Market Opening - An Overview

SGX Nifty futures were trading 1.43% lower at 16,880, signalling that Dalal Street was headed for a gap-down start on Monday.

Japanese shares fell on Monday ahead of consecutive public holidays, as investors focused on upcoming US Federal Reserve monetary policy meeting. Nikkei 225 was down 0.53% and Topix dropped 0.48%. Financial markets in China and Hong Kong are shut on account of public holidays.

Indian rupee inched up 5 paise to 76.42 against the US dollar on Friday.

Life Insurance Corporation of India’s IPO subscription will open this week on May 4. The price band has been set at Rs 902-949 per equity share.

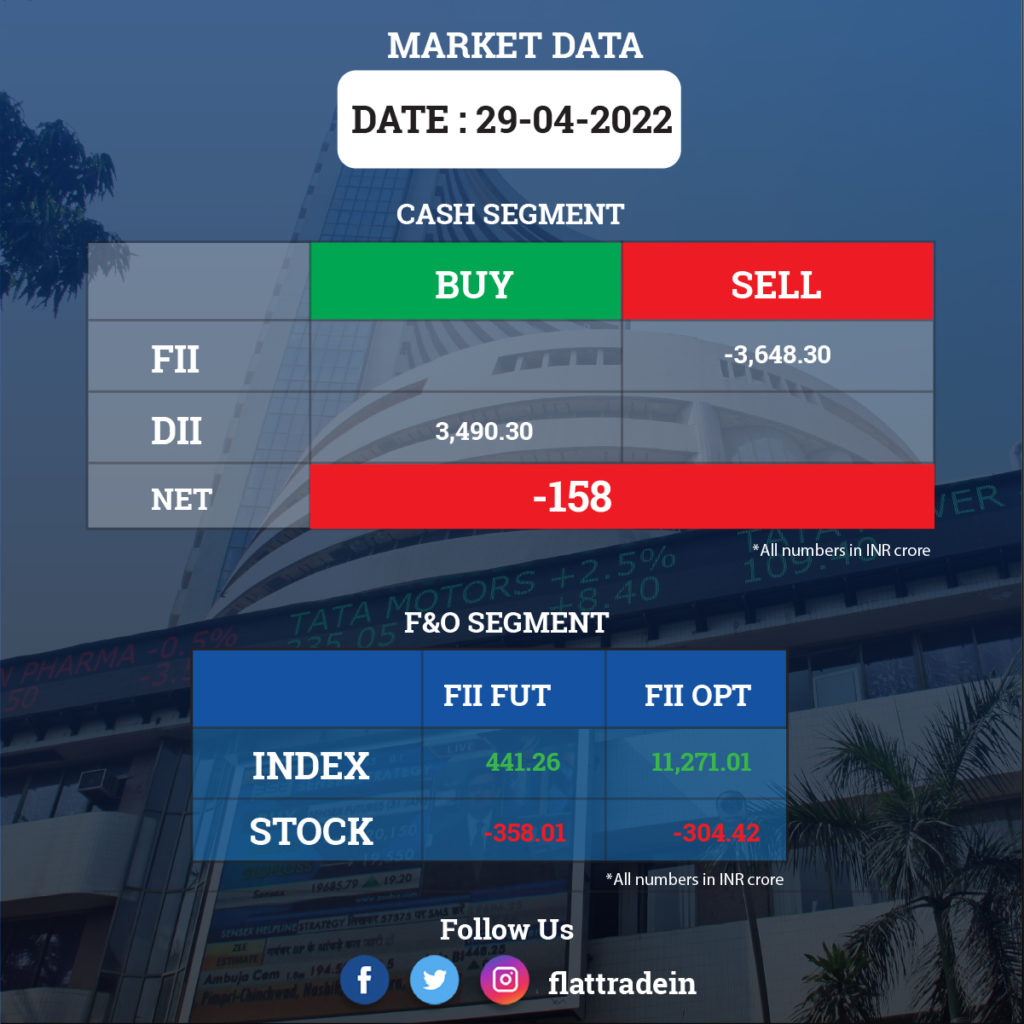

FII/DII Trading Data

Upcoming Results

HDFC, Britannia Industries, Alembic Pharmaceuticals, Astec Lifesciences, Adani Wilmar, Castrol India, CG Power and Industrial Solutions, Devyani International, Dwarikesh Sugar Industries, EIH Associated Hotels, IDBI Bank, Inox Leisure, JBM Auto, Jindal Stainless, Mahindra & Mahindra Financial Services, Mahindra Holidays & Resorts India, Meghmani Organics, NGL Fine-Chem, Olectra Greentech, Saregama India, Shakti Pumps (India), and Surana Solar will release quarterly results.

