Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.41% lower at 17,872.50, signalling that Dalal Street was headed for a negative start on Wednesday.

Asian equities were trading lower, tracking losses in the US markets amid US Treasury yields rising as investors priced in higher interest rates.

Indian rupee fell 7 paise to 82.79 against the US dollar on Tuesday.

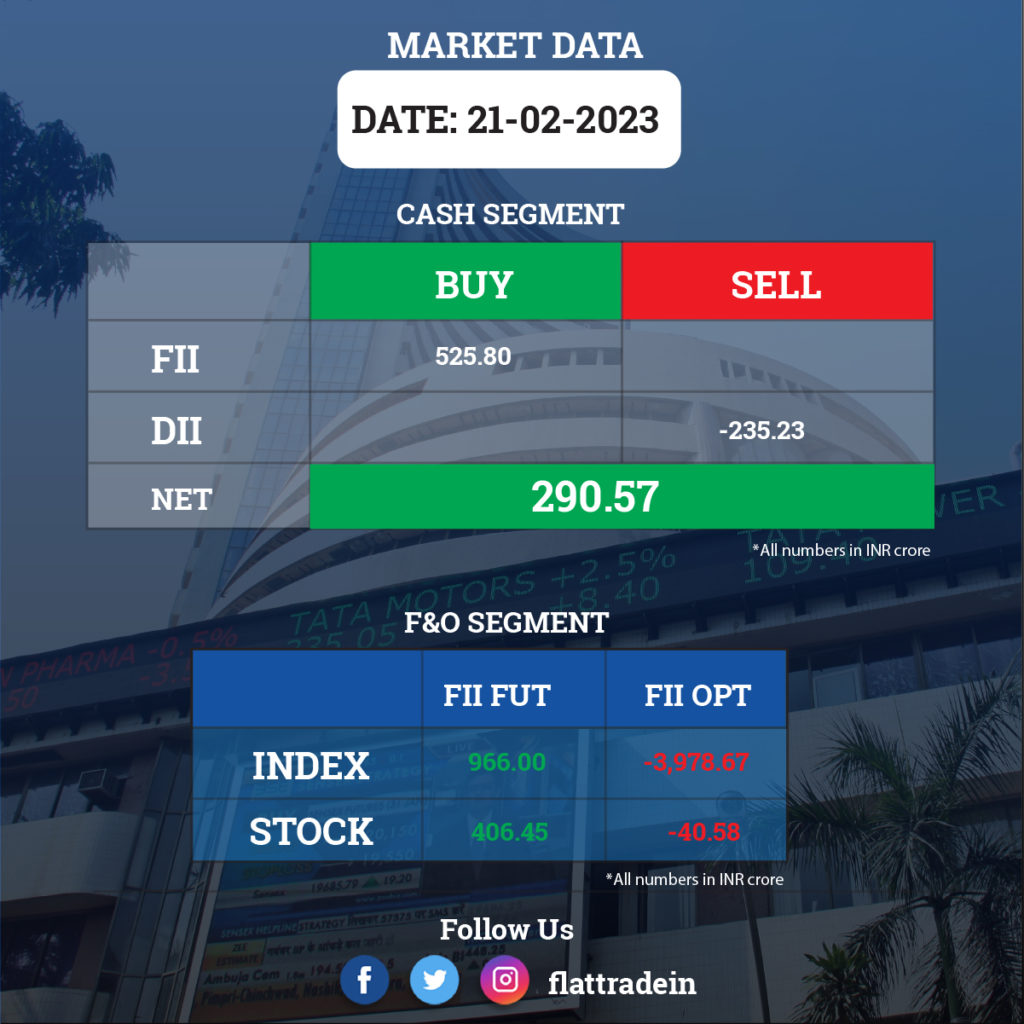

FII/DII Trading Data

Stocks in News Today

Mahindra & Mahindra (M&M): The company has entered into an asset transfer agreement for certain identified assets related to four-wheeler passenger electric vehicles with Mahindra Electric Automobile (MEAL), which would be incorporated as a subsidiary. M&M and British International Investment Plc have agreed to invest up to Rs 1,925 crore each in MEAL in two tranches.

Reliance Industries (RIL): The company’s subsidiary, Reliance New Energy, has completed the purchase of 7,433 common shares; 1,518 series B1 preferred shares; and 660 series B2 preferred shares of Nexwafe GmbH, for an aggregate consideration of 7,55,684 euro.

State Bank of India (SBI): The lender has successfully raised Rs 4,544 crore non-convertible, taxable, perpetual, subordinated, unsecured, fully paid up Basel III compliant AT-1 bonds at a coupon of 8.20% per annum.

Bharat Electronics (BEL): The state-owned defence company has signed MoU with Aeronautical Development Agency (ADA), DRDO for the advanced medium combat aircraft (AMCA) programme. The Advanced Medium Combat Aircraft is a 5th generation, multi-role, all-weather fighter aircraft designed with high survivability and stealth capability.

Sapphire Foods India: The company’s wholly-owned subsidiary Gamma Pizzakraft (Overseas) has increased stake in its subsidiary Gamma Island Food to 75%, from 51% after the acquisition of 81,914 equity shares. The acquisition cost of those shares is MVR 1,88,40,220. Gamma Island Food is incorporated in the Republic of Maldives, to operate Pizza Hut and KFC restaurants in Maldives under franchisee agreements. Sapphire Foods India is a quick service restaurants operator.

IRCTC: Shares of the company will trade ex-dividend today with respect to the Rs 3.5 dividend announced along with the third quarter results.

Biocon: The biopharmaceutical company has raised Rs 1,070 crore by issuing 1.07 lakh non-convertible debentures of the face value of Rs 1 lakh each on a private placement basis in 3 Series. The tenure of the NCDs is five years from the deemed date of allotment.

Mirza International: The NCLT has approved the amalgamation of RTS Fashions Pvt Ltd (the transferor company) with and into Mirza International and the de-merger of the latter’s branded business into Redtape Ltd on a going concern basis.

Lemon Tree Hotels: The company has signed a franchise agreement for a 34-room property in Manali, Himachal Pradesh under its brand “Lemon Tree Hotel’. The hotel is expected to be operational by June 2023.

Capacit’e Infraprojects: The company said it has received a contract worth Rs 181 crore from Indian Oil for construction of residential towers at Indian Oil Nagar in Mumbai.

Zensar Technologies: Nippon Life India Trustee has bought an additional 1.7529% stake in the IT services management company via open market transactions. With this, its stake in the company increased to 5.2275%, up from 3.4745% earlier.

LIC Housing Finance: ICICI Prudential Mutual Fund has acquired an additional 2.03% stake in the housing finance company via open market transactions. With this, the mutual fund house shareholding in LIC Housing Finance increased to 7.07%, up from 5.04 percent earlier.

Petronet LNG: The company has received approval from board members for the extension of Vinod Kumar Mishra’s tenure as Director (Finance), the whole-time Key Managerial Personnel and Chief Financial Officer, for another two years. The extension of two years will be effective from April 18, 2023, on the existing terms and conditions.

Rashtriya Chemicals & Fertilizers: Sanjay Rastogi is appointed as government nominee director on the board of RCF with effect from February 21, 2023. He is currently working as an additional secretary and financial adviser in the Ministry of Chemicals and Fertilizers, Government of India.

ITI: The government has appointed Rajesh Rai as the Chairman and Managing Director of ITI for a period of five years with effect from February 21, till the date of his superannuation, or until further orders, whichever is the earliest. Rai was General Manager at Mahanagar Telephone Nigam.