Market Opening - An Overview

SGX Nifty futures fell 0.38% to 17,262.50, signalling that Dalal Street was headed for a negative start on Monday.

Most Asian shares were trading lower as concerns over higher energy prices and inflation weighed on the global economy. Japan’s Nikkei fell 1.83% and Topix dropped 1.59%, Hang Seng was up 0.67% and CSI 300 was down 0.56%.

Indian rupee closed 4 paise lower at 76.17 against the US dollar on Wednesday.

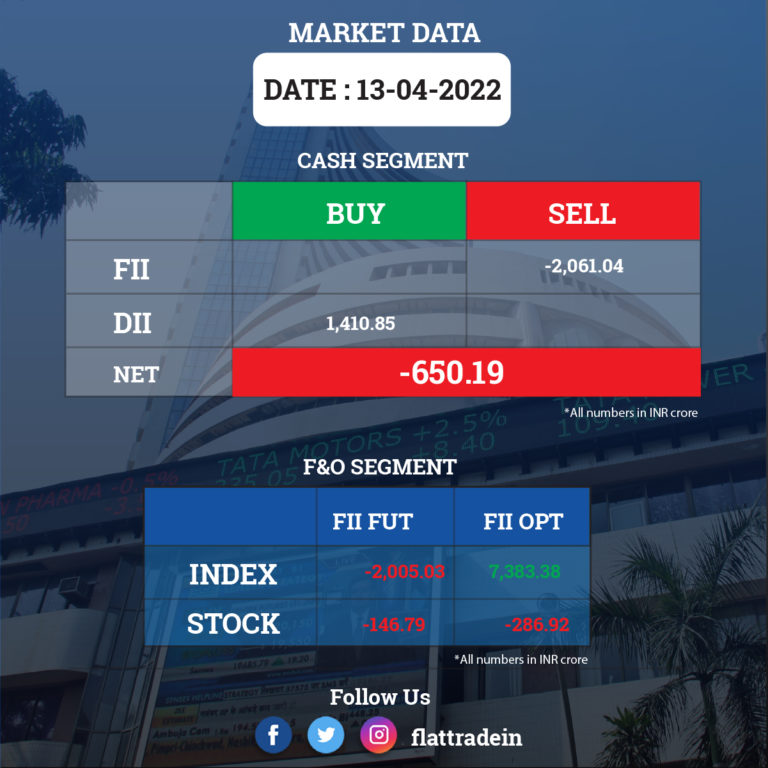

FII/DII Trading Data (13-4-2022)

Upcoming Results

Mindtree, Star Housing Finance, Earum Pharmaceuticals, DRC Systems India, Mishtann Foods, Ramsarup Industries, Sheetal Cool Products, SE Power, SM Gold and Swiss Military Consumer Goods.

Stocks in News Today

HDFC Bank: The lender’s profit in Q4 FY22 grew 22.8% to Rs 10,055.2 crore YoY as provisions declined 29.4% in the same period. Net interest income rose 10.2% to Rs 18,873 crore, with credit growth of 20.8% and a deposits growth of 16.8% YoY. Gross non-performing assets fell sequentially to 1.17% and net NPAs declined QoQ to 0.32% in the March quarter.

HDFC Bank said it will raise up to Rs 50,000 crore in the next one year by issuing bonds aimed at financing infrastructure and affordable housing loan requirements of the customers. In addition, the board has approved to re-appoint Renu Karnad as non-executive director on the board of the bank for a period of five years with effect from September 3, 2022.

Infosys Ltd: The IT major posted a net profit of Rs 5,686 crore for the quarter ended March 2022 as against a profit of Rs 5,076 crore reported in the same quarter last year. On a sequential basis, Infosys net profit declined by 2.11% as compared to Rs 5,809 crore in December quarter. The company registered 22.7% rise in its revenue to Rs 32,276 crore and estimated its revenue growth to be between 13% to 15% for financial year 2023. The company witnessed higher attrition, which jumped to 27.7% in Q4, up from 25.55% in Q3FY22. The company recruited 85,000 freshers in FY22 and plans to hire upwards of 50,000 in FY23.

Reliance Industries Ltd (RIL): The company is mulling a bid for Walgreens Boots Alliance Inc.’s international drugstore unit, according to people familiar with the matter, Bloomberg reported. Reliance is in the early stages of exploring the feasibility of an offer for the Boots chain, sources said.

Ambuja Cements Ltd and ACC Ltd: Holcim, which controls 63.1% of Ambuja, is considering a potential sale of businesses in India including ACC, according to people familiar with the matter, Bloomberg reported. Ambuja has a market value of about $9.6 billion. The Swiss conglomerate is believed to have held early-stage negotiations with JSW and Adani Group, among others, to explore their interest levels, according to Economic Times news report.

ICICI Prudential Life Insurance: The company posted over two-fold jump in its net profit to Rs 185 crore for the January-March quarter on account of robust growth in new business. The company had posted a profit after tax of Rs 64 crore in the year-ago period. For the full year 2021-22, the company’s net profit declined to Rs 754 crore from Rs 960 crore for the year ended in March 2021, it said.

Mahindra & Mahindra (M&M): The automaker said it has increased prices of its entire model range by 2.5 % with immediate effect. The price increase will be in the range between Rs 10,000 and Rs 63,000 on ex-showroom prices across its range, depending upon the model and the variant.