Stocks in News Today

Wipro: The IT company on Friday reported a consolidated net profit of Rs 3,087 crore for the quarter ended March 2022, up 4% from Rs 2,972 crore in the year-ago period. Revenue from operations, rose 28% to Rs 20,860 crore for the quarter under review. In dollar terms, the IT major’s revenue stood at $2.72 billion. Wipro expects 1-3% sequential growth in Q1FY23 revenue at $2,748-2,803 million.

IndusInd Bank: The private sector lender registered 55.4% YoY growth in profit at Rs 1,361.4 crore for the quarter ended March 2022 as provisions declined 21.5% with an improvement in asset quality performance. Net interest income grew by 12.7% YoY to Rs 3,985.16 crore in Q4.

Yes Bank: The private sector lender reported a profit of Rs 367 crore in Q4FY22 against a loss of Rs 3,788 crore in the corresponding quarter of the previous fiscal, helped by a steep decline in provisions, strong net interest income, and improvement in asset quality performance. For the full year, it reported a profit for the first time since FY19, at Rs 1,066 crore against a loss of Rs 3,462 crore in FY21 and a loss of Rs 22,715 crore in FY20, but net interest income (NII) declined 12.5% to Rs 6,498 crore compared to the previous year.

IDFC First Bank: The bank posted over two-fold rise in net profit to Rs 343 crore in the March 2022 quarter on the back of strong core operating income and lower provisioning for bad loans. The private sector lender had reported a net profit of Rs 128 crore in the same quarter of the previous fiscal. The net interest income (NII) during the quarter increased by 36 per cent to Rs 2,669 crore, while fee and other income jumped 40 per cent to Rs 841 crore. The total income during the January-March quarter of 2021-22 rose to Rs 5,384.88 crore from Rs 4,811.18 crore in the same period of FY21.

L&T Finance Holdings: The company’s consolidated net profit rose 28.1% YoY to Rs 342 crore in the fourth quarter ended March 2022 compared with Rs 267 crore in Q4FY21. Its gross non-performing assets (NPAs) declined to 3.8% at end of March 2022 from 4.97% a year ago.

SBI Cards and Payment Services: The company reported over three-fold jump in its net profit at Rs 580.86 crore for the quarter ended March 2022. The pure-play credit card issuer had reported a net profit of Rs 175.42 crore in the same quarter of the previous fiscal year. Total income rose by 22.2% to Rs 3,016.10 crore.

Star Health and Allied Insurance: The company narrowed down its Q4 net loss to Rs 82.04 crore for the quarter ended March 2022, compared with a net loss of Rs 956.92 crore in the quarter ended March 2021. Total income soared 266.1% to Rs 2,740.38 crore in the quarter under review from Rs 748.54 crore in the year-ago period.

Usha Martin: The company clocked a 60.1% YoY growth in consolidated profit at Rs 108.7 crore in Q4FY22 driven by subsidy of Rs 31.18 crore from the Jharkhand government, and higher revenue. Sales during the quarter grew by 17.4% to Rs 766.56 crore YoY.

GHCL: The company clocked a healthy 144% YoY growth in Q4FY22 profit at Rs 271.3 crore despite rising input cost, led by strong revenue and operating income. Revenue during the quarter grew by 77% to Rs 1,273.3 crore compared to the corresponding period last fiscal.

Just Dial: The local search engine company recorded a 34% YoY decline in profit at Rs 22.1 crore for the quarter ended March 2022 hit by lower topline and operating loss. Revenue from operations stood at Rs 166.7 crore for the quarter, down 5.1% compared to the year-ago period. Total traffic of unique visitors for the quarter stood at 144.8 million, up 12.2% YoY and total active listings stood at 31.9 million, an increase of 4.9% YoY, while active paid campaigns at the end of the quarter stood at 4,61,495, which rose by 0.9% YoY.

Tanla Platforms: The largest CPaaS provider reported a 37% YoY growth in profit at Rs 140.6 crore aided by robust sales and operating performance. Revenue increased by 32% year-over-year to Rs 853.1 crore and operating income grew by 37% to Rs 184.1 crore compared to the year-ago period.

Macrotech Developers: Realty firm Macrotech Developers is in an advanced stage of talks with two global investors to set up a platform that will invest more than $1 billion to develop warehousing and industrial parks across India, a top company official said. Its CEO Abhishek Lodha said that the company would largely provide assets, including land and ready warehousing space, in the platform while the two partners will bring in equity investments to develop warehousing and light industrial parks.

Cochin Shipyard Limited: The company has committed to invest an initial corpus of Rs 50 crore in the Start-up companies engaged in the maritime sector, according to Union Minister for Ports, Shipping, and Waterways Sarbananda Sonowal. The Minister also unveiled the Start-up engagement framework of Cochin Shipyard Limited on the occasion of the inauguration of the Golden Jubilee celebrations of Cochin Shipyard Limited (CSL).

In other news, the Cochin Shipyard Limited (CSL) here will develop and build the first indigenous hydrogen-fuelled electric vessels, Union Minister for Ports, Shipping and Waterways