Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.52% higher at 18,725, signalling that Dalal Street was headed for positive start on Monday.

Most Asian shares were trading higher on positive global cues and on optimism that the Federal Reserve would pause its rate hikes this month. The Nikkei 225 index jumped 1.65%, the Topix climbed 1.34%. The Hang Seng rose 0.67%, while CSI 300 index fell 0.26%.

Meanwhile, oil prices jumped as Saudi Arabia pledged big output cuts in July.

Indian rupee appreciated by 11 paise to 82.31 against the US dollar on Friday.

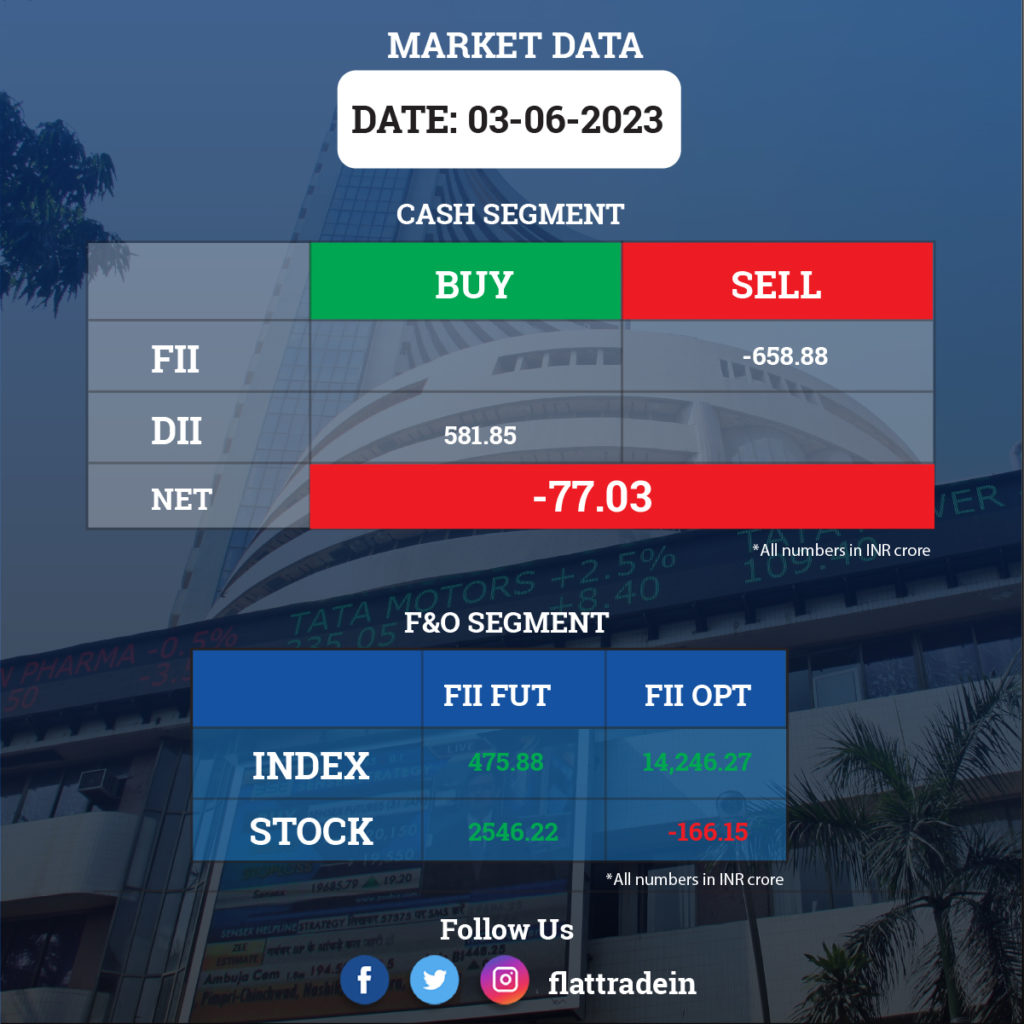

FII/DII Trading Data

Stocks in News Today

Tech Mahindra: The IT services company said that its subsidiary Comviva Technologies along with the company’s step-down subsidiary Comviva Technologies BV agreed to sell 0.04% and 99.96% shareholding in Comviva Technologies do Brasil Indústria, Comércio, Importação e Exportação Ltda. The buyer is Druid Internet Systems Comércio E Serviços Ltda. The transaction is expected to be completed by August 2023. The company will exit the product line without impacting its customers being served, it said.