Tata Power Co Ltd: The company and BlackRock Real Assets-led consortium including Mubadala Investment Company have entered into a binding agreement to invest in Tata Power’s renewable energy subsidiary, Tata Power Renewable Energy Limited. The consortium will invest Rs 4,000 crore (~$ 525 million) by way of equity / compulsorily convertible instruments for a 10.53% stake in Tata Power Renewables.

Tata Steel: The company’s of Tata Steel is going to meet in early May to consider a stock split. The company’s stock has surged over five-fold from the lows of March 2020.

Oil India Ltd: The PSU major suffered a cyberattack disrupting its operations in Assam and has received a ransom demand of USD 75,00,000 (over Rs 57 crore) from the perpetrator, officials said. The company registered a case under various sections of the Indian Penal Code and the Information Technology Act, 2000.

Petronet LNG Ltd: The company is likely to set up a fourth facility in the country to meet the rising energy demand in India, its CEO A K Singh said. It is looking to set up a floating LNG import terminal at Gopalpur in Odisha in the next 3 years at a cost of Rs 1,600 crore. It already operates a 17.5 million tonnes a year LNG import facility at Dahej in Gujarat and another 5 million tonnes facility at Kochi in Kerala.

Jet Airways: The Kalrock Jalan consortium has got 65 days more to fulfill conditions required for implementation of the airline’s revival plan. The National Company Law Tribunal has granted more time to ensure revival of the grounded airline after a plea by the consortium for exclusion of a certain number of days from implementation timeline.

Lupin Ltd: The pharma company said it has received approval from the US health regulator to market generic version of Desvenlafaxine extended-release tablets used for treating depression. The product will be manufactured at Lupin’s facility in Goa, India.

Tech Mahindra: The company announced a collaboration with Keysight Technologies to certify 5G vendors’ equipment at its O-RAN (open radio access network) lab in New Jersey, the US.

Jubilant Ingrevia: The company has received CDMO contract worth Rs 270 crore in specialty chemicals business from an “international customer”. The contract is for three years. The company will supply two key GMP intermediates for one of the “patented drugs” of the innovator pharmaceutical customer. Commercial supplies of both these products will start from FY23.

Future Retail Ltd: The company said that the meetings of its shareholders and creditors next week to consider and approve the sale of its retail assets to billionaire Mukesh Ambani’s Reliance Retail are in compliance with the directions issued by the NCLT. Earlier this week, e-commerce giant Amazon, which is contesting the Rs 24,713 crore deal, had said the meetings were “illegal”.

Meanwhile, Bank of India (BOI), the lead banker of a consortium of banks that lent money to Future Retail Ltd (FRL), also urged the insolvency tribunal to appoint Vijay Kumar V Iyer as the interim professional of the company.

UltraTech Cement: The company announced investing $101.10 million (Rs 839.52 crore approx.) for a 29.39 per cent equity stake in the UAE-based RAK Cement Co for White Cement and Construction Materials PSC (RAKWCT). This is a “strategic investment” for the company, the company said in a regulatory filing.

IndiGo: The budget carrier has appointed former Shell India chairman Vikram Singh Mehta and former Indian Air Force (IAF) chief B S Dhanoa as independent non-executive directors. Mehta will replace Anupam Khanna, whose second term came to an end on March 26, and Dhanoa will replace former SEBI chief M Damodaran, who is stepping down on May 3, it said.

Oriental Hotels Ltd: The company reported a consolidated net profit of Rs 1.38 crore in the fourth quarter ended March 2022, compared with a consolidated net loss of Rs 4.66 crore in the same period a year ago. Consolidated revenue from operations stood at Rs 66.08 crore in the quarter under review as against Rs 52.76 crore in the year-ago period, it added.

Housing Development Finance Corp (HDFC): The mortgage lender has moved insolvency tribunal NCLT against multi-system operator SITI Networks Ltd for an alleged default of Rs 296 crore. SITI Networks, part of Essel Group, has received a notice issued by the Mumbai bench of the NCLT.

NHPC: The state-owned signed a memorandum of understanding (MoU) with the district administration of Chamba, Himachal Pradesh for development of green hydrogen technologies to produce hydrogen. Under the project, a 300 kilowatt solar plant will be set up and its energy will be utilised for electrolysis of water to generate green hydrogen.

Future Enterprises Ltd (FEL): The company has defaulted on the payment of interest of Rs 1.22 crore due on non-convertible debentures, according to a regulatory filing. The due date for payment of Rs 1.22 crore interest was April 13, 2022, FEL said in the regulatory filing. The company had earlier defaulted on the payment of Rs 9.10 crore interest due on NCDs.

Bharat Petroleum Corporation Ltd (BPCL): The oil refiner and tech giant Microsoft have entered a strategic cloud partnership to accelerate BPCL’s digital transformation and drive innovation in the oil and gas industry. Through a seven-year collaboration, Microsoft will provide infrastructure as a service (IAAS), platform as a service (PAAS), network and security services on the cloud, including Azure native services on Azure Datafactory, IOT (Internet of Things) and analytics.

IDBI Bank: The Private lender has proposed a nearly 10-fold hike in the salary of its managing director and CEO Rakesh Sharma. The CEO has been instrumental in bringing the bank out of the RBI’s restrictive prompt corrective action (PCA) framework. Sharma draws a salary of Rs 2.64 lakh per month, while the bank has proposed to raise the salary to about Rs 20 lakh per month.

Vishal Fabrics: The denim manufacturer is adding capacities and targeting to more than double its exports as part of its bid to cash in on the China-plus-one strategy that most global companies have adopted and become the third-largest player by FY25.