood at Rs 10,938 crore at the end of June 2023 quarter.

BirlaSoft: The company’s consolidated net profit rose 22.63% to Rs 137.54 crore and its revenue from operations increased by 2.97% to Rs 137.54 crore in Q1FY24 over Q4FY23. On a yearly basis, the company’s net profit jumped 13.93%, and revenue rose 9.39% during the quarter. Ebitda was at Rs 169.8 crore for the quarter ended June 2023, up 15.7% QoQ and 13.7% YoY. The company’s revenue in dollar terms stood at $148.6million, registering a growth of 3.1% QoQ and 3.4% YoY. The company said it signed deals having a total contract value (TCV) of $146 million during the quarter. TCV of new deal wins was $80 million and renewals amounted to $66 million for Q1FY24.

ACC: The cement maker said that its consolidated net profit more than doubled to Rs 466.1 crore for the quarter ending in June 2023, led by volume growth. The company had posted a net profit of Rs 227 crore in the year-ago period. Revenue from operations stood at Rs 5,201.1 crore in the quarter under review, a significant increase from Rs 4,468 crore in the same period last year. Ebitda surged 77% YoY to Rs 848 crore in Q1FY24, and EBITDA margin expanded to 16.3 percent from 10.7% YoY.

IEX: The company reported a net sales of Rs 104.04 crore for the quarter June 2023, up 5.78% from Rs. 98.35 crore for the quarter ended June 2022. Its consolidated net profit stood at Rs 75.83 crore in Q1FY24, a rise of 9.69% from Rs 69.13 crore in Q1FY23. Ebitda stood at Rs 104.88 crore in April-June 2023 quarter, up 9.19% from Rs 96.05 crore in April-June 2022 quarter.

Deepak Fertilisers and Petrochemicals Corporation: The company’s net Sales fell 23.69% to Rs 2,313.01 crore in Q1FY24 from Rs. 3,031.07 crore in Q1FY23. Its net profit stood at Rs 110.03 crore in Q1FY24, down 74.64% from Rs. 433.89 crore in Q1FY23. Ebitda fell to Rs. 300.92 crore in Q1FY24 from Rs 751.67 crore in Q1FY23.

Ujjivan Small Finance Bank: The Bengaluru-based lender reported a 60.3% year-on-year increase in net profit at Rs 324 crore in the first quarter of FY24, compared to a net profit of Rs 202 crore in the corresponding quarter of the previous year. Its net interest income (NII) , the difference between the interest earned from lending activities and paid to depositors, was at Rs 793 crore, up 32 percent from Rs 600 crore in the year-ago period. Its net interest margin (NIM) declined 40 basis points (bps) from 9.6% to 9.2%. The lender’s net non-performing assets fell to 0.06% from 0.11% in the year-ago period.

Latent View: The data and analytics company said its net profit fell 3.8% to Rs 32.9 crore in Q1FY24 as against Rs 34.2 crore in Q4FY23. Revenue rose 4.7% QoQ to Rs 147.7 crore in Q1FY24 as against Rs 141.1 crore in Q4FY23. EBITDA was up 7% QoQ to Rs 28.1 crore in Q1FY24 as against Rs 30.2 crore in Q4FY23.

Westlife Foodworld: The company said its net profit was up 22.5% at Rs 28.8 crore in Q1FY24 as against Rs 24 crore in Q1FY23. Revenue rose 14.2% to Rs 614.3 crore in Q1FY24 from Rs 537.8 crore in Q1FY23. EBITDA climbed 14.5% to Rs 105.3 crore in Q1FY24 from Rs 92 crore in Q1FY23.

Coromandel International: The company’s consolidated net profit fell 1% to Rs 494 YoY during the April-June 2023 quarter. Consolidated revenue from operations was down 0.6% at Rs 5,693.4 crore in Q1FY24 as compared to 5729.1 crore in the year-ago period. The company’s revenue from crop and allied business increased 1.7% YoY to Rs 5,200 crore in the April-June quarter. Its crop fertilizer business fell 17% YoY to Rs 547 crore in Q1FY24.