SBI Life Insurance Company: Insurance Regulatory and Development Authority of India has identified SBI Life as the acquirer insurer of the life insurance business of Sahara India Life Insurance Company (SlLIC) to protect the interest of the policyholders. SBI Life will take over the policy liabilities of around 2 lakh policies of SILIC, backed by the policyholders’ assets, with immediate effect.

Wipro: The IT services company has fixed June 16, 2023 as the record date for determining the entitlement and the names of equity shareholders who are eligible for the buyback offer. On April 27, the company received approval from the board for the share buy back worth up to Rs 12,000 crore, at a price of Rs 445 per share.

Zydus Lifesciences: The US Food and Drug Administration (USFDA) has closed the inspection of the company’s animal health drug manufacturing facility in Ahmedabad, with nil observations. The USFDA inspected the plant from May 30 to June 2.

Indian Overseas Bank (IOB): The Reserve Bank of India (RBI) has imposed a penalty of Rs 2.20 crore on Indian Overseas Bank for deficiencies in regulatory compliance.

Lupin: The pharma major has launched Darunavir tablets, in 600 mg and 800 mg strength, to market a generic equivalent of Prezista tablets of Janssen Products, LP, which reduces the amount of HIV in the blood. Darunavir tablets had estimated annual sales of $308 million in the US, as per IQVIA MAT March 2023.

IIFL Finance: The board has approved Tranche II public issue of non-convertible debentures of Rs 300 crore with a green-shoe option of up to Rs 1,200 crore. This is within the shelf limit of Rs 5,000 crore. The issue will open on June 9 and close June 22.

Wonderla Holidays: The Tamil Nadu government has granted a waiver of local body tax (LBT) of 10% to its Chennai project for 10 years from the commencement of commercial operations. This is subject to the condition that the commercial operation shall commence within two years from June 2.

Tata Chemicals: The company signed an agreement with the Gujarat Government to set up a 20 GW capacity lithium-ion cell manufacturing giga factory with an investment of Rs 13,000 crore, the state government said in a statement. The company will reorganise its US operations to rationalise the number of intermediate entities.

Dish TV: The company has cancelled the extraordinary general meeting scheduled on June 9 after the resignation of Zohra Chatterji from the position of non-executive independent director.

NTPC: The company declared on commercial operation the fifth and last part of 300 MW Nokhra solar PV project of NTPC Green Energy at Bikaner, Rajasthan with 50 MW capacity. Further, NTPC Green Energy Limited, a wholly owned subsidiary of NTPC has incorporated a new company, in 50:50 joint venture with Indian Oil Corporation Limited, in the name of India Oil NTPC Green Energy Private Limited.

Bajaj Finserv: The financial services company on Saturday signed a Memorandum of Understanding (MoU) with the Government of Maharashtra, to develop Rs 5,000 crore projects in Pune.

Hero MotoCorp: The two-wheeler maker has increased the price of its electric scooter VIDA V1 Pro by around Rs 6,000 in order to offset the impact of curtailed subsidy structure on electric two-wheelers coming into effect from June 1.

Godrej Properties: The company bought the remaining 26% stake in Godrej Home Constructions for Rs 14.99 crore, taking its total shareholding to 100%.

Minda Corporation: The company will raise Rs 600 crore through further issuance of securities through public and/or private offerings including preferential issue, qualified institutions placement, further public offer or any of the permissible modes.

Mahindra Lifespace Developers: Japan-based Omron Healthcare will start operations at Origins by Mahindra industrial cluster in Chennai by March 2025.

PI Industries: The company completed acquisition of 100% stake of Therachem Research Medilab (India) and Solis Pharmachem, as well as acquisition of certain identified assets of TRM U.S. by PI Health Sciences U.S.A.

Greenply Industries: The company approved disposal of Greenply Industries (Myanmar) assets due to difficulty in continuing its operation on account of political developments resulting in adverse business environment in Myanmar.

Lemon Tree Hotels: The company has started two hotels in Agra and Bhopal, which will be managed by its subsidiary Carnation Hotels.

Brigade Enterprises: The realty firm will launch 10 housing projects this financial year across Bengaluru and Chennai at a cost of Rs 3,000 crore, MD Pavitra Shankar told PTI